- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Iridium Communications (IRDM): Assessing Valuation After New Dividend and Strategic Board Appointment

Reviewed by Simply Wall St

Iridium Communications (IRDM) just gave investors two fresh talking points, pairing a new 0.15 dollar quarterly dividend with the appointment of seasoned tech executive Louis Alterman to its expanded board.

See our latest analysis for Iridium Communications.

Even with the new dividend and board upgrade, sentiment is still catching up. The latest 1 year total shareholder return of about negative 41 percent reflects fading momentum after a much steeper year to date share price pullback.

If Iridium’s mix of income and satellite exposure has your attention, this might be a good moment to explore other aerospace and defense stocks that could be setting up for the next leg higher.

With shares down sharply despite steady revenue and profit growth, and analysts seeing upside to nearly 30 dollars, investors have to decide whether Iridium is trading at a material discount or if the market is already pricing in its next chapter of growth.

Most Popular Narrative Narrative: 43.3% Undervalued

With the narrative fair value of $29.75 well above Iridium Communications' last close at $16.87, the spotlight shifts squarely to its long term cash engine.

The company's fully deployed next gen constellation and declining capex profile are freeing up significant cash flow for buybacks and steady dividend increases, directly boosting per share earnings potential and making Iridium's free cash flow yield structurally attractive.

Curious how modest growth assumptions can still support a premium earnings multiple and a sharply higher fair value? The real twist lies in future margin gains, accelerating EPS, and shrinking share count. Want to see how those levers add up to this target?

Result: Fair Value of $29.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing IoT momentum and sharper spectrum competition could compress growth and margins, testing whether Iridium truly deserves a premium multiple.

Find out about the key risks to this Iridium Communications narrative.

Another Angle on Value

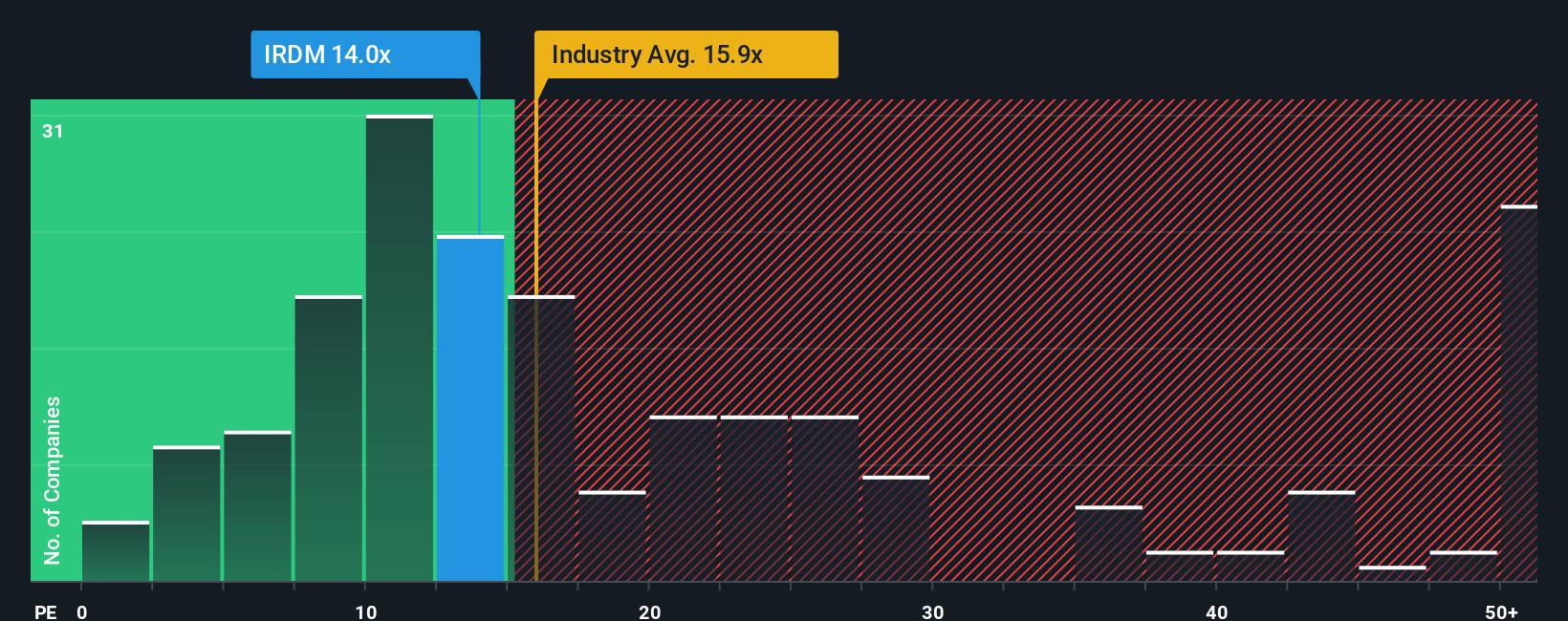

On earnings, Iridium looks less extreme. Its 14 times P E is cheaper than the global telecom average of 15.8 times, but much richer than close peers at 6.7 times and only slightly below a 14.5 times fair ratio. Is that premium really justified if growth stays modest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Iridium Communications Narrative

If you would rather trust your own judgment and dig through the numbers yourself, you can build a personalized Iridium story in minutes: Do it your way.

A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas you do not want to miss?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover high potential stocks that match your strategy.

- Capture early stage growth potential by scanning these 3625 penny stocks with strong financials that pair tiny market caps with improving fundamentals and room for meaningful multiple expansion.

- Tap into powerful structural tailwinds by reviewing these 13 dividend stocks with yields > 3% that can add steady income alongside capital appreciation in shifting rate environments.

- Position yourself ahead of the market by filtering these 80 cryptocurrency and blockchain stocks aligned with the rise of real world blockchain adoption and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)