- United States

- /

- Transportation

- /

- NYSE:R

How Ryder System’s (R) 12% Dividend Increase Will Impact Investors

Reviewed by Simply Wall St

- On July 10, 2025, Ryder System’s Board of Directors approved a regular quarterly cash dividend of $0.91 per share, to be paid on September 19, reflecting a 12% increase from its prior $0.81 dividend.

- This increase suggests growing confidence in Ryder’s financial stability, enhancing its profile among investors seeking consistent and rising income streams.

- We’ll explore how Ryder’s larger dividend, as a sign of management confidence, impacts the company’s investment outlook going forward.

Ryder System Investment Narrative Recap

For investors to be comfortable as Ryder System shareholders, they likely need confidence in the company’s ongoing shift toward asset-light operations and steady capital returns, while recognizing the risk that a prolonged freight market downturn could impact both earnings and dividend reliability. The recent 12% dividend increase reinforces Ryder’s commitment to returning cash and might support its appeal in the short term, though it does not materially change the primary catalyst of supply chain solutions growth or fully offset pressure from freight market risks.

Among Ryder's recent announcements, the company’s Q1 2025 earnings report stands out, with improvements in revenue, net income, and earnings per share. While these gains reflect clear operational momentum, mitigating concerns tied to slower traditional segments, the dividend hike signals that management remains focused on shareholder value, even as shifting business conditions continue to shape Ryder’s outlook.

By contrast, investors should also be aware that even with rising dividends, extended freight market weakness could...

Read the full narrative on Ryder System (it's free!)

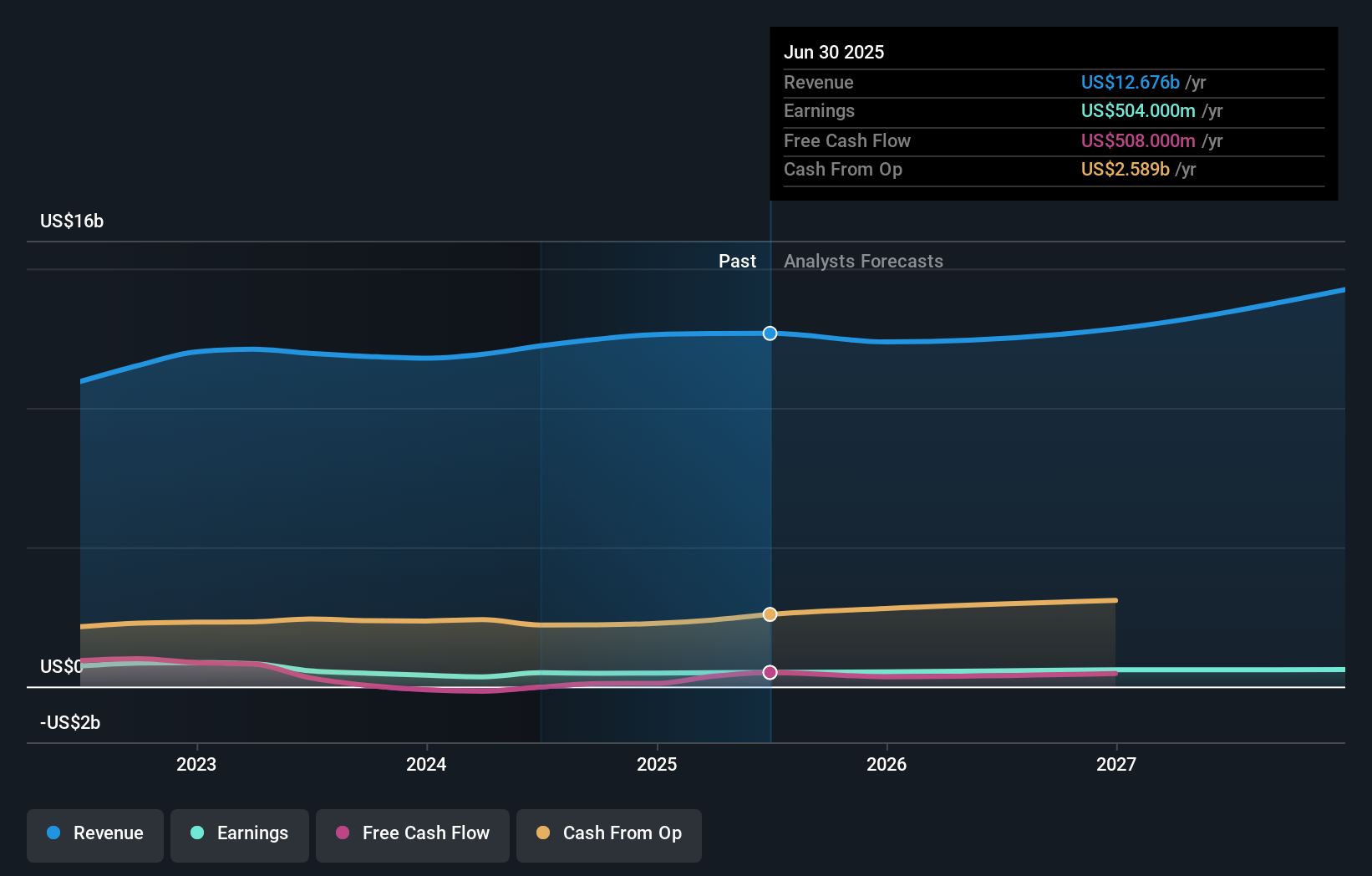

Ryder System’s outlook anticipates $14.5 billion in revenue and $712.7 million in earnings by 2028. This scenario is based on a 4.7% annual revenue growth rate and a $214.7 million increase in earnings from the current $498.0 million.

Uncover how Ryder System's forecasts yield a $158.27 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Only one community valuation of US$158.27 per share was published by Simply Wall St Community members prior to the latest dividend news. Some investors remain focused on risks like lower rental demand, which may challenge Ryder’s ability to sustain its growth plans.

Build Your Own Ryder System Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ryder System research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ryder System research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ryder System's overall financial health at a glance.

No Opportunity In Ryder System?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:R

Ryder System

Operates as a logistics and transportation company worldwide.

Solid track record established dividend payer.

Market Insights

Community Narratives