- United States

- /

- Airlines

- /

- NYSE:CPA

How Copa’s Rising Load Factor and Passenger Traffic in July Reshapes Its Investment Narrative at CPA

Reviewed by Simply Wall St

- Copa Holdings, S.A. recently announced its preliminary operating results for July 2025, reporting 2,854.8 million ASM, 2,533.7 million RPM, and a load factor of 88.8%, all higher than the same month a year earlier.

- An important insight is that Copa's improvement in both passenger traffic and operational efficiency suggests rising travel demand and successful capacity management during this period.

- We will explore how Copa’s increased passenger traffic and higher load factor could shape its long-term investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Copa Holdings Investment Narrative Recap

To feel comfortable as a Copa Holdings shareholder, you need confidence in its ability to turn strong regional air travel demand and disciplined capacity management into reliable earnings, even as yield pressures persist. This recent set of July 2025 operational results, higher ASM, RPM, and load factor, reinforces near-term momentum for Copa’s most important catalyst: robust, efficient passenger growth. However, pricing pressure from sustained capacity growth and rising competition remains the company’s most immediate risk. The latest results, while positive for demand, do not fundamentally change the risk of continuing yield headwinds, so caution remains warranted.

Among Copa’s recent announcements, the August 8 full-year operating guidance stands out, projecting 7–8% capacity growth for 2025. This guidance underscores management’s confidence in ongoing demand and supports the narrative that network expansion and operational efficiency are vital to competing successfully in the region. It provides additional context for how sustained improvements in traffic and utilization could support Copa’s earnings provided cost control and yield management stay on track.

Yet even as Copa reports positive passenger metrics, investors should closely watch for signs that persistent downward pressure on passenger yields could still challenge...

Read the full narrative on Copa Holdings (it's free!)

Copa Holdings' narrative projects $4.5 billion revenue and $849.9 million earnings by 2028. This requires 8.6% yearly revenue growth and a $212.4 million earnings increase from $637.5 million.

Uncover how Copa Holdings' forecasts yield a $154.00 fair value, a 32% upside to its current price.

Exploring Other Perspectives

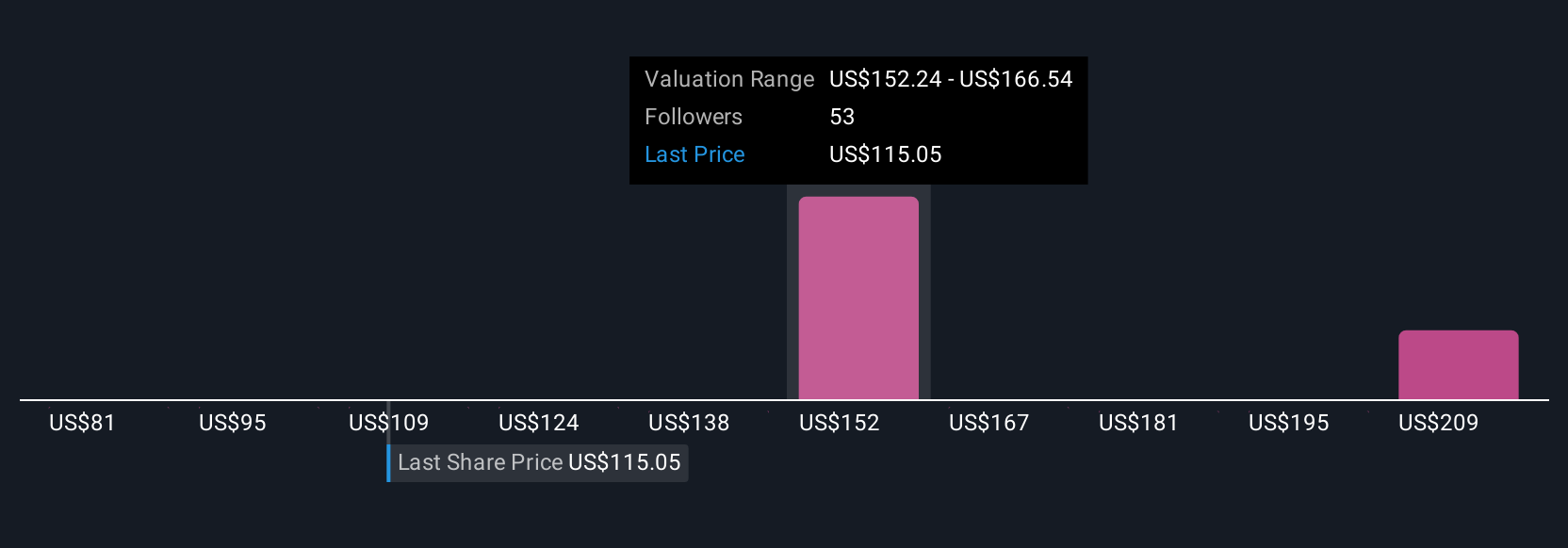

Seven members of the Simply Wall St Community independently estimate Copa’s fair value between US$80.73 and US$226.23 per share. While some focus on projected demand growth, others remain cautious about ongoing yield pressures that could impact margins, highlighting the range of opinions you can explore.

Explore 7 other fair value estimates on Copa Holdings - why the stock might be worth as much as 93% more than the current price!

Build Your Own Copa Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Copa Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Copa Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Copa Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives