- United States

- /

- Transportation

- /

- NasdaqGS:LSTR

Landstar System (LSTR): Is Recent Weakness Creating a Value Opportunity?

Reviewed by Kshitija Bhandaru

Landstar System (LSTR) has caught the market’s attention as investors take stock of its recent price moves and overall performance. With shares fluctuating through the month, many are now reassessing the company’s long-term trajectory and value.

See our latest analysis for Landstar System.

After a sharp slide earlier this year, Landstar System’s 1-year total shareholder return is down 31.1%, reflecting shifting investor sentiment amid a tougher freight environment and some market recalibration. While the past month’s share price drifted lower, recent days have seen modest signs of momentum returning as buyers dip back in. However, longer-term performance remains muted.

If you’re wondering what other opportunities might be building in the market, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

The key question for investors now is whether Landstar System’s recent weakness leaves the stock undervalued, or if today’s price already reflects all of its future growth prospects. Is this a setup for buyers, or is the market already one step ahead?

Most Popular Narrative: 7.1% Undervalued

Landstar System’s widely followed narrative assigns a fair value of $136.79, which is about 7% above the last close of $127.06. This signals that the consensus expects some meaningful upside if key assumptions materialize and industry dynamics improve.

Robust growth in infrastructure-related and data center freight, fueled by domestic investment and the AI/data center buildout, is expected to drive continued strength in Landstar's specialized heavy haul segment. This supports higher revenue per load and overall earnings growth. Persistent industry digitization and Landstar's ongoing investment in technology platforms and digital tools are streamlining network operations, leading to increased operational efficiency, lower SG&A as a percentage of revenue, and improved net margins over time.

Curious what’s powering this bold valuation call? The real intrigue hides in future margin gains and a projected profit surge, backed by ambitious tech investments. What are the numbers behind these claims? The next section breaks open the case.

Result: Fair Value of $136.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent rate pressure and high insurance costs could quickly challenge Landstar System’s margins if market conditions remain unfavorable.

Find out about the key risks to this Landstar System narrative.

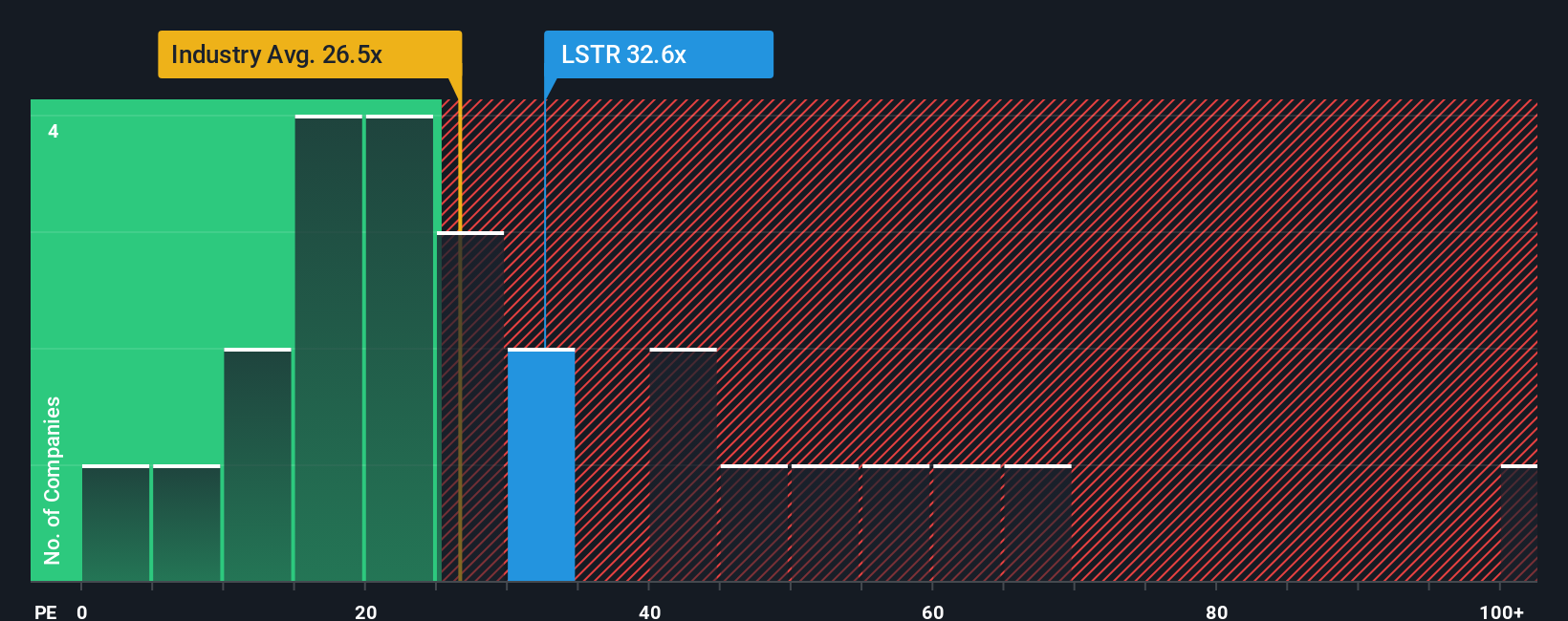

Another View: The Multiples Perspective

While some see Landstar System as undervalued, a look at its price-to-earnings ratio reveals a different story. At 26.2x, the company is priced higher than the industry average of 24.1x and much loftier than the fair ratio of 14x. This suggests the market may be placing a premium on its shares. This raises questions about potential downside risk if expectations shift. Is Landstar’s premium justified, or are investors overlooking something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Landstar System Narrative

If you see the numbers differently or would rather chart your own path, it’s easy to build your own take in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Landstar System.

Looking for More Smart Investment Ideas?

Staying ahead means always scouting for your next opportunity. Don’t let great investment themes pass you by when the market is full of fresh possibilities:

- Tap into high-yield strategies by checking out these 18 dividend stocks with yields > 3% with strong, sustainable payouts and steady growth potential.

- Spot early movers in artificial intelligence by reviewing these 25 AI penny stocks as these are positioned to benefit from surging demand for data-driven solutions.

- Uncover value gems with cash-flow strength through these 877 undervalued stocks based on cash flows, which brings hidden bargains to the surface before the crowd reacts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSTR

Landstar System

Provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives