- United States

- /

- Consumer Finance

- /

- NasdaqGS:TREE

Three Growth Companies With High Insider Ownership And 11% Revenue Growth On US Exchange

Reviewed by Simply Wall St

As the U.S. market experiences fluctuations, with the S&P 500 and Nasdaq Composite showing recent declines amid pressures on big tech stocks, investors might find opportunities in growth companies with high insider ownership. These firms often demonstrate a commitment to long-term success, which can be particularly appealing in uncertain economic times marked by potential interest rate adjustments and varied corporate earnings reports.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a product-focused technology company that utilizes data science and proprietary artificial intelligence to serve financial institutions and investors across the United States, Israel, the Cayman Islands, and internationally, with a market capitalization of approximately $1.00 billion.

Operations: The company generates revenue primarily through its software and programming segment, amounting to approximately $870.69 million.

Insider Ownership: 19.7%

Revenue Growth Forecast: 15.9% p.a.

Pagaya Technologies, despite its challenges with a low forecasted Return on Equity of 9.2% in three years and recent shareholder dilution, shows promising growth potential. The company is expected to grow earnings by 127.6% annually and become profitable within the next three years, outpacing average market growth. Recent inclusion in multiple Russell indexes could enhance visibility and investor interest. Additionally, substantial insider transactions have not been observed recently, maintaining a steady ownership structure amidst expansion efforts.

- Get an in-depth perspective on Pagaya Technologies' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Pagaya Technologies is priced lower than what may be justified by its financials.

LendingTree (NasdaqGS:TREE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LendingTree, Inc. operates an online consumer platform in the United States that facilitates various financial transactions, and it has a market capitalization of approximately $0.69 billion.

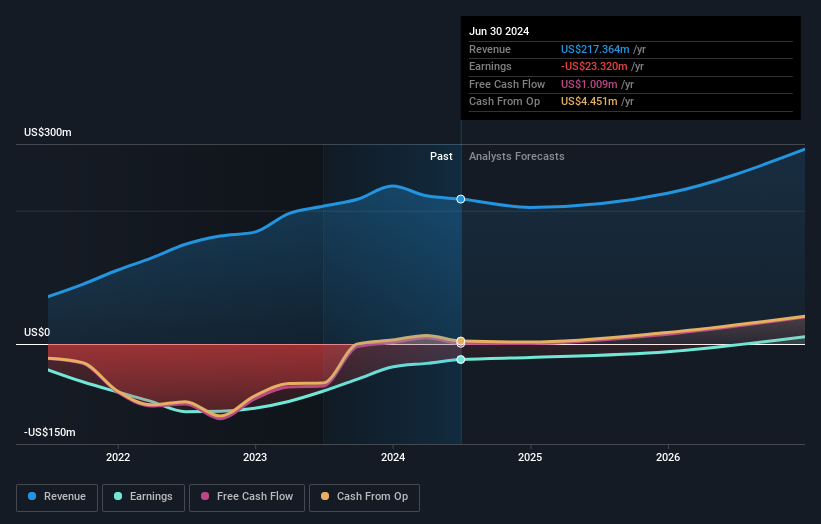

Operations: The company's revenue is segmented into Home ($130.52 million), Consumer ($250.69 million), and Insurance ($258.40 million).

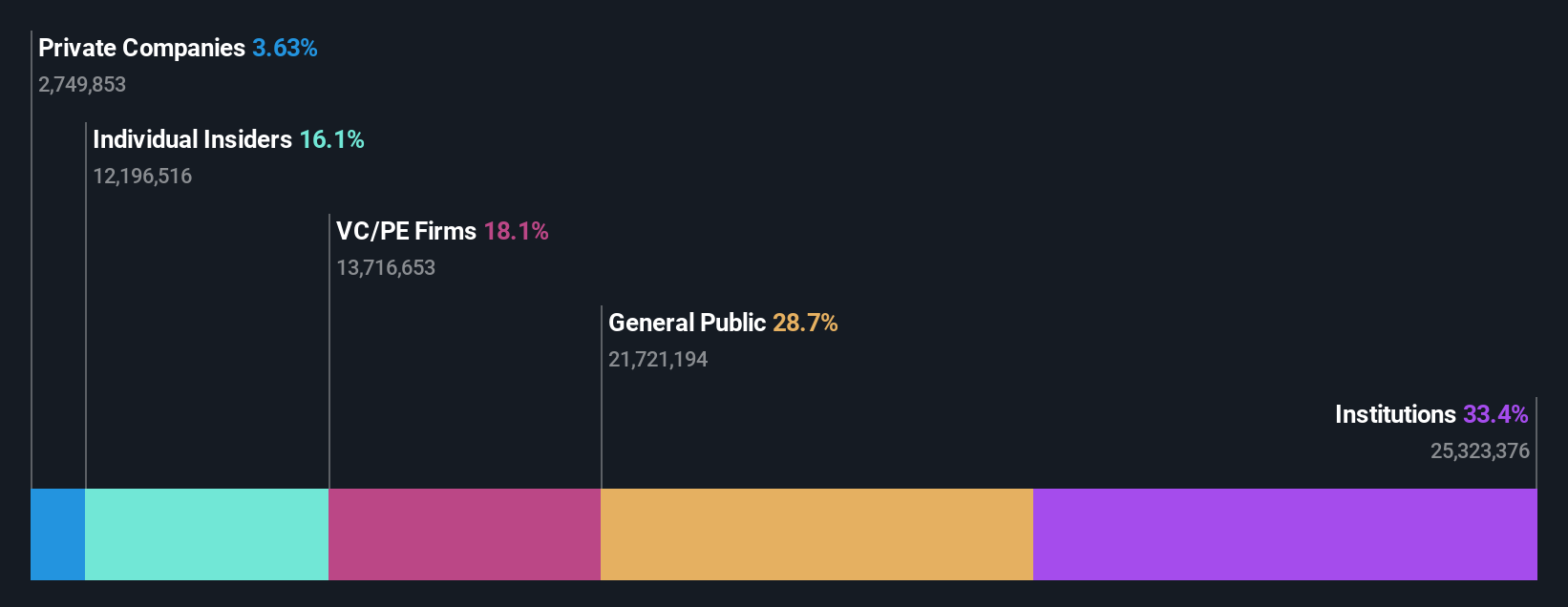

Insider Ownership: 18.1%

Revenue Growth Forecast: 11.1% p.a.

LendingTree, despite its challenges with covering interest payments and recent shareholder dilution, is poised for notable growth. The company is expected to become profitable within the next three years, outpacing average market growth with an 87.97% annual increase in earnings. Recent executive changes and raised guidance suggest a strategic push towards operational efficiency and revenue growth, with forecasts indicating revenues could reach US$720 million by year-end. However, significant insider selling raises concerns about long-term commitment from insiders.

- Click to explore a detailed breakdown of our findings in LendingTree's earnings growth report.

- Upon reviewing our latest valuation report, LendingTree's share price might be too pessimistic.

SmartRent (NYSE:SMRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartRent, Inc. is a global enterprise real estate technology firm offering management software and applications to various stakeholders in the housing industry, with a market capitalization of approximately $482.37 million.

Operations: The company generates its revenue primarily through the sale of electronic security devices, totaling $222.25 million.

Insider Ownership: 11.8%

Revenue Growth Forecast: 17.3% p.a.

SmartRent is set to become profitable within the next three years, outperforming average market expectations with a significant annual earnings growth forecast. Despite a low projected Return on Equity of 8.5%, revenue growth is anticipated at 17.3% per year, surpassing the US market forecast of 8.7%. The company's stock is currently undervalued, trading at 64.8% below its estimated fair value, presenting a potentially attractive entry point for investors interested in growth companies with high insider ownership.

- Dive into the specifics of SmartRent here with our thorough growth forecast report.

- Our expertly prepared valuation report SmartRent implies its share price may be lower than expected.

Make It Happen

- Reveal the 183 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TREE

LendingTree

Through its subsidiary, operates online consumer platform in the United States.

High growth potential and good value.