- United States

- /

- Consumer Durables

- /

- NasdaqGS:CRCT

US Market's Hidden Gems These 3 Undiscovered Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust 15% increase over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying small-cap stocks that have not yet gained widespread attention can offer unique opportunities for investors seeking potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Euroseas (ESEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Euroseas Ltd. is a company that offers ocean-going transportation services globally, with a market cap of $346.27 million.

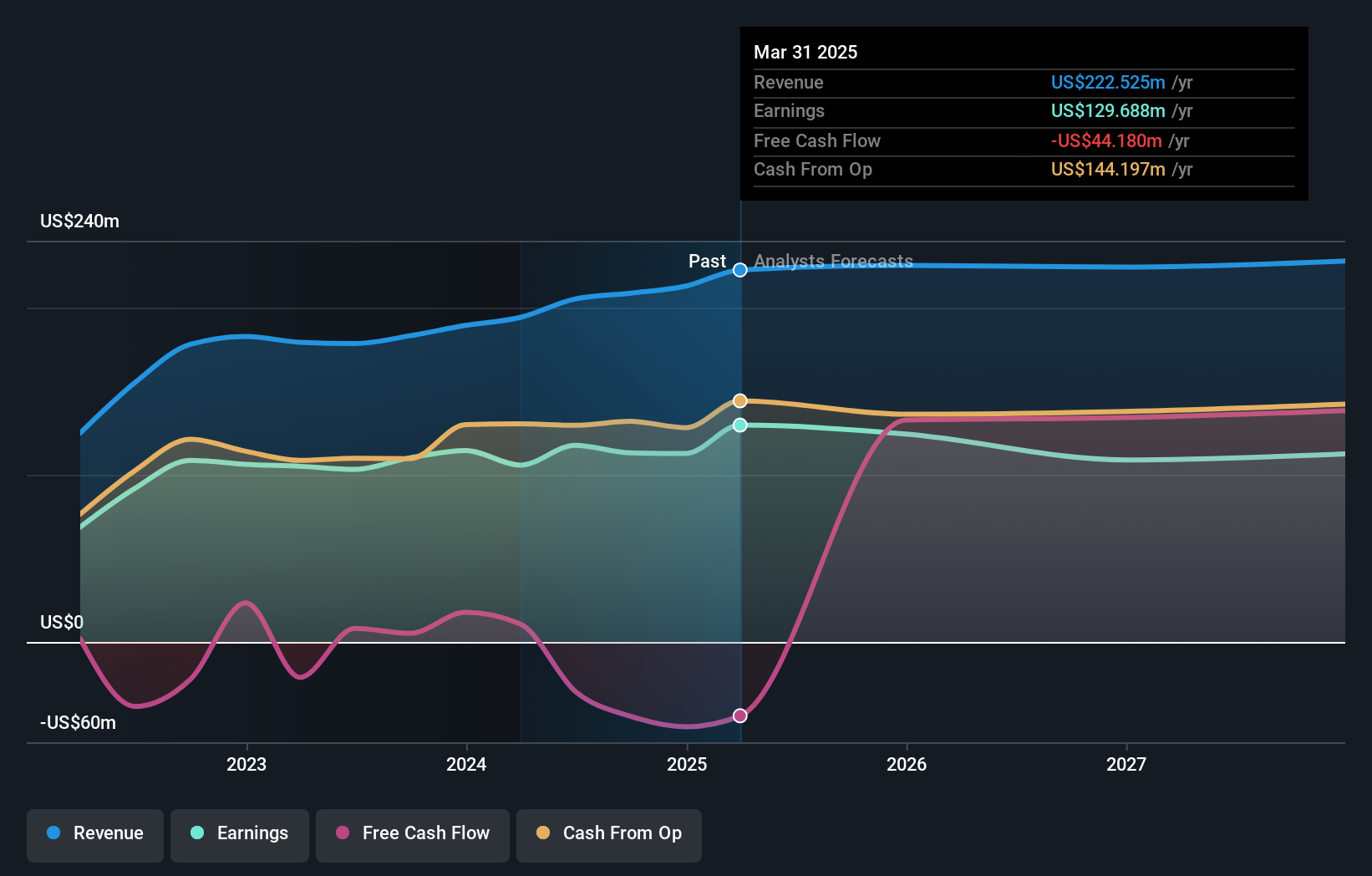

Operations: Euroseas Ltd. generates revenue primarily from its transportation shipping services, with reported earnings of $222.53 million.

Euroseas, a smaller player in the shipping industry, has demonstrated notable growth with earnings rising by 22.6% over the past year, outpacing the industry's -5.3%. The company's net debt to equity ratio stands at 40.7%, which is considered high but has improved significantly from 288.1% five years ago. Trading at an attractive valuation, Euroseas is priced 77.9% below its estimated fair value compared to peers and industry standards. Despite challenges like declining charter rates and geopolitical risks, recent moves such as securing new time charters and vessel sales suggest strategic efforts to bolster financial stability and operational capacity.

John Marshall Bancorp (JMSB)

Simply Wall St Value Rating: ★★★★★★

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering a range of banking products and financial services in the United States, with a market cap of $271.61 million.

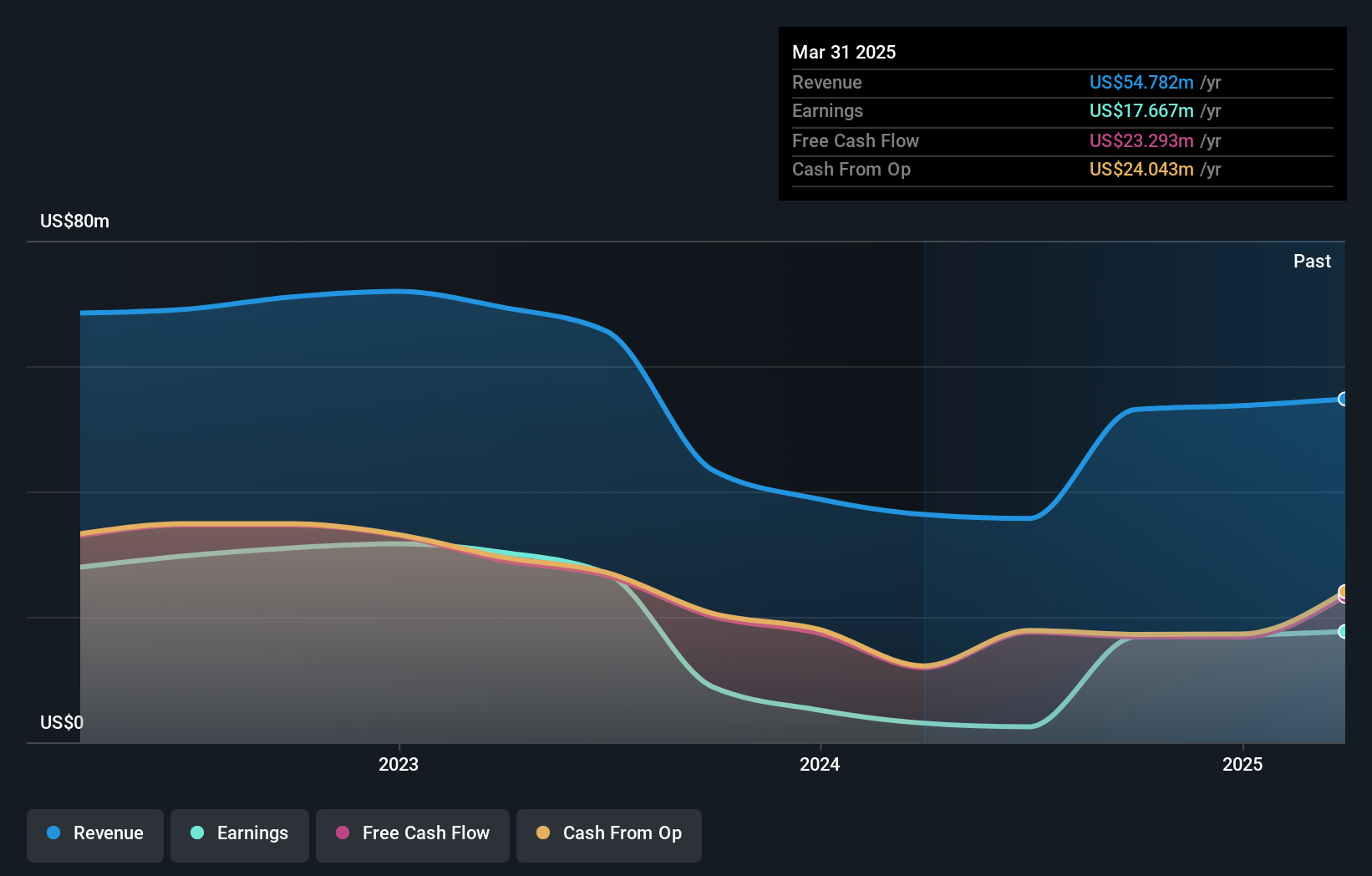

Operations: John Marshall Bancorp generates revenue primarily through its banking segment, which reported $54.78 million. The company's financial performance can be assessed by examining its net profit margin trends over time.

John Marshall Bancorp, with total assets of US$2.3 billion and equity of US$253 million, stands out for its robust earnings growth over the past year at 479.2%, significantly outperforming the industry average of 6.2%. The bank's allowance for bad loans is sufficient at 0.5% of total loans, indicating prudent risk management. Trading at a discount to its estimated fair value by 17%, it seems undervalued in the market despite being dropped from the Russell 2000 Dynamic Index recently. The company repurchased shares worth US$0.1 million this year and announced a dividend increase to US$0.30 per share, reflecting confidence in its financial health.

- Delve into the full analysis health report here for a deeper understanding of John Marshall Bancorp.

Cricut (CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform for crafting professional-looking handmade goods across various regions globally, with a market cap of $1.15 billion.

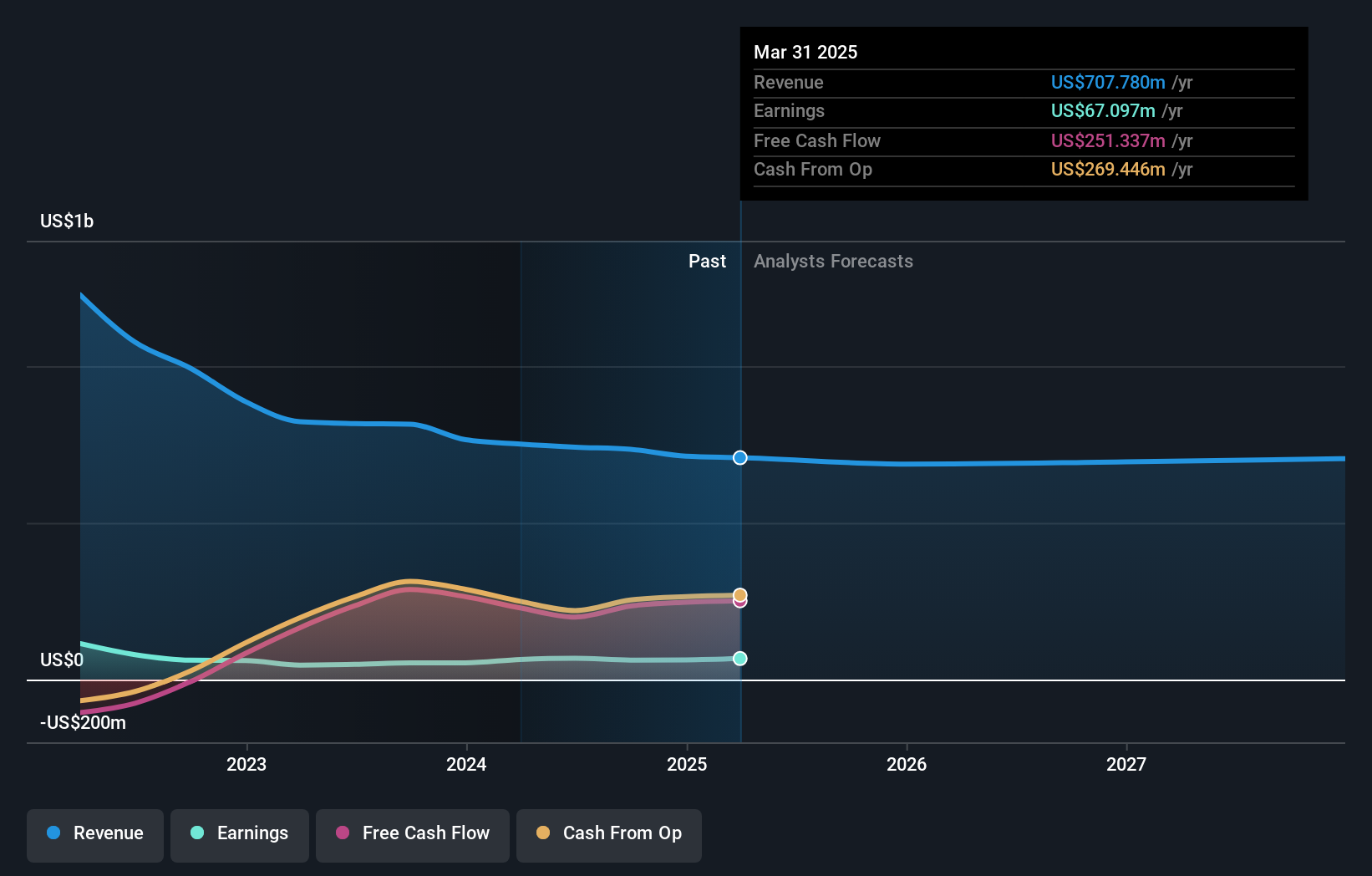

Operations: Cricut generates revenue primarily from its platform, which contributes $314.68 million, while segment adjustments add $393.10 million. The company's gross profit margin stands at 48%.

Cricut, a nimble player in the crafting industry, has seen its earnings grow by 4.5% over the past year, outpacing the Consumer Durables sector's -3.3%. Despite a challenging five-year period with earnings falling by 29.2% annually, Cricut remains debt-free—a significant improvement from five years ago when its debt-to-equity ratio was 27.3%. The company recently completed a share buyback of 6.61 million shares for US$39.15 million and plans to repurchase an additional US$50 million worth of shares without an expiration date, signaling confidence in its valuation and future prospects despite recent index exclusions.

- Get an in-depth perspective on Cricut's performance by reading our health report here.

Understand Cricut's track record by examining our Past report.

Key Takeaways

- Click here to access our complete index of 279 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRCT

Cricut

Engages in the design, marketing, and distribution of a creativity platform that enables users to turn ideas into professional-looking handmade goods in the United States, Canada, the United Kingdom, Ireland, Australia, New Zealand, Western Europe, the Middle East, Latin America, South Africa, and Asia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives