- United States

- /

- Transportation

- /

- NYSE:NSC

Norfolk Southern (NYSE:NSC) Reports Q1 2025 Net Income Surge to US$750 Million

Reviewed by Simply Wall St

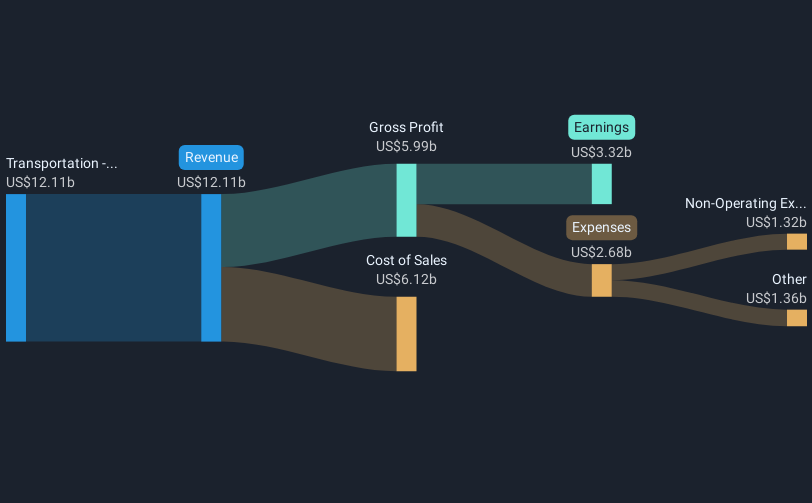

Norfolk Southern (NYSE:NSC) recently announced a substantial increase in net income for Q1 2025, rising to $750 million from $53 million the previous year, alongside a quarterly dividend of $1.35 per share. These factors, along with share buybacks totaling $248 million, underscore the company's strong financial performance and commitment to returning shareholder value. Over the past month, Norfolk Southern's stock price moved up 15%, significantly outpacing the market's 5% increase. The company's robust earnings and strategic financial actions would have added weight to its price appreciation amid a broadly positive market trend.

You should learn about the 1 warning sign we've spotted with Norfolk Southern.

Norfolk Southern's recent announcement of a substantial net income increase to US$750 million and a US$1.35 per share dividend, coupled with a US$248 million share buyback, is likely to reinforce investor confidence in its financial health and commitment to shareholder returns. These factors, along with a 15% stock price appreciation over the past month, may drive positive sentiment around the ongoing PSR 2.0 transformation, potentially impacting future revenue and earnings growth. The company's focus on improving operational efficiencies and boosting customer service is expected to support these financial metrics, even amid challenges such as storm restoration costs and competitive pricing pressures.

Over the past five years, Norfolk Southern's total return, including share price and dividends, was 59.17%. In contrast, over the past year, NSC's performance matched the US Transportation industry's return and slightly underperformed the broader US market return. Analysts have set a consensus price target at US$257.88, approximately 15.2% higher than the current share price of US$218.63. This indicates potential upside if the company continues to achieve anticipated revenue growth and margin improvements. The recent news could contribute to narrowing the gap to the price target, reflecting analyst expectations of enhanced earnings and operational performance in the medium term.

Upon reviewing our latest valuation report, Norfolk Southern's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives