- United States

- /

- Transportation

- /

- NYSE:RXO

How RXO's Expanded Triumph Partnership and Digital Factoring Tools (RXO) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this month, RXO expanded its collaboration with Triumph by launching RXO Extra | Factoring, a suite of Triumph-powered financial tools now available to all carriers, supporting factoring services and digital payments with 24/7 access. This initiative marks an effort to provide logistics carriers with on-demand working capital and digital banking, even if they do not haul loads directly for RXO.

- By letting any carrier access branded financial solutions through RXO’s platform, the company is broadening its reach in the freight ecosystem and deepening loyalty through both financial services and its RXO Extra loyalty program.

- We’ll examine how expanding access to digital financial services for carriers could reshape RXO’s investment narrative and competitive strengths.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

RXO Investment Narrative Recap

To be a shareholder in RXO, you need to believe in the growth of digital freight solutions and RXO's ability to capture value amid challenging macroeconomic conditions, including ongoing softness in the truckload (TL) freight market. The launch of RXO Extra | Factoring could help RXO attract more carriers to its platform, but the impact on near-term revenue and profitability may be limited unless broader TL volumes recover; persistent cyclical and competitive risks remain the most important concerns in the short term.

The recent inclusion of RXO in multiple Russell value and small cap indices at the end of June is particularly relevant, as it may increase institutional investor attention and impact trading volumes. Yet, this expanded visibility comes as the company is broadening its service offerings to carriers, potentially reinforcing its differentiators while the key sector catalysts and risks remain unchanged.

However, investors should be aware that despite these positive developments, intense competition in digital freight matching and pressure on gross margins could...

Read the full narrative on RXO (it's free!)

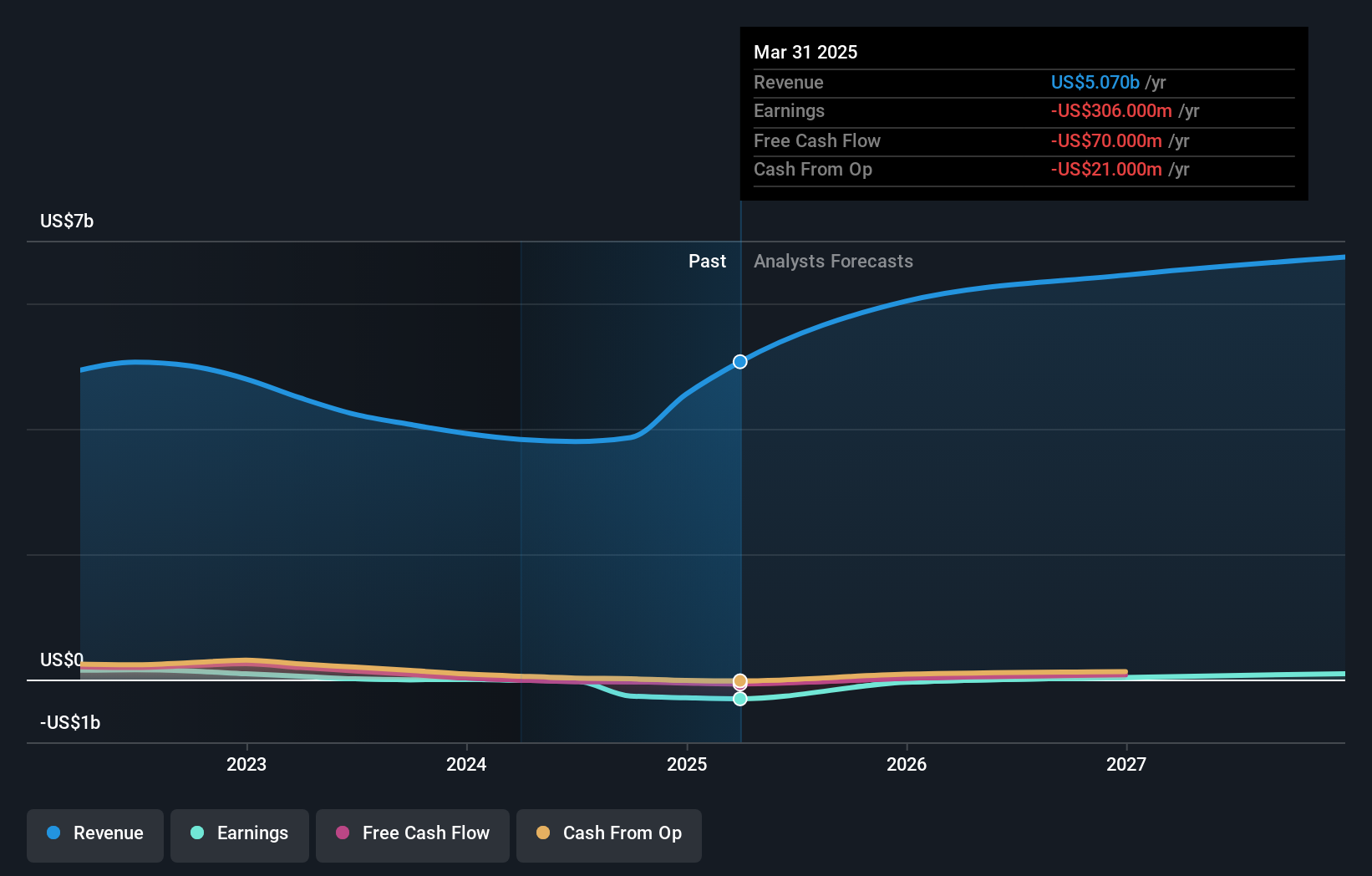

RXO's narrative projects $7.2 billion revenue and $120.9 million earnings by 2028. This requires 12.5% yearly revenue growth and a $426.9 million earnings increase from -$306.0 million today.

Uncover how RXO's forecasts yield a $16.57 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for RXO, ranging from US$16.57 to US$122.05 per share. As many continue to focus on RXO’s ability to drive margin expansion with new platform tools, it’s clear your outlook on competitive threats could shape your conviction about future returns.

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

No Opportunity In RXO?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RXO

RXO

Engages in truck brokerage business in the United States, Canada, Mexico, Asia, and Europe.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives