Key Takeaways

- The shift to asset-light services enhances revenue stability and provides higher margin opportunities, transforming Ryder's business model.

- Strategic cost savings and share buybacks are set to boost EPS and improve returns amid muted freight market conditions.

- Economic uncertainty and reduced vehicle demand may challenge Ryder's growth, impacting revenues, earnings, and future investment capabilities.

Catalysts

About Ryder System- Operates as a logistics and transportation company worldwide.

- Ryder System is transforming its business model by shifting its revenue mix towards Supply Chain Solutions (SCS) and Dedicated Transportation Solutions (DTS), with 60% of 2025 revenue expected to come from these asset-light businesses. This shift can enhance revenue stability and growth as these segments may provide higher margin opportunities compared to traditional Fleet Management Solutions (FMS).

- Ryder's multiyear strategic initiatives, including maintenance cost savings and lease pricing improvements, are expected to deliver an annual pre-tax earnings benefit of approximately $150 million by 2025. These initiatives are designed to structurally enhance earnings and returns, contributing positively to net margins in the years ahead.

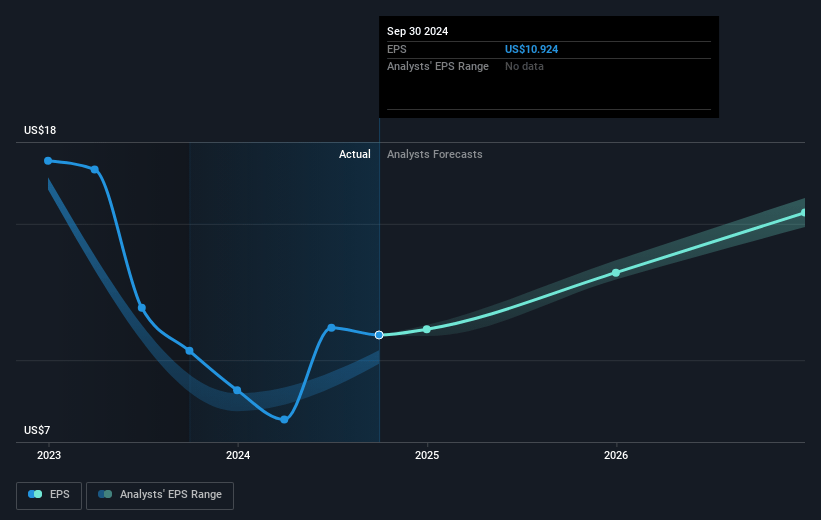

- Compared to its historical performance, Ryder projects its transformed business model to generate significantly higher earnings per share (EPS) and return on equity (ROE) even during current muted freight market conditions. Expected EPS for 2025 is more than double the figure from 2018. This is likely to positively impact earnings growth.

- The company anticipates significant free cash flow generation, estimated at a range of $375 million to $475 million for 2025, primarily due to lower expected capital spending. This can improve net margins and the company’s ability to deploy capital strategically for growth or shareholder returns.

- Ryder plans substantial capital allocation towards share repurchases and strategic acquisitions, a strategy that has already reduced the share count by 20% since 2021. Ongoing buybacks are likely to enhance EPS by decreasing the number of outstanding shares.

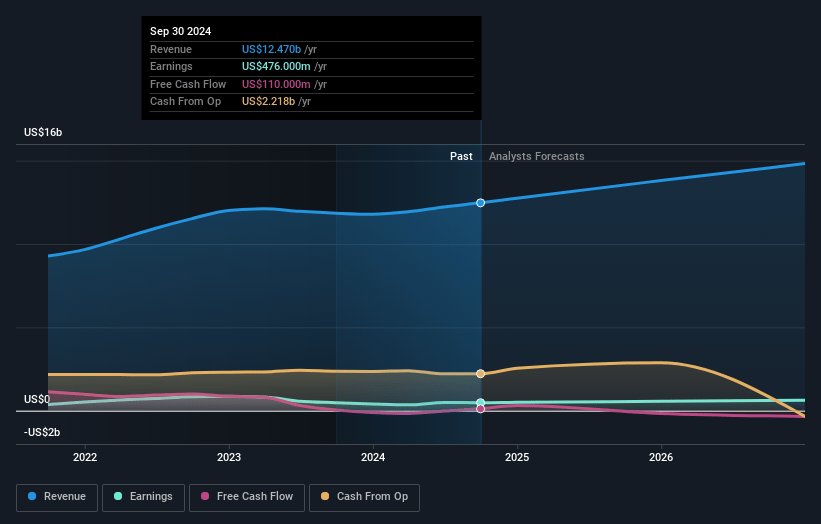

Ryder System Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ryder System's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.9% today to 4.9% in 3 years time.

- Analysts expect earnings to reach $712.7 million (and earnings per share of $15.47) by about April 2028, up from $498.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, down from 11.4x today. This future PE is lower than the current PE for the US Transportation industry at 23.6x.

- Analysts expect the number of shares outstanding to decline by 5.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.64%, as per the Simply Wall St company report.

Ryder System Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lower rental demand and used vehicle sales could dampen Ryder's revenues and earnings, impacting its ability to hit projected financial targets.

- Economic uncertainty and extended freight downturns may result in customers delaying decisions or downsizing fleets, which could pose risks to net margins and future revenue streams.

- A weaker than expected macroeconomic environment, which includes lower rental demand, could hinder Ryder's earnings projections and limit its capacity for growth and investment.

- Concerns about used vehicle sales pricing due to aged inventory and wholesale activity could weigh on Ryder’s revenue from this segment and impact overall earnings resilience.

- Capital spending being adjusted downward indicates caution about market conditions, potentially affecting future growth opportunities and revenue sources.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $161.49 for Ryder System based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $175.0, and the most bearish reporting a price target of just $143.94.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.5 billion, earnings will come to $712.7 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 10.6%.

- Given the current share price of $137.82, the analyst price target of $161.49 is 14.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.