- United States

- /

- Transportation

- /

- NYSE:UHAL

U-Haul (UHAL): Fresh Analyst Upgrade Sparks a Closer Look at Value and Long-Term Upside Potential

Reviewed by Kshitija Bhandaru

U-Haul Holding (UHAL) just received an upgrade from a research analyst, moving from 'buy' to 'strong buy.' The decision centers on its attractive valuation and recent revenue growth, even though there are ongoing market headwinds.

See our latest analysis for U-Haul Holding.

U-Haul Holding's share price has drifted lower over the past year, with a recent close at $56.99 and a 1-year total shareholder return of -0.26%. While some short-term volatility persists, the longer-term picture shows modest gains over three and five years. This hints at underlying resilience despite headwinds and shifting investor sentiment around its valuation and fundamentals.

If you’re looking to expand your investing universe beyond the usual names, this is the perfect moment to explore fast growing stocks with high insider ownership.

With U-Haul trading well below its analyst price target and fundamentals showing signs of resilience, investors must ask if the stock is undervalued or if the market has already factored in all future growth.

Most Popular Narrative: 36.6% Undervalued

U-Haul Holding’s current price of $56.99 sits well below the narrative’s fair value estimate of $89.84. The gap is driven by concrete expectations for future growth and efficiency improvements, providing a bold outlook for the company's long-term potential.

U-Haul is working through fleet imbalances by acquiring new trucks and deleting outdated ones. As they correct these imbalances, they expect to better serve customer needs, potentially improving revenue and efficiency, which could drive future revenue growth.

Curious what’s fueling such a confident jump in fair value? Behind this outlook are big assumptions about growth, efficiency upgrades, expanded storage, and margin moves. But what exactly are the analysts banking on to justify such a leap? Find out which projections could send shares higher if they come true.

Result: Fair Value of $89.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from rivals and rising operating costs could threaten U-Haul’s revenue growth outlook. These factors serve as key challenges to monitor ahead.

Find out about the key risks to this U-Haul Holding narrative.

Another View: What Do the Numbers Say?

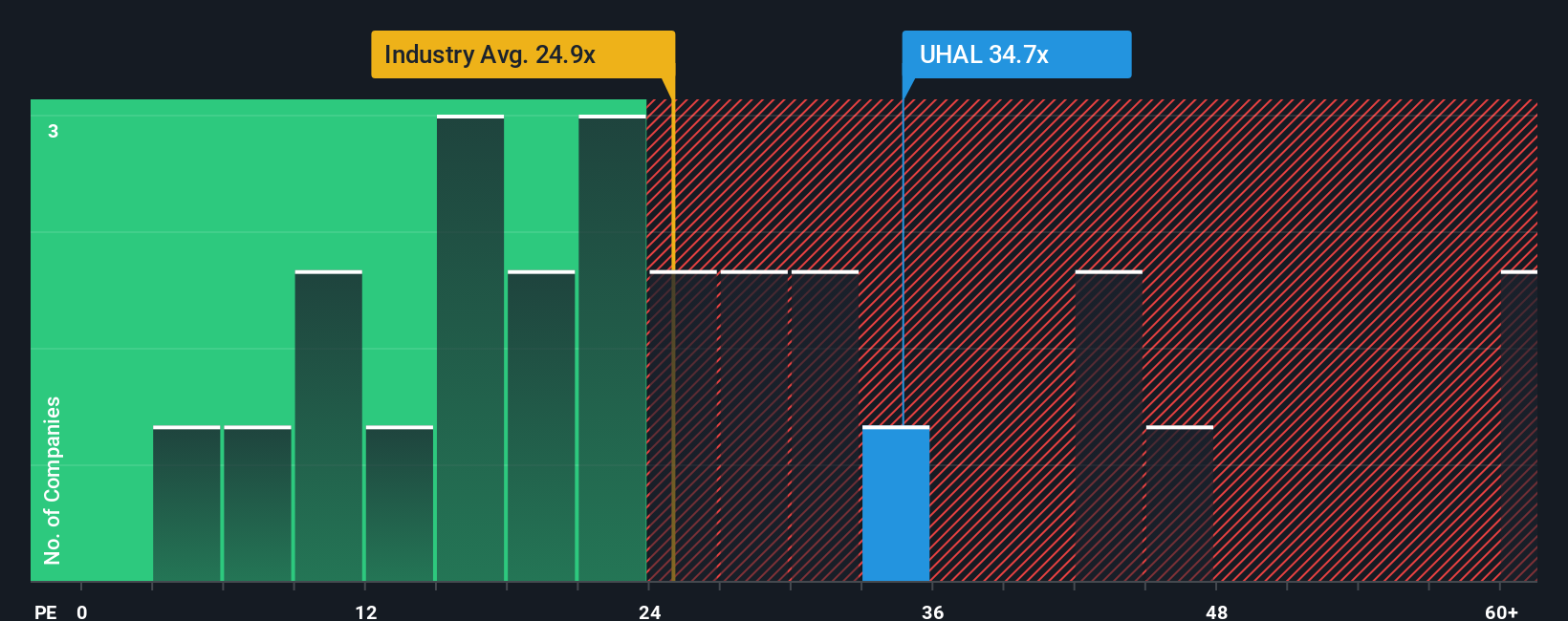

Looking at U-Haul’s valuation through the lens of its price-to-earnings ratio tells a different story. The company trades at 35.6 times earnings, noticeably higher than both its peer average of 26.9 and the US Transportation industry at 24.1. This premium means the market expects more growth ahead, but it also raises the bar for U-Haul to deliver. Could this lofty multiple signal risk that the earlier optimistic narrative has not reckoned with?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U-Haul Holding Narrative

If you see things differently or want to dig into the details on your own, you can put together your own narrative in just a few minutes. Do it your way

A great starting point for your U-Haul Holding research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Now is the time to expand your watchlist with smart, high-potential picks you might be missing out on.

- Unlock huge income streams by targeting top yielders using these 19 dividend stocks with yields > 3% with proven track records above 3%.

- Spot tomorrow’s market disruptors when you capitalize on early-stage innovation by checking out these 24 AI penny stocks.

- Multiply your upside by seeking companies trading below their estimated worth using these 896 undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UHAL

U-Haul Holding

Operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives