- United States

- /

- Banks

- /

- NYSE:PNC

Top Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through renewed trade tensions with China, investors are feeling the impact of geopolitical uncertainties despite strong earnings from major banks. Amidst this backdrop, dividend stocks often appeal to those seeking stability and income, offering a potential buffer against market volatility and economic unpredictability.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 3.99% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.52% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.79% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.19% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.82% | ★★★★★★ |

| Ennis (EBF) | 5.69% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.86% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.39% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.72% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.54% | ★★★★★☆ |

Click here to see the full list of 132 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

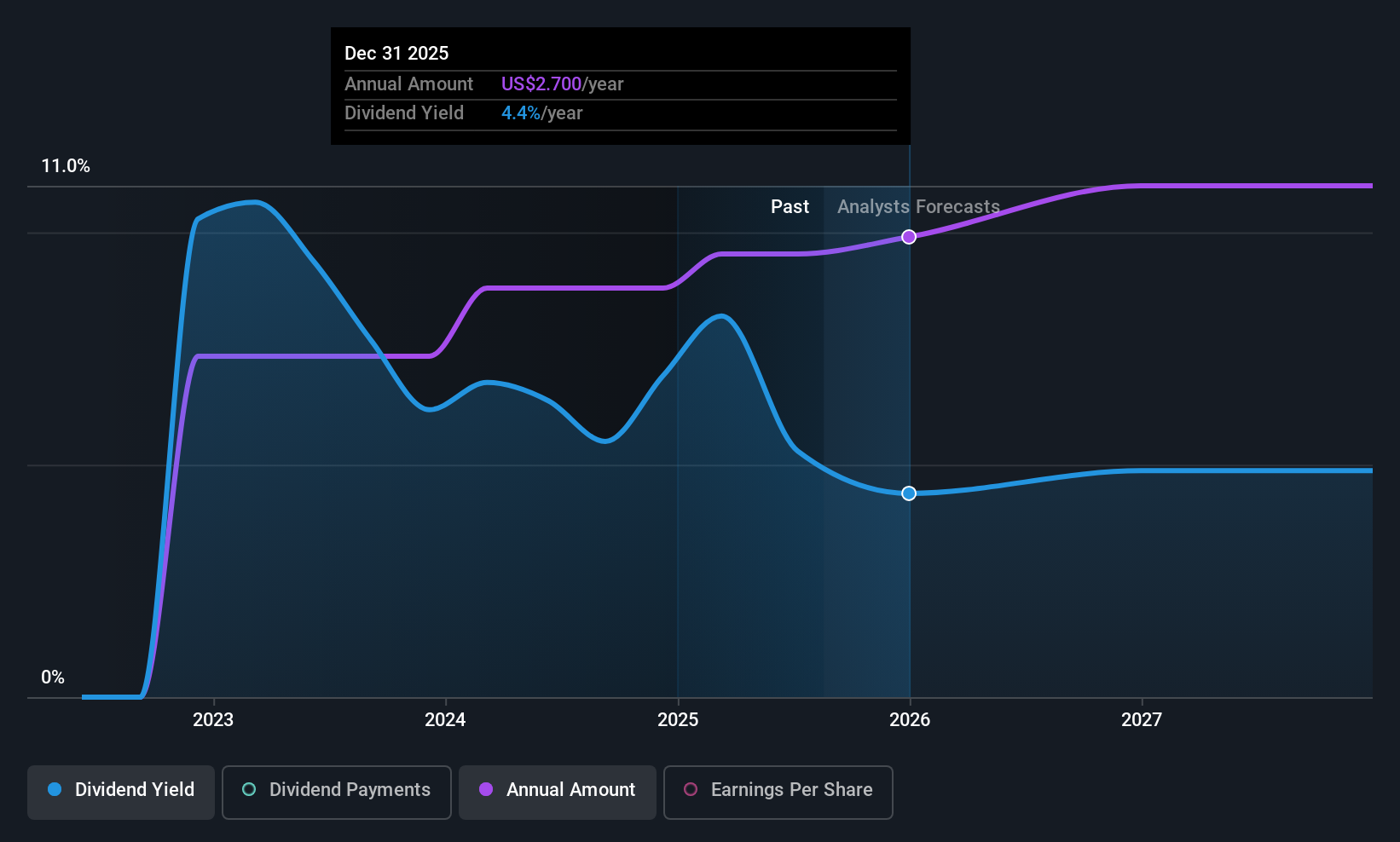

Euroseas (ESEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Euroseas Ltd. offers ocean-going transportation services globally and has a market cap of $406.66 million.

Operations: Euroseas Ltd. generates revenue of $221.03 million from its transportation - shipping segment.

Dividend Yield: 5%

Euroseas Ltd. offers a compelling dividend profile, trading at 79% below its estimated fair value with a dividend yield of 4.98%, placing it in the top 25% of US market payers. The company's dividends are well-covered by earnings with an 11.4% payout ratio and reasonable cash flow coverage at 74.5%. Despite only three years of payments, dividends have grown steadily. Recent contracts and vessel additions could support future earnings stability, enhancing dividend reliability further.

- Take a closer look at Euroseas' potential here in our dividend report.

- The analysis detailed in our Euroseas valuation report hints at an deflated share price compared to its estimated value.

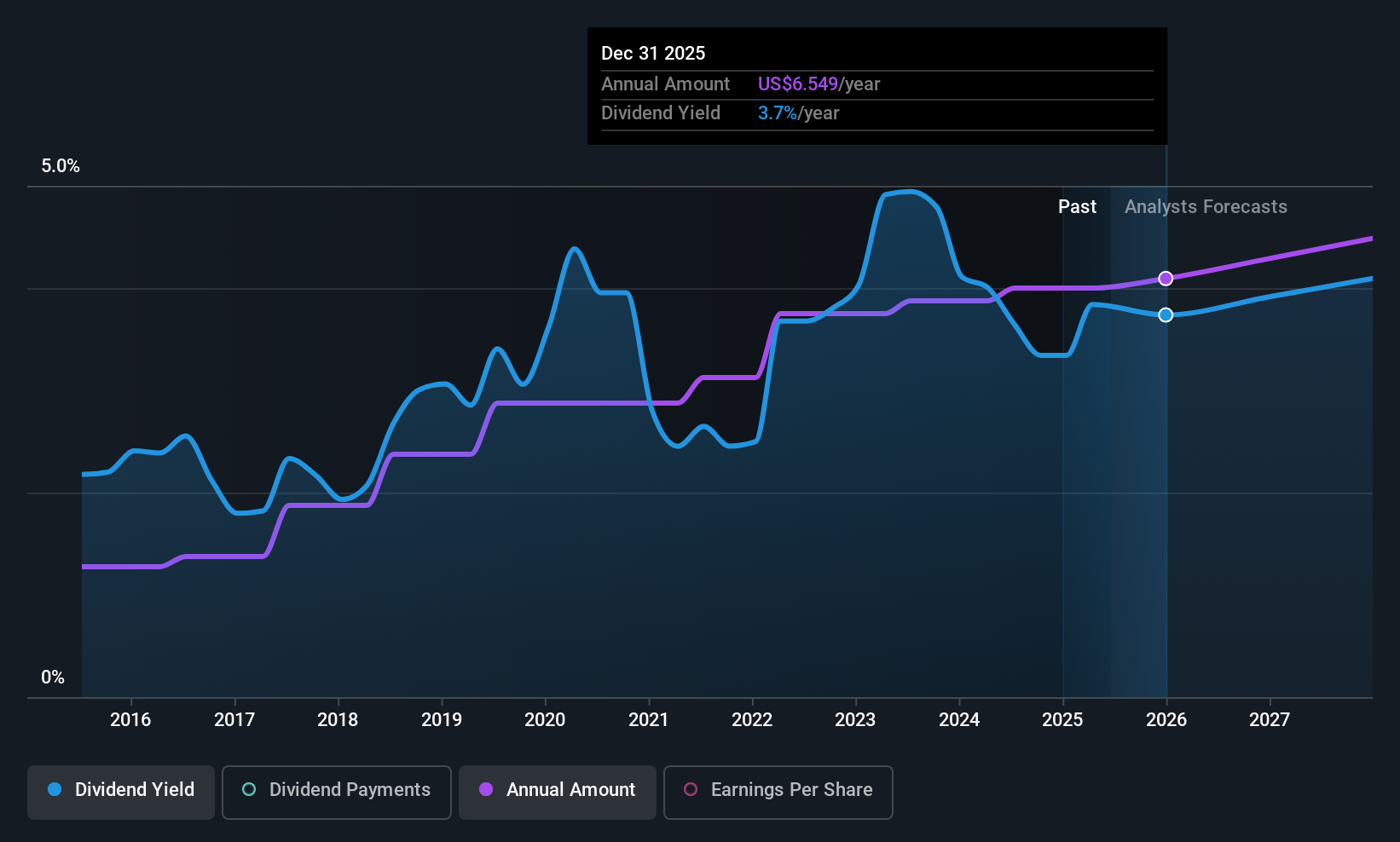

PNC Financial Services Group (PNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The PNC Financial Services Group, Inc. is a diversified financial services company operating in the United States with a market cap of approximately $73.34 billion.

Operations: PNC Financial Services Group generates revenue from its Asset Management Group ($1.69 billion), Corporate & Institutional Banking ($10.24 billion), and Retail Banking including Residential Mortgage ($13.84 billion) segments.

Dividend Yield: 3.6%

PNC Financial Services Group maintains a stable dividend profile with a 3.58% yield, though lower than the top US payers. Its dividends are well-covered by earnings, with a payout ratio of 43.7%, and forecasted to remain sustainable at 41.2%. Recent affirmations include a quarterly cash dividend of $1.70 per share payable in November 2025. Earnings have grown by 22.1% over the past year, supporting consistent dividend increases over the last decade.

- Navigate through the intricacies of PNC Financial Services Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that PNC Financial Services Group is priced lower than what may be justified by its financials.

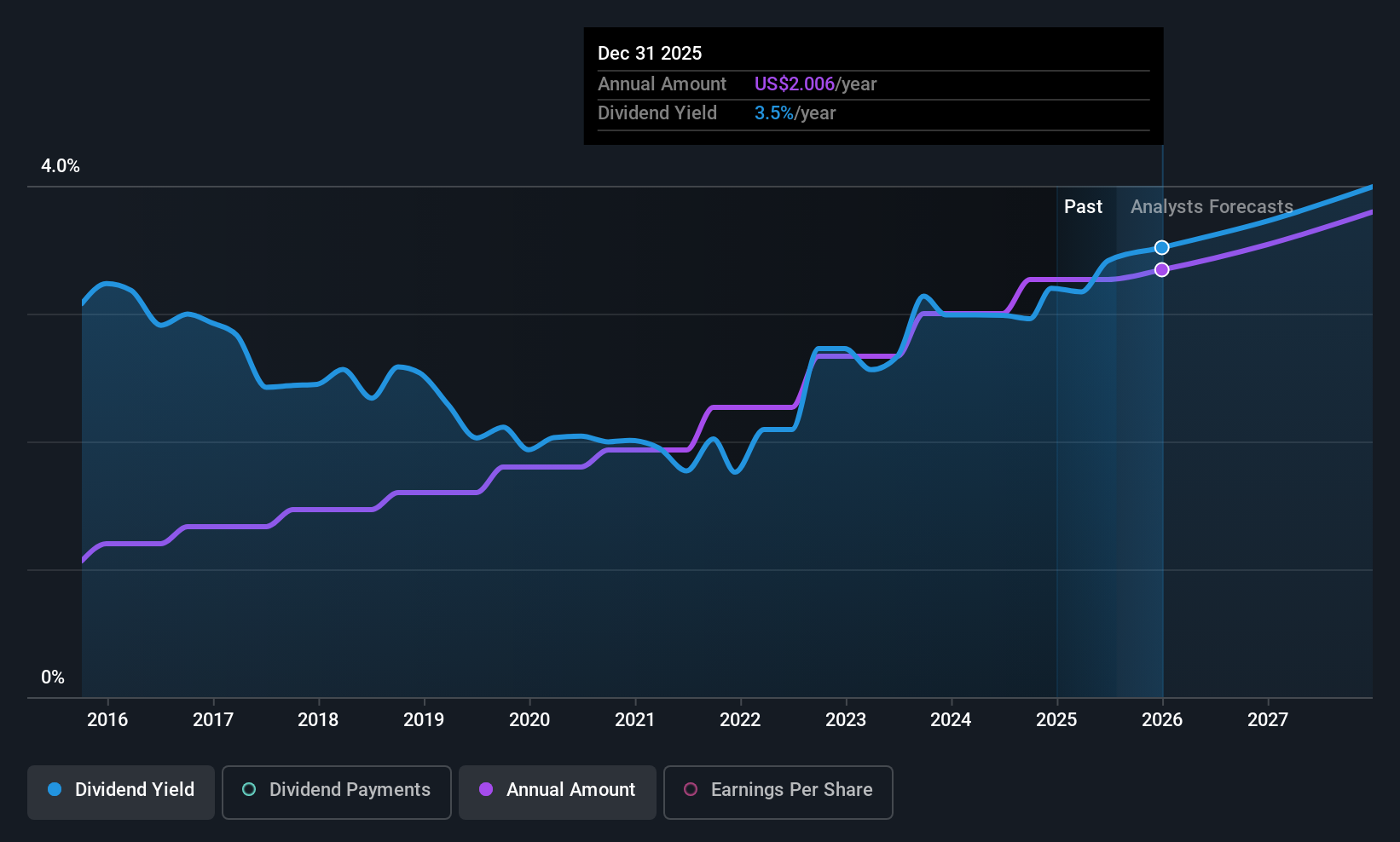

Terreno Realty (TRNO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. markets with a market cap of approximately $5.89 billion.

Operations: Terreno Realty Corporation generates revenue primarily through its investment in industrial real estate, amounting to approximately $426 million.

Dividend Yield: 3.6%

Terreno Realty offers a stable and growing dividend, currently yielding 3.63%, although lower than top US payers. Its dividends are covered by earnings with a payout ratio of 76.2% and cash flows at 88.3%. Recent developments include significant industrial property acquisitions and lease agreements, enhancing its asset base across key coastal markets. Despite insider selling in the past quarter, Terreno's consistent dividend growth over the past decade underscores its reliability for income-focused investors.

- Get an in-depth perspective on Terreno Realty's performance by reading our dividend report here.

- According our valuation report, there's an indication that Terreno Realty's share price might be on the cheaper side.

Summing It All Up

- Get an in-depth perspective on all 132 Top US Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives