- United States

- /

- Transportation

- /

- NYSE:XPO

XPO (XPO) Valuation in Focus Following Major Joseph Joseph Logistics Partnership

Reviewed by Simply Wall St

XPO (XPO) just landed a major contract with Joseph Joseph, the UK-based kitchen and homewares specialist, to take over omnichannel fulfillment, warehousing, and distribution at its Rugby facility. The move brings together XPO’s advanced, high-volume logistics platform with a fast-growing consumer brand that is seeking both flexibility and scale. For investors, this deal signals XPO’s strength in capturing long-term, strategic partnerships and may illustrate why the company is often considered by those looking for exposure to modern logistics solutions.

This development follows steady performance for XPO so far this year. While shares have climbed just 10% in the past year and are up 4% year-to-date, momentum has picked up recently with a 17% gain over the past three months. The Joseph Joseph contract comes on the heels of robust annual revenue and net income growth, keeping XPO in focus as it aims to build on its three- and five-year returns that have outpaced the broader sector.

With the stock showing momentum and a new growth contract underway, a key question for observers is whether XPO is trading at a discount to its actual value or if the market has already accounted for the next phase of growth.

Most Popular Narrative: Fairly Valued

According to community narrative, XPO is considered to be fairly valued right now based on analyst consensus of its future earnings, margin expansion, and risk factors.

"XPO's ongoing investments in AI-powered optimization and proprietary technology are driving measurable productivity gains, even in a weak freight market, by reducing linehaul miles, improving labor efficiency, and cutting maintenance costs. As industry shipping volumes recover and these technology benefits compound, this should drive sustained margin expansion and higher net income."

Think XPO’s valuation is just about recent contract wins? Think again. There is a bold set of quantitative assumptions fueling this price target. It hinges on a financial story that could surprise you. Want to see what future growth metrics the market is quietly betting on? The full analyst narrative reveals the math behind XPO’s fair value.

Result: Fair Value of $138.8 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistently rising labor costs or a prolonged slowdown in the freight market could quickly pressure XPO’s margins and challenge the current fair value outlook.

Find out about the key risks to this XPO narrative.Another View: Our DCF Model's Perspective

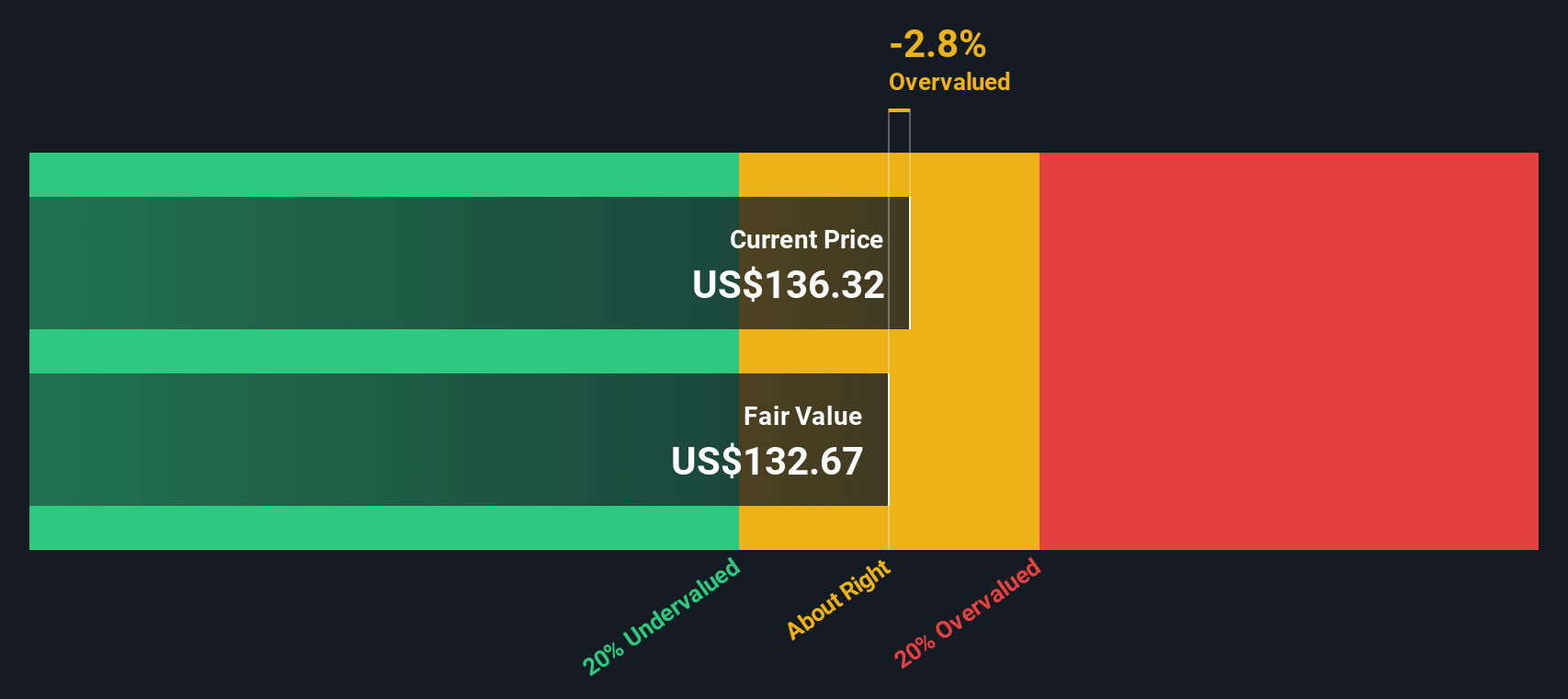

While analysts call XPO fairly valued based on future earnings, our DCF model tells a different story. The discounted cash flow approach suggests the market might be overvaluing the stock and challenges optimistic assumptions. Could forward-looking models be missing something in today's price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own XPO Narrative

If you’re curious to dig into the numbers and shape your own perspective, it’s easy to build a personalized narrative in just a few minutes, so why not do it your way?

A great starting point for your XPO research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Great investing is about keeping your options open and spotting opportunities others might miss. Don’t let your next big idea slip away. Use these powerful shortcuts to find standout stocks aligned with your interests and goals:

- Boost your income with stocks offering strong yields by checking out dividend stocks with yields > 3%. This resource is ideal for those seeking to maximize returns from reliable dividend payers.

- Stay ahead of technology trends by pinpointing leaders in innovation with AI penny stocks. These companies are leading the way in artificial intelligence and helping to shape the markets of tomorrow.

- Uncover high-potential value plays by exploring undervalued stocks based on cash flows. Here, you can find stocks that the market may be overlooking based on their cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives