- United States

- /

- Transportation

- /

- NYSE:R

Ryder (R): Margin Stability Challenges High-Growth Narratives as Earnings Decelerate

Reviewed by Simply Wall St

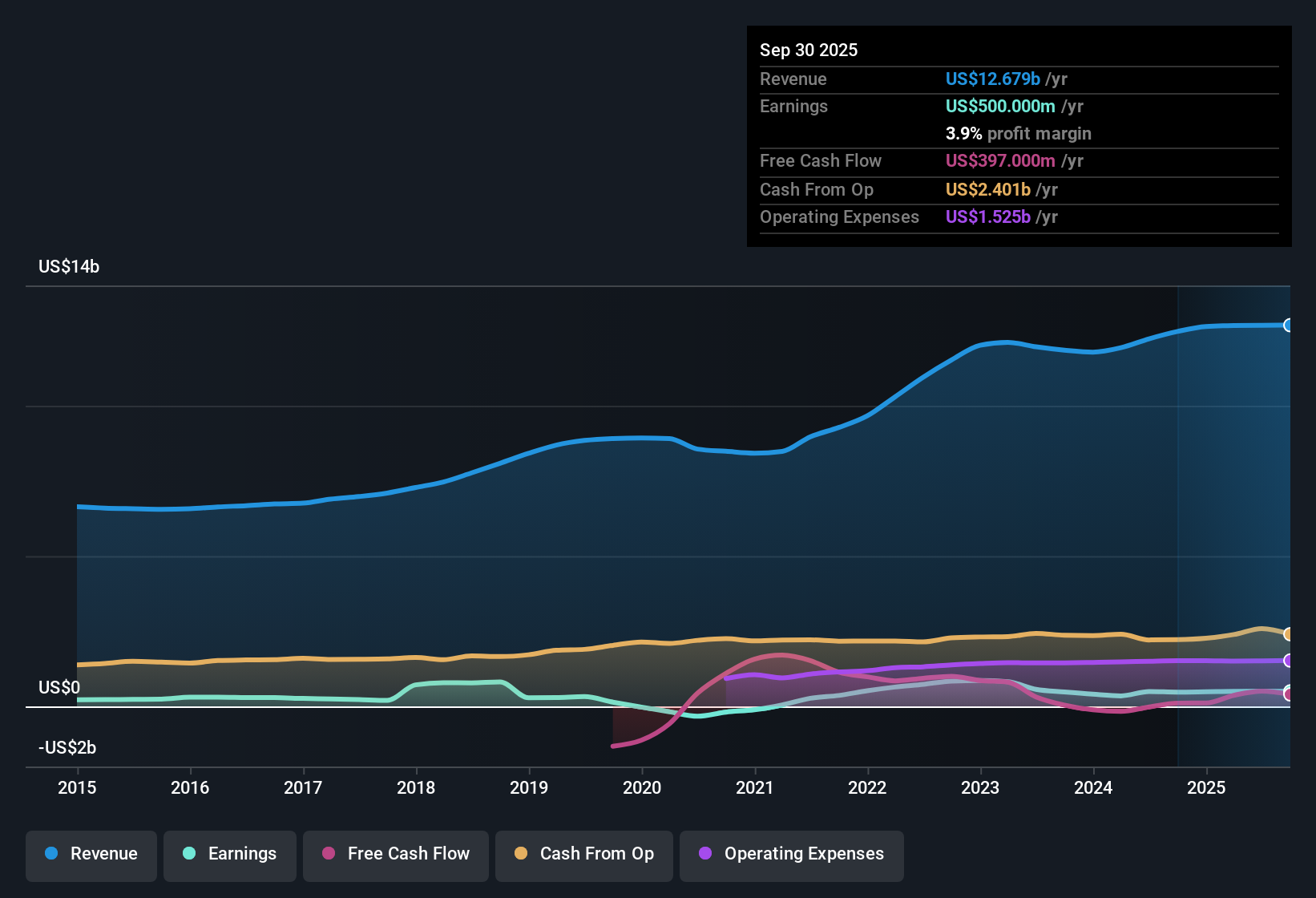

Ryder System (R) posted a net profit margin of 4% for the period, holding steady from last year, while its earnings growth rate came in at 2%, which is well below the company’s 18% per year average over the past five years. Looking ahead, analysts see annual earnings growth of 9.8% and revenue growth of 5.4%, both trailing the broader US market’s expected gains. Ryder’s solid profitability and value-focused metrics remain key pillars for investors, even as growth rates moderate compared to historical levels.

See our full analysis for Ryder System.Up next, we will set these earnings results against the current market narratives to see which stories hold up and where expectations might need to shift.

See what the community is saying about Ryder System

Contract Revenues Power Margin Stability

- Ryder's net profit margin held steady at 4% this year, even as the company shifted more focus toward higher-margin, contract-based supply chain and logistics streams.

- According to analysts' consensus view, this margin resilience is underpinned by:

- 93% of revenue coming from U.S.-based operations, which benefit from trends toward regionalized supply chains and rising demand for recurring service agreements.

- Persistent investment in technology and digital platforms, boosting operational efficiency and helping Ryder better navigate economic swings compared to more traditional logistics competitors.

- Curious how long-term contracts and supply chain shifts are changing the narrative for Ryder? 📊 Read the full Ryder System Consensus Narrative.

Attractive Valuation Versus Industry Peers

- The company is valued at 13x forward P/E, which is far below the industry average of 27.3x and the peer group’s 35.8x. This makes Ryder comparatively inexpensive within its sector.

- Consensus narrative highlights several supportive factors for this valuation:

- Stable and quality earnings, with recurring revenue streams providing a cushion in tougher freight markets.

- The current dividend yield and the potential for capital returns increase Ryder’s appeal. Shares are trading below major analyst target prices, pointing toward a potential value opportunity if targets are met.

Risks: Financial Position and Freight Headwinds

- Despite steady profits and an attractive valuation, analysts note Ryder is not currently seen as being in a strong financial position. Persistent weak freight markets could strain growth if conditions persist.

- The consensus view calls out two key concerns:

- Prolonged downturns in freight and uncertainty around used vehicle prices make margin improvement less predictable than in prior years.

- Heavy capital expenditure requirements for fleet replacement and technology could pressure free cash flow and limit Ryder’s ability to fund future growth if economic softness continues.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ryder System on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on Ryder’s latest numbers? Put your perspective into focus and shape your own narrative. Do it your way Do it your way.

A great starting point for your Ryder System research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Ryder’s balance sheet strength is questioned by analysts due to ongoing freight market softness and substantial capital needs. These factors could constrain future growth.

If you’d prefer companies with stronger financial foundations and less balance sheet risk, filter for healthier picks using our solid balance sheet and fundamentals stocks screener (1984 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:R

Ryder System

Operates as a logistics and transportation company worldwide.

Established dividend payer and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)