- United States

- /

- Airlines

- /

- NasdaqGS:ALGT

US Growth Stocks With Up To 18% Insider Ownership

Reviewed by Simply Wall St

As the U.S. equities market continues to grapple with a recent slump, marked by declines in major indices like the Dow Jones and S&P 500, investors are keenly observing market dynamics that might offer stability or growth potential. In such an environment, companies with substantial insider ownership can be appealing as they often indicate a strong alignment of interests between company executives and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49% |

| Smith Micro Software (NasdaqCM:SMSI) | 23.1% | 85.4% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| Neonode (NasdaqCM:NEON) | 22.6% | 110.9% |

We're going to check out a few of the best picks from our screener tool.

Allegiant Travel (NasdaqGS:ALGT)

Simply Wall St Growth Rating: ★★★★☆☆

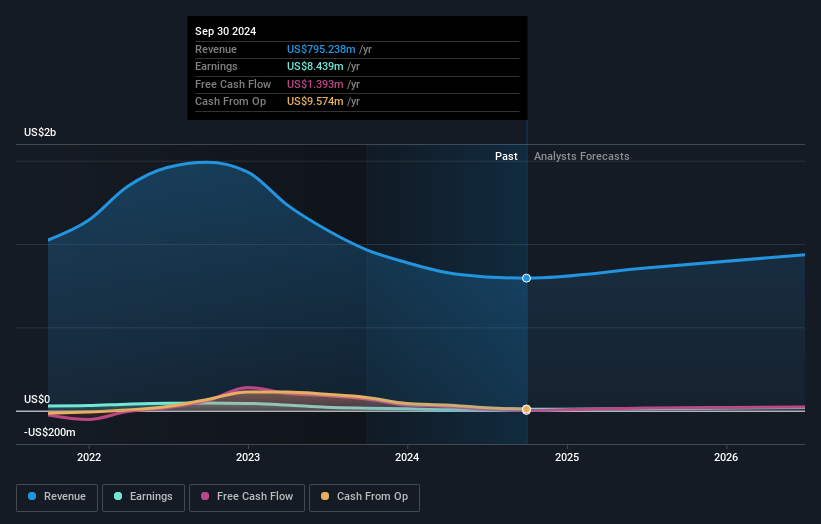

Overview: Allegiant Travel Company is a leisure travel company that offers travel services and products to residents of under-served cities in the United States, with a market cap of approximately $1.67 billion.

Operations: The company's revenue is primarily generated from its airline segment, which accounts for approximately $2.44 billion.

Insider Ownership: 15.6%

Allegiant Travel's growth prospects are bolstered by its strategic expansion with 44 new nonstop routes, targeting high leisure demand periods. Despite insider selling in the past three months, the company is expected to achieve profitability above market average within three years. However, challenges persist with interest payments not well covered by earnings and recent net losses reported. The company's revenue growth forecast of 10.4% annually surpasses the US market average but remains below optimal growth rates for high-growth companies.

- Get an in-depth perspective on Allegiant Travel's performance by reading our analyst estimates report here.

- Our valuation report here indicates Allegiant Travel may be overvalued.

Radiant Logistics (NYSEAM:RLGT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Radiant Logistics, Inc. is a third-party logistics company offering technology-enabled global transportation and value-added logistics solutions mainly in the United States and Canada, with a market cap of $307.34 million.

Operations: The company's revenue segment includes Transportation - Air Freight, generating $795.24 million.

Insider Ownership: 15.8%

Radiant Logistics shows promising growth prospects with expected annual earnings growth of over 50%, significantly outpacing the US market. Despite a slight decline in revenue to US$203.57 million, net income improved to US$3.38 million, reflecting operational resilience. The company completed a share buyback program, enhancing shareholder value. However, profit margins have decreased from last year, and insider trading activity remains unclear for the past three months.

- Dive into the specifics of Radiant Logistics here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Radiant Logistics' current price could be inflated.

Warby Parker (NYSE:WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, offering eyewear products, with a market cap of approximately $2.91 billion.

Operations: The company generates revenue from its Medical - Optical Supplies segment, amounting to $742.53 million.

Insider Ownership: 18.8%

Warby Parker is experiencing robust growth with expected annual earnings growth of 125.64%, surpassing the market average. The company reported Q3 2024 sales of US$192.45 million, up from US$169.85 million a year ago, with net losses narrowing to US$4.07 million from US$17.41 million previously. Despite past shareholder dilution and low forecasted return on equity, insider ownership remains significant, supporting its strategic direction and potential profitability within three years.

- Take a closer look at Warby Parker's potential here in our earnings growth report.

- Our expertly prepared valuation report Warby Parker implies its share price may be too high.

Turning Ideas Into Actions

- Reveal the 203 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGT

Allegiant Travel

A leisure travel company, provides travel services and products to residents of under-served cities in the United States.

Reasonable growth potential very low.

Similar Companies

Market Insights

Community Narratives