- United States

- /

- Transportation

- /

- NasdaqGS:ULH

With EPS Growth And More, Universal Logistics Holdings (NASDAQ:ULH) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Universal Logistics Holdings (NASDAQ:ULH). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Universal Logistics Holdings

How Fast Is Universal Logistics Holdings Growing Its Earnings Per Share?

Over the last three years, Universal Logistics Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Universal Logistics Holdings' EPS shot from US$2.74 to US$5.76, over the last year. It's a rarity to see 110% year-on-year growth like that.

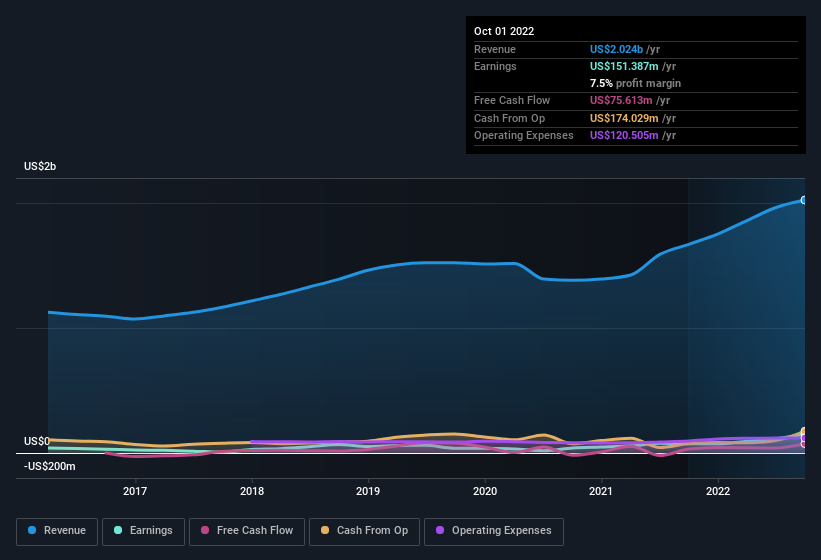

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Universal Logistics Holdings shareholders can take confidence from the fact that EBIT margins are up from 6.2% to 11%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Universal Logistics Holdings' balance sheet strength, before getting too excited.

Are Universal Logistics Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Independent Director Richard Urban spent US$102k acquiring shares, doing so at an average price of US$20.49. Purchases like this clue us in to the to the faith management has in the business' future.

On top of the insider buying, we can also see that Universal Logistics Holdings insiders own a large chunk of the company. To be exact, company insiders hold 74% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. At the current share price, that insider holding is worth a staggering US$735m. That level of investment from insiders is nothing to sneeze at.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Tim Phillips is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Universal Logistics Holdings with market caps between US$400m and US$1.6b is about US$3.6m.

The Universal Logistics Holdings CEO received total compensation of just US$1.0m in the year to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Universal Logistics Holdings Deserve A Spot On Your Watchlist?

Universal Logistics Holdings' earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Universal Logistics Holdings deserves timely attention. Before you take the next step you should know about the 1 warning sign for Universal Logistics Holdings that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Universal Logistics Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ULH

Universal Logistics Holdings

Provides customized transportation and logistics solutions in the United States, Mexico, Canada, and Colombia.

Adequate balance sheet slight.

Market Insights

Community Narratives