- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX): Evaluating Valuation as Leadership Changes Signal a New Strategic Phase

Reviewed by Simply Wall St

CSX (CSX) has announced a series of executive leadership changes, with Kevin Boone stepping in as both executive vice president and chief financial officer. These appointments are intended to support the company’s evolving strategy and long-term growth.

See our latest analysis for CSX.

CSX’s latest leadership changes come on the heels of an 8.8% year-to-date share price return, but the stock has struggled to keep momentum, with total shareholder return down 1.7% over the past year. While restructuring at the top often signals fresh growth strategies or heightened risk controls, investors will be watching closely to see if these moves reignite long-term performance or simply stabilize recent volatility.

If you’re curious about what else is trending beyond railroad giants, now is a smart time to broaden your lens and discover fast growing stocks with high insider ownership

With the stock lagging broader markets despite steady revenue and profit growth, the real question becomes whether CSX is trading below its intrinsic value or if expectations for future gains are already included in the price. This raises the issue of whether the stock offers a compelling entry point or not.

Most Popular Narrative: 10.8% Undervalued

With the most popular valuation narrative setting fair value at $39.20 and the last close at $34.98, the suggested upside is notable. This gap comes as analysts factor in operational efficiencies and potential growth stemming from ongoing transformation at CSX.

CSX's completion of major infrastructure projects, such as the Howard Street Tunnel and Blue Ridge subdivision rebuild, is expected to improve network fluidity, leading to increased operational efficiency and service reliability, which should enhance revenue and margin growth.

Curious why this valuation runs so high? There is a bold forecast driving it, rooted in long-term profit expansion and ambitious margin gains. Find out which assumptions tip the scales.

Result: Fair Value of $39.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing infrastructure delays or commodity market volatility could stall CSX’s earnings momentum, which may challenge the optimistic outlook for growth and margins.

Find out about the key risks to this CSX narrative.

Another View: What Do Multiples Suggest?

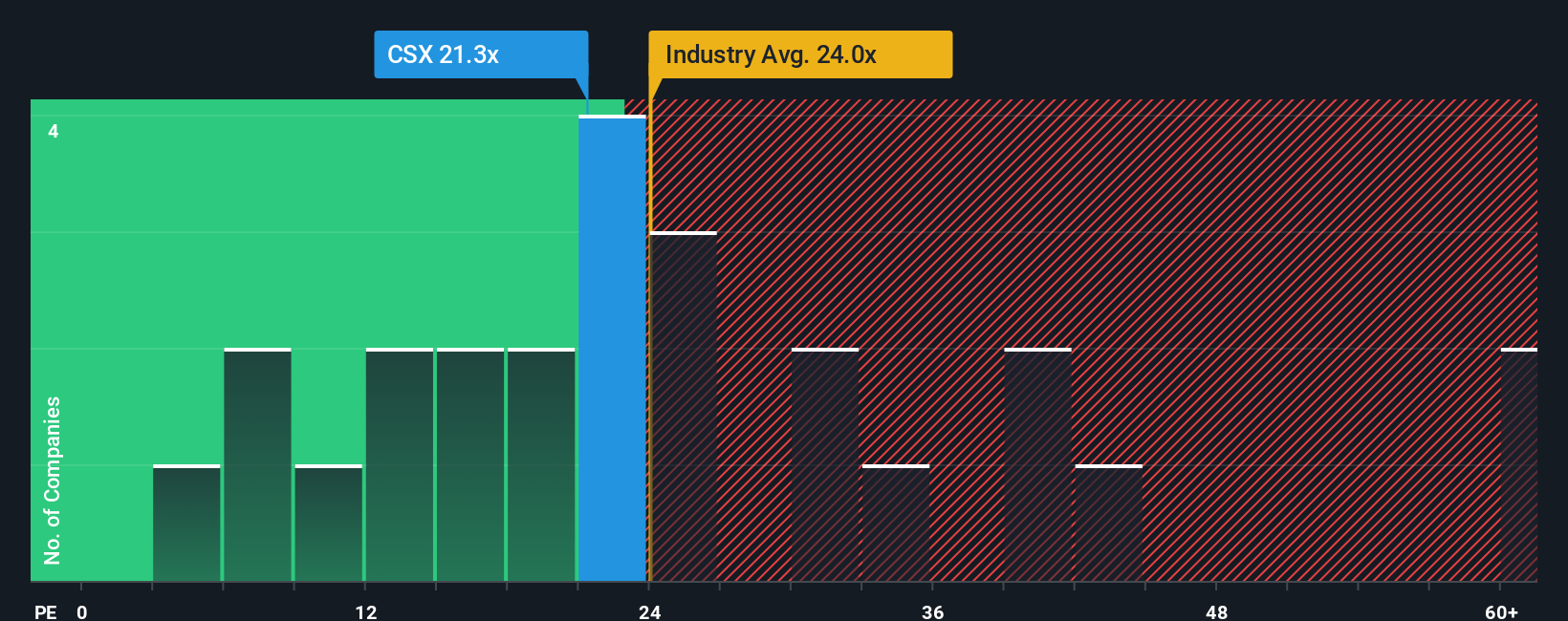

Looking at CSX’s valuation through the lens of its price-to-earnings ratio, the story is more cautious. The current P/E stands at 22.4x, which is higher than both its peer average of 20.9x and the fair ratio of 19.7x that the market could shift toward. While CSX's P/E is still below the broader US Transportation industry average of 27.2x, this premium suggests investors may be paying up for anticipated growth or stability. This raises the question of whether those expectations hold up under scrutiny.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CSX Narrative

If you want to see the story differently or would rather let the numbers guide your own thesis, you can create a custom narrative in just a few minutes. Do it your way

A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Uncover your next winner with these unique angles and curated lists built to put you ahead of the pack.

- Boost your income by targeting market leaders with proven payout records. Check out these 15 dividend stocks with yields > 3% offering attractive yields above 3%.

- Stay at the forefront of innovation by jumping into these 27 quantum computing stocks, where ambitious companies are revolutionizing tomorrow’s tech.

- Seize rare bargains by focusing on these 872 undervalued stocks based on cash flows based on robust cash flow metrics that signal true underlying value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives