- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

3 Noteworthy Stocks Estimated To Be Up To 35.6% Below Intrinsic Value

Reviewed by Simply Wall St

As the major stock indexes in the United States continue to rise, with the S&P 500 on track for a five-day winning streak, investor sentiment is buoyed by positive economic indicators and easing trade tensions between the U.S. and China. In this environment of cautious optimism, identifying stocks that are potentially undervalued becomes crucial for investors seeking opportunities to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $17.86 | $35.51 | 49.7% |

| Quaker Chemical (NYSE:KWR) | $106.23 | $211.15 | 49.7% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.11 | $22.22 | 50% |

| Valley National Bancorp (NasdaqGS:VLY) | $9.16 | $18.18 | 49.6% |

| Flowco Holdings (NYSE:FLOC) | $19.38 | $37.99 | 49% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.49 | 49.4% |

| Insteel Industries (NYSE:IIIN) | $36.81 | $72.27 | 49.1% |

| Bel Fuse (NasdaqGS:BELF.A) | $71.89 | $142.60 | 49.6% |

| Carvana (NYSE:CVNA) | $297.40 | $586.29 | 49.3% |

| Mobileye Global (NasdaqGS:MBLY) | $15.94 | $31.09 | 48.7% |

Let's uncover some gems from our specialized screener.

Array Technologies (NasdaqGM:ARRY)

Overview: Array Technologies, Inc. manufactures and sells solar tracking technology products across the United States, Spain, Brazil, Australia, and other international markets with a market cap of approximately $1.27 billion.

Operations: The company's revenue is derived from two primary segments: STI Operations, contributing $304.31 million, and Array Legacy Operations, accounting for $760.46 million.

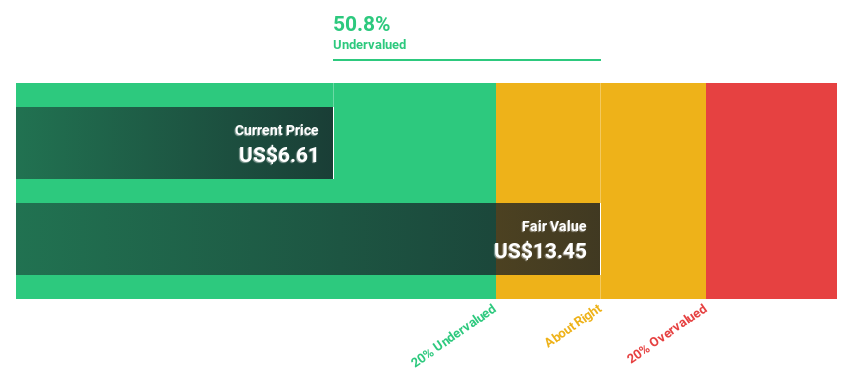

Estimated Discount To Fair Value: 27.3%

Array Technologies is trading at US$8.44, below its estimated fair value of US$11.61, indicating potential undervaluation based on cash flows. Recent earnings showed significant improvement with Q1 net income rising to US$16.75 million from US$2.17 million a year ago, reflecting strong operational performance despite previous impairments and losses in 2024. The introduction of innovative products like DuraTrack Hail XP™ enhances its market position, potentially supporting future cash flow growth amidst volatile share prices.

- The growth report we've compiled suggests that Array Technologies' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Array Technologies stock in this financial health report.

Flutter Entertainment (NYSE:FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally, and has a market cap of approximately $43.83 billion.

Operations: The company's revenue segments include $6.05 billion from the US and $3.62 billion from the UK and Ireland.

