- United States

- /

- Airlines

- /

- NYSE:CPA

A Look at Copa Holdings (NYSE:CPA) Valuation Following Strong September 2025 Traffic Gains

Reviewed by Kshitija Bhandaru

Copa Holdings (NYSE:CPA) just released its operating results for September 2025, catching the market's attention. The company reported year-over-year gains in both capacity and passenger traffic, with a meaningful boost in its system load factor.

See our latest analysis for Copa Holdings.

Copa Holdings’ upbeat September traffic figures arrive after an already impressive year for investors, with the stock’s 1-year total return reaching nearly 40% and its share price up 49% year-to-date. Momentum has clearly been building, supported by robust operational gains and growing investor confidence in the company’s long-term growth prospects.

If you’re interested in expanding your watchlist beyond airlines, now is an ideal moment to see what’s trending among fast growing stocks with high insider ownership.

With shares sitting about 20% below analyst price targets, soaring returns, and continued operational momentum, is Copa Holdings still trading at a discount? Or has the market already priced in years of future growth?

Most Popular Narrative: 16.9% Undervalued

With Copa Holdings closing at $128.07 and the most popular narrative suggesting fair value sits at $154.20, bulls find genuine upside in today's market price. The stage is set for a valuation thesis built on ambitious network growth, tech investments, and resilient margins.

"Expansion of Copa's network through new and returning destinations (including San Diego, Los Cabos, Puerto Plata, Salvador de Bahia, Salta, and Tucuman) and the ongoing airport infrastructure enhancements at Panama's Tocumen hub position Copa to capitalize on rising passenger volumes driven by a growing middle class and urbanization across Latin America. This supports sustained top-line revenue growth."

Want to know what powers this bullish view? Find out which bold revenue and earnings forecasts, and a forward profit multiple rarely seen in airlines, underpin the valuation. The full narrative dives into the financial blueprints and future assumptions forming Copa's case for a much higher share price.

Result: Fair Value of $154.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent downward pressure on passenger yields or major disruptions at Copa’s Panama City hub could quickly challenge the company’s optimistic outlook.

Find out about the key risks to this Copa Holdings narrative.

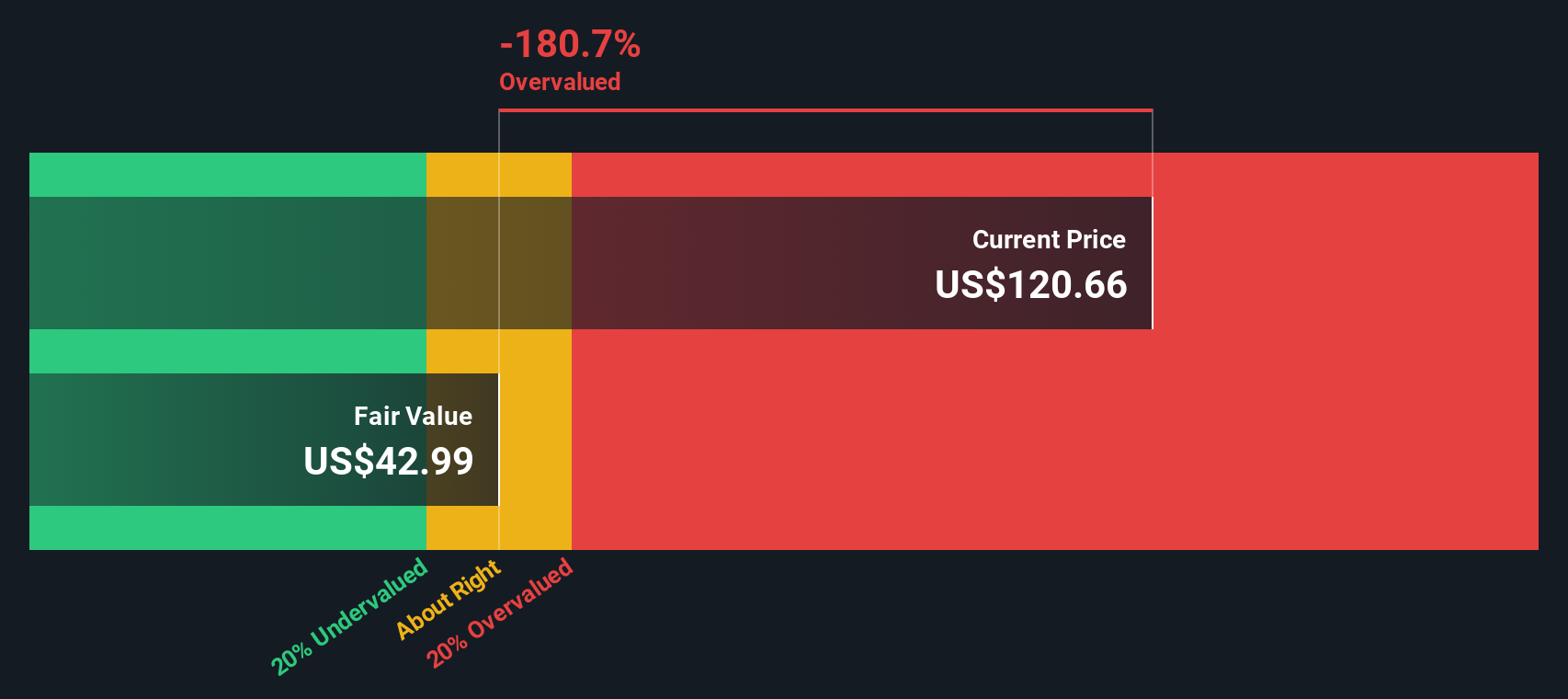

Another View: SWS DCF Model Paints a Different Picture

While many investors rely on analyst price targets and recent multiples for valuation, our SWS DCF model presents a much less optimistic outlook for Copa Holdings. Based on projected future cash flows, it estimates fair value at just $43.13, which is significantly below today’s price. Is the market too bullish, or is the DCF model overlooking important strengths?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Copa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Copa Holdings Narrative

If you have a different take or enjoy digging into the numbers yourself, you can shape your own Copa Holdings story in just a few minutes. Do it your way.

A great starting point for your Copa Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always seek their next big edge. Now is the moment to spot new opportunities that could transform your strategy for the second half of the year.

- Capture high yields by checking out these 18 dividend stocks with yields > 3% with attractive payouts and robust financial health.

- Get ahead of the AI curve with these 24 AI penny stocks making headlines for their innovations in machine learning and automation.

- Take advantage of deep value with these 877 undervalued stocks based on cash flows poised for a potential rebound and long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives