With EPS Growth And More, IDT (NYSE:IDT) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like IDT (NYSE:IDT), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for IDT

How Fast Is IDT Growing Its Earnings Per Share?

In the last three years IDT's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, IDT's EPS shot from US$1.20 to US$3.33, over the last year. You don't see 178% year-on-year growth like that, very often.

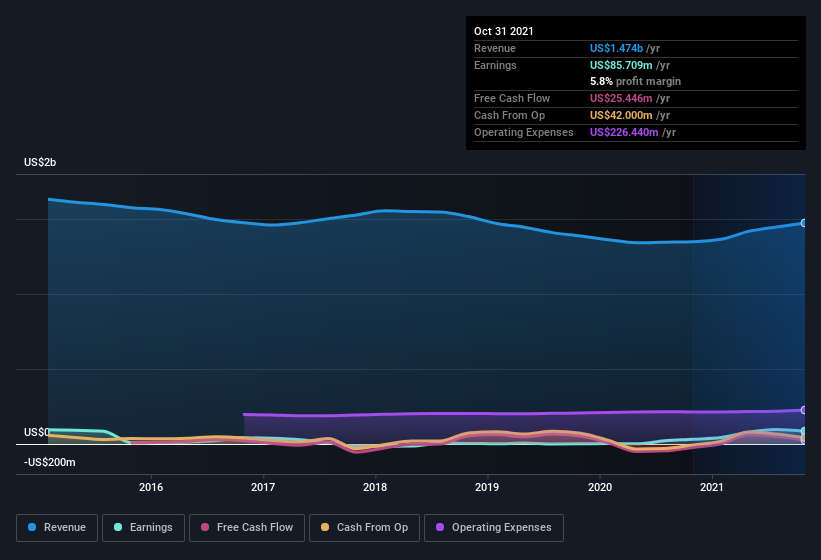

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. IDT maintained stable EBIT margins over the last year, all while growing revenue 9.2% to US$1.5b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are IDT Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own IDT shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$363m. That equates to 33% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like IDT with market caps between US$400m and US$1.6b is about US$2.4m.

The CEO of IDT only received US$1.1m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is IDT Worth Keeping An Eye On?

IDT's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so I do think IDT is worth considering carefully. However, before you get too excited we've discovered 2 warning signs for IDT that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives