- United States

- /

- Transportation

- /

- NasdaqGS:ODFL

Old Dominion Freight Line (NasdaqGS:ODFL) Slides 10% After Earnings Show Drop

Reviewed by Simply Wall St

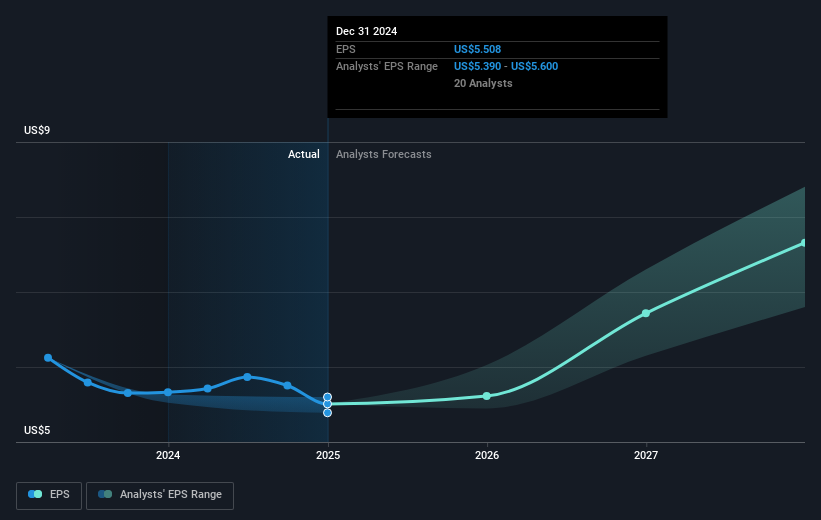

Old Dominion Freight Line (NasdaqGS:ODFL) saw its share price decline 10% over the last month, which coincided with the release of their Q4 and 2024 full-year earnings showing a drop in both sales and net income. Although the company announced a 7.7% increase in its first-quarter dividend, the positive news may have been overshadowed by broader market trends and mixed reactions to earnings. The Dow Jones Industrial Average experienced a mixed session with the S&P 500 and Nasdaq showing slight declines, coinciding with concerns about economic policies and new tariffs. These market conditions may have contributed to pressure on Old Dominion's stock. Despite a continued buyback program that reflects confidence in its future, the impact of falling earnings and market volatility likely influenced the stock's recent movement.

Unlock comprehensive insights into our analysis of Old Dominion Freight Line stock here.

Over the past five years, Old Dominion Freight Line (NasdaqGS:ODFL) has experienced significant total returns, rising by 160.75%. This performance reflects the company's steady earnings growth, averaging 15.4% annually, coupled with high return on equity of 27.9%. While its price-to-earnings ratio of 31.5x indicates the stock is currently expensive relative to its industry, the company's solid financial base may have supported its long-term success.

The ongoing share buyback program has been another factor that fueled ODFL's returns, repurchasing 5.39 million shares, worth US$1.05 billion since July 2023. Additionally, a series of quarterly dividend increases have provided added incentives for shareholders. Despite recent challenges, these measures illustrate managerial efforts in enhancing shareholder value, contributing to the favorable returns witnessed over the last five years.

- Learn how Old Dominion Freight Line's intrinsic value compares to its market price with our detailed valuation report.

- Understand the uncertainties surrounding Old Dominion Freight Line's market positioning with our detailed risk analysis report.

- Got skin in the game with Old Dominion Freight Line? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Old Dominion Freight Line, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ODFL

Old Dominion Freight Line

Operates as a less-than-truckload motor carrier in the United States and North America.

Flawless balance sheet with acceptable track record.