- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (NYSE:LUMN) shareholders have earned a 262% return over the last year

Lumen Technologies, Inc. (NYSE:LUMN) shareholders might be rather concerned because the share price has dropped 31% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 262% in that time. So some might not be surprised to see the price retrace some. Only time will tell if there is still too much optimism currently reflected in the share price.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Lumen Technologies

Lumen Technologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Lumen Technologies saw its revenue shrink by 10%. We're a little surprised to see the share price pop 262% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

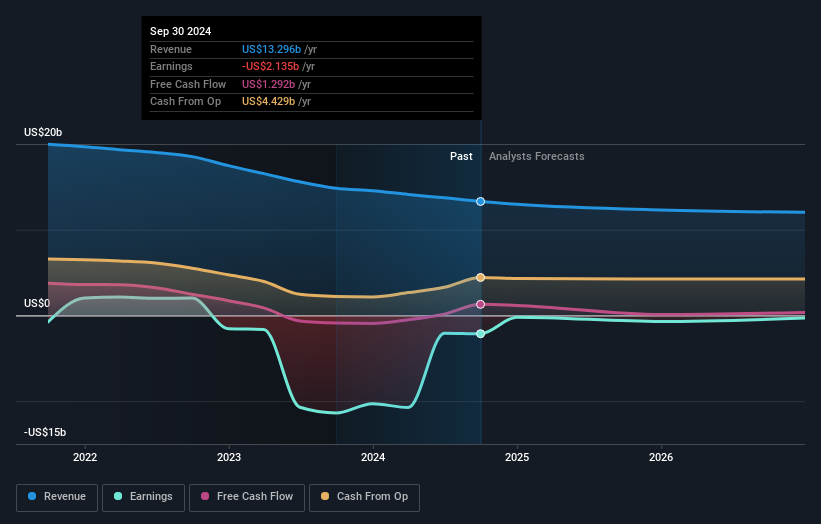

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Lumen Technologies will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Lumen Technologies shareholders have received a total shareholder return of 262% over the last year. Notably the five-year annualised TSR loss of 7% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Lumen Technologies has 2 warning signs we think you should be aware of.

Lumen Technologies is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LUMN

Lumen Technologies

A facilities-based technology and communications company, provides various integrated products and services to business and residential customers in the United States and internationally.

Mediocre balance sheet and slightly overvalued.