- United States

- /

- Logistics

- /

- NYSE:ZTO

Will Weakness in ZTO Express (Cayman) Inc.'s (NYSE:ZTO) Stock Prove Temporary Given Strong Fundamentals?

With its stock down 14% over the past three months, it is easy to disregard ZTO Express (Cayman) (NYSE:ZTO). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to ZTO Express (Cayman)'s ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for ZTO Express (Cayman)

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for ZTO Express (Cayman) is:

14% = CN¥8.7b ÷ CN¥61b (Based on the trailing twelve months to September 2024).

The 'return' is the income the business earned over the last year. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.14.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

ZTO Express (Cayman)'s Earnings Growth And 14% ROE

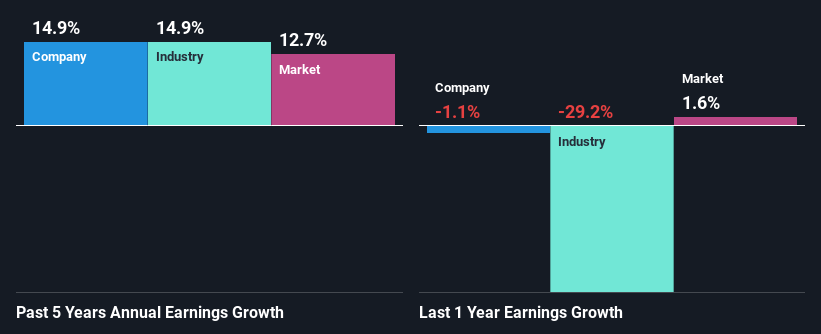

To begin with, ZTO Express (Cayman) seems to have a respectable ROE. Further, the company's ROE compares quite favorably to the industry average of 8.9%. This certainly adds some context to ZTO Express (Cayman)'s decent 15% net income growth seen over the past five years.

We then performed a comparison between ZTO Express (Cayman)'s net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 15% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for ZTO? You can find out in our latest intrinsic value infographic research report.

Is ZTO Express (Cayman) Efficiently Re-investing Its Profits?

While ZTO Express (Cayman) has a three-year median payout ratio of 53% (which means it retains 47% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Additionally, ZTO Express (Cayman) has paid dividends over a period of six years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 43%. As a result, ZTO Express (Cayman)'s ROE is not expected to change by much either, which we inferred from the analyst estimate of 15% for future ROE.

Conclusion

Overall, we are quite pleased with ZTO Express (Cayman)'s performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if ZTO Express (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZTO

ZTO Express (Cayman)

Provides express delivery and other value-added logistics services in the People's Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026