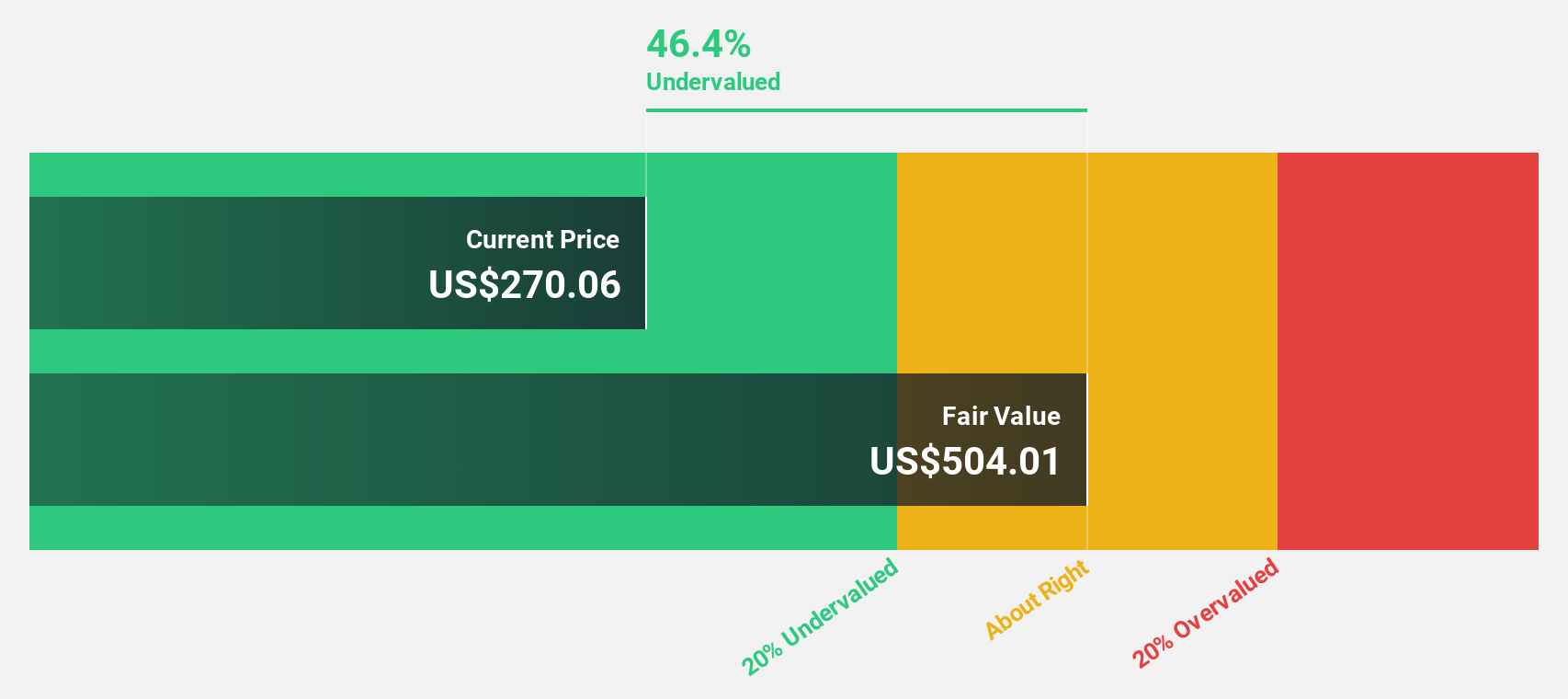

Estimated Discount To Fair Value: 32.7%

Flutter Entertainment is trading at US$244.1, well below its estimated fair value of US$362.56, highlighting potential undervaluation based on cash flows. The company reported a Q1 net income of US$283 million, reversing a prior year's loss and demonstrating strong financial recovery. With revenue expected to grow faster than the market and earnings projected to increase significantly over the next three years, Flutter's strategic buybacks further enhance shareholder value amidst robust earnings guidance for 2025.

- Our growth report here indicates Flutter Entertainment may be poised for an improving outlook.

- Navigate through the intricacies of Flutter Entertainment with our comprehensive financial health report here.

RXO (NYSE:RXO)

Overview: RXO, Inc. operates a truck brokerage business across the United States, Canada, Mexico, Asia, and Europe with a market cap of $2.81 billion.

Operations: The company's revenue is primarily derived from its Transportation - Trucking segment, which generated $5.07 billion.

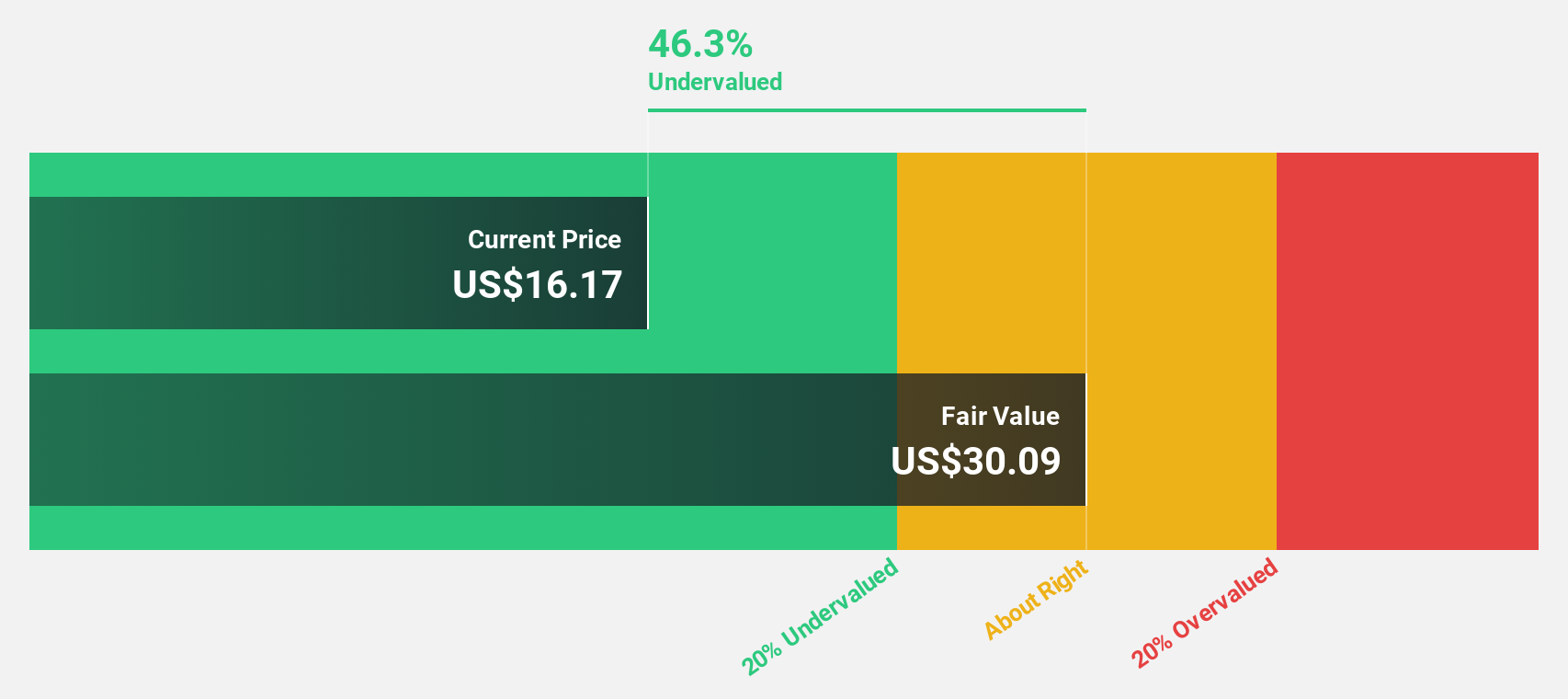

Estimated Discount To Fair Value: 35.6%

RXO is trading at US$17.07, significantly below its estimated fair value of US$26.51, suggesting undervaluation based on cash flows. Despite a recent net loss of US$31 million in Q1 2025, RXO's revenue growth outpaces the broader market with an expected annual increase of 10.9%. The company is forecasted to become profitable within three years, offering potential upside given its strong relative value compared to peers and industry standards.

- Our earnings growth report unveils the potential for significant increases in RXO's future results.

- Delve into the full analysis health report here for a deeper understanding of RXO.

Summing It All Up

- Dive into all 171 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Array Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARRY

Array Technologies

Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives