- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies (LUMN) Unveils Wavelength RapidRoutes For Fast Enterprise Connectivity

Reviewed by Simply Wall St

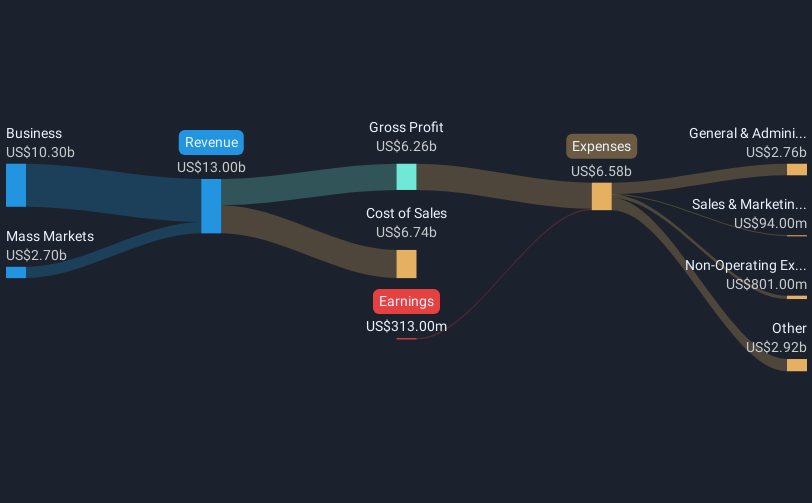

Lumen Technologies (LUMN) announced significant initiatives over the past month, including the launch of Wavelength RapidRoutes, which aims to enhance connectivity for various sectors with reduced provisioning times. The partnership with Palantir to integrate its AI platforms and a collaboration with Pac-12 Enterprises for improved sports broadcasting also stand out. Concurrently, the market has achieved record highs, supported by factors such as lower PPI data and increased demand for AI, as seen with Oracle's surge. Lumen's 50% stock price increase aligns with these broader market dynamics and recent company developments.

Lumen Technologies’ recent initiatives, such as launching the Wavelength RapidRoutes and forming partnerships with Palantir and Pac-12 Enterprises, spotlight its commitment to enhancing connectivity and broadcasting capabilities. These moves are aligned with its strategic refocus on enterprise and digital segments, potentially driving margin expansion and incremental revenue. The AI-driven infrastructure contracts may position Lumen to harness data growth effectively. However, persistent legacy revenue declines and competitive pressures could challenge these efforts, potentially impacting earnings forecasts despite these strategic steps.

Over the longer term, Lumen's total return over the past year was a modest 5.04%. Short-term market enthusiasm, indicated by a 50% stock price jump, seems reflective of these recent developments aligning with market highs driven by AI demand and favorable economic data like lower PPI. Compared to the broader market, Lumen underperformed the US Telecom industry with a 15.6% return and the US market returning 20% over the past year.

Looking at the revenue and earnings forecasts, continued integration of AI and cloud services into its offerings could bolster Lumen’s commercial reach and improve utilization, yet the current revenue projection suggests a 3.3% annual decline. With the share price at US$5.63, slightly above the analyst price target of US$5.06, market participants may appreciate Lumen’s potential yet remain cautious due to existing risks. This tight spread between the current price and the target hints at market skepticism over significant upside potential without clearer profitability projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)