Quote of the Week: “We must not let ourselves be swept off our feet in horror at the danger of nuclear power. Nuclear power is not infinitely dangerous. It's just dangerous, much as coal mines, petrol repositories, fossil-fuel burning and wind turbines are dangerous.” - David J. C. MacKay

Whoever is running nuclear power’s public relations team, they’ve done a great job these last few years.

With trends in global power consumption rapidly going up and to the right, nuclear energy has received a lot of attention due to its ability to deliver clean and reliable energy at scale.

We gave an overview of the industry back in September last year during our Big Trends series, and we checked in again on developments in May this year when the uranium price was peaking.

Since then, a few big catalysts have unfolded that are worth discussing, and some big challenges still remain. This raises some long-term and short-term opportunities in the energy space.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube!

What Happened In Markets This Week?

Here’s a quick summary of what’s been going on:

- 💻 Digital Ad Market Booms For Big Tech ( Axios )

- What’s our take?

- Advertising proves once again to be an AI winner.

- Digital media companies reported bumper ad revenue during the third quarter. Online platforms including Alphabet , Meta , Snap , and Reddit all reported strong growth, and several record quarters, while Roku's revenue passed $1 billion for the first time.

- Investments in AI, US election advertising, and robust consumer spending contributed to sales. US TV networks have also scored big during the election period, but they’ll have to wait two years for the next windfall.

- Online advertising was the first industry to monetize AI in a big way. Meta and Google both harnessed the power of machine learning to drive engagement and optimize the value they could offer to advertisers. With generative AI, they can now help advertisers create the ads at a fraction of the cost. It’s not surprising to see companies like Netflix, Disney , Spotify and even Walmart investing heavily in their ad businesses.

- 📉 Super Micro Stock in Free Fall After Accountant Resigns ( Barrons )

- What’s our take?

- If the auditor doesn’t trust the numbers, neither should investors.

- In August, we mentioned that short-seller Hindenburg Research said it “found glaring accounting red flags” in the company’s accounts. Short sellers have been known to get things wrong or to exaggerate, so it was worth giving the company some benefit of the doubt at the time.

- Ernst and Young, SMCI’s auditor, has now resigned - which is a very different story.

- The statement from EY starts as follows: “We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations…”

- Could this create an opportunity at the right price? Overstated numbers would mean the valuation was likely too high - but that doesn’t mean the real value is zero either. That may be true, but keep in mind that any fair value estimate can’t really be based on any numbers provided by the company.

- ☁️ Google’s Cloud Business Powers Accelerating Revenue Growth ( WSJ )

- What’s our take?

- At last some AI revenue to show for the billions in Capex.

- Google’s cloud business reported a 35% year-on-year increase in revenue, up from 28% in the second quarter. Google’s cloud revenue reached $11.35 billion, which was still less than its $13 billion capital expenditure, which is mostly related to AI.

- Big tech companies are under pressure to justify their AI investments, and most have warned that there will be more capex next year.

- The fact that Google’s cloud revenue is increasing and margins are improving will help it justify the billions it is pouring into AI. Most of that revenue probably comes from ‘legacy’ cloud services, but a growing percentage presumably comes from AI-related services.

- The acceleration in cloud growth is coming just in time, as search and YouTube are struggling to beat the high bar set over the last 12 months.

- 💰 China has ‘lost’ a third of its billionaires ( Spectator )

- What’s our take?

- The bigger problem could be the number of millionaires leaving.

- According to a new report from Huran, there are now 753 billionaires in China. That’s 36% lower than the 2021 peak of 1,185.

- The hot takes on this data tend to suggest that billionaires have left the country, or that their fortunes have plummeted due to the state of China’s economy and stock market.

- There are two more reasons. Some billionaires may be doing a better job of concealing their wealth to avoid scrutiny. Others have literally disappeared - make of that what you will. There’s no doubt that it has become risky to be ultrawealthy in China.

- Another recent report estimated that 15,200 millionaires have emigrated from China. The fact that this group is leaving could be more damaging to the economy. These are the people still building their careers or businesses - which they are now going to do elsewhere. Their combined spending power could also be more than that of a few hundred billionaires.

- 🚗 BYD Q uarterly Sales Beat Tesla For First Time ( Barrons )

- What’s our take?

- Hybrid EVs are the real winners in this battle.

- BYD’s quarterly revenue topped Tesla’s for the first time during Q3. BYD’s revenue jumped 28% in the last year as its low-priced vehicles proved to be a hit in China and Europe.

- Even more of a surprise were margins, which were up across the board. That’s not something you expect to see during a price war. Tesla’s operating margin has fallen from 19% to 10% since mid-2022, while BYD’s has doubled to 8.5% during that period. Yes, BYD benefits from subsidies, but Tesla also receives government support in the form of tax credits.

- In the EV market, it’s not surprising to see BYD doing relatively well. Its cheapest EV sells for $9,800 in China, while Tesla’s cheapest models sell for about three times that in China and more in the US and Europe. But BYD’s growth really comes from hybrid EVs, which accounted for 62% of the 1.1 million vehicles it sold during the quarter.

- Tesla is still leading on EVs and profits, but BYD has the momentum and a more diversified business model.

☢️ Bullish Developments In The Nuclear Landscape

It’s amazing what can happen when the right incentives are in place. Energy demands are increasing globally, and both the public and private sectors have been looking at their options.

Fossil fuels are reliable, but don’t have great long-term prospects and don’t help with emissions targets. Renewable energy sources like wind and solar are emission-friendly, but intermittent, and we don’t have great energy storage options yet.

So naturally, this has helped move the spotlight back onto nuclear over the last few years.

The increasing global power demands combined with the desire for energy security and reliability brought nuclear front and center for many governments.

Amongst other things, 2 of the more recent key factors that have driven this renewed interest in nuclear are:

- 🏢 Big Tech’s growth in data centers that need cheap, reliable power

- ⚡ More governments are keen to shore up their energy grids

They have only kicked into gear over the last few years and will take many years to play out. Shoring up energy grids and creating new power sources won’t be an easy or cheap transition, but if it occurs, a decade or so from now our energy grids could look very different.

Let’s cover each catalyst.

📈 Big Tech’s Data Center Growth And Long-Term Energy Needs

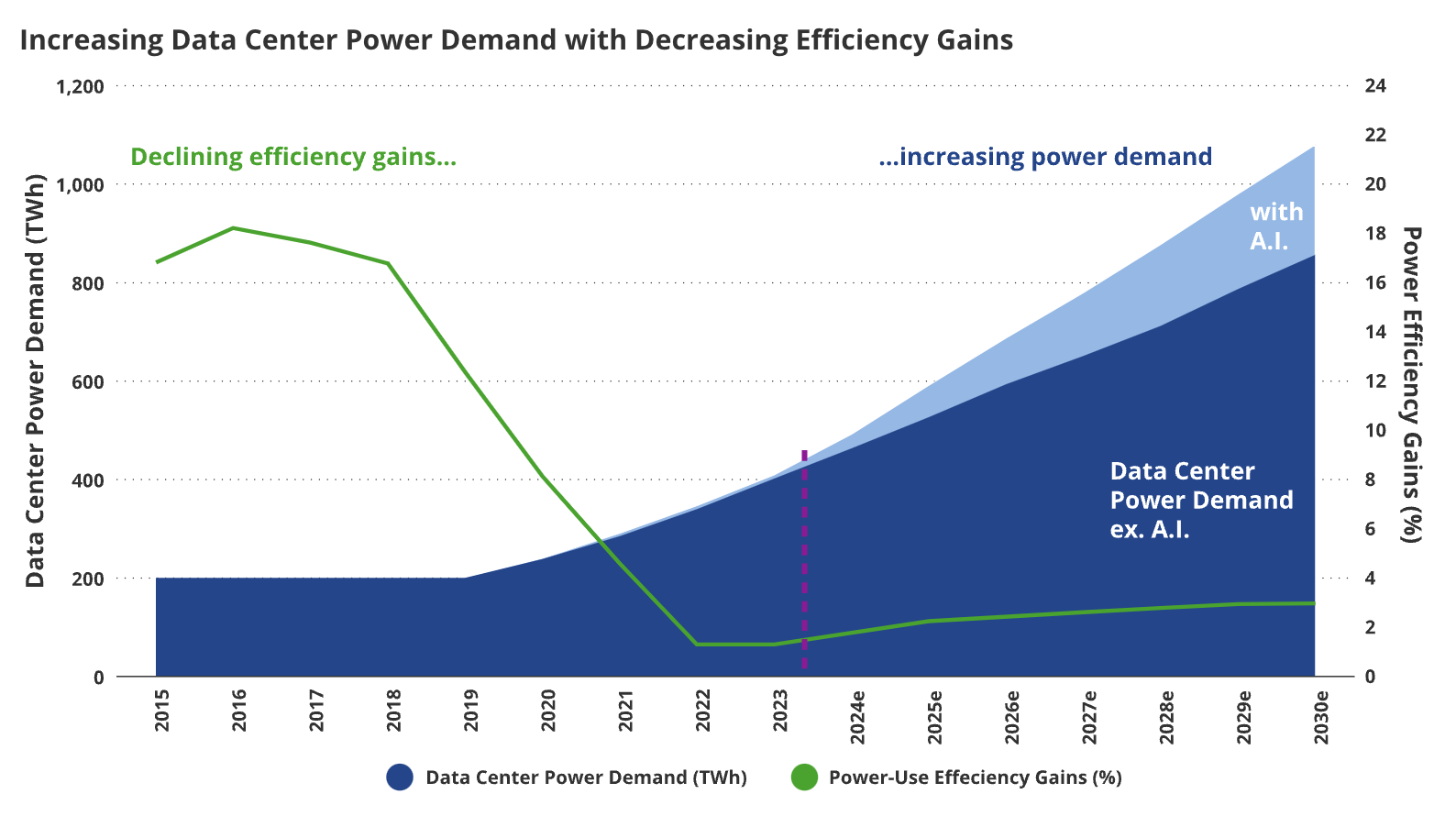

While energy consumption was already on the up, the explosive growth in data centers has pushed this into overdrive.

The big tech companies need their data centers to run all day, every day, with no downtime. That means they need cheap, reliable power to run optimally.

It’s worth remembering the importance of data centers in today’s economy.

They’re responsible for powering cloud computing services, e-commerce operations, processing big data, social media databases and running machine learning and AI models.

Data centers allow these companies to provide services, analytics, and storage to end customers and themselves, and that means they are pivotal to these businesses running smoothly. Without them, they’d be left holding a lot of heavy pieces of machinery with not much revenue coming in.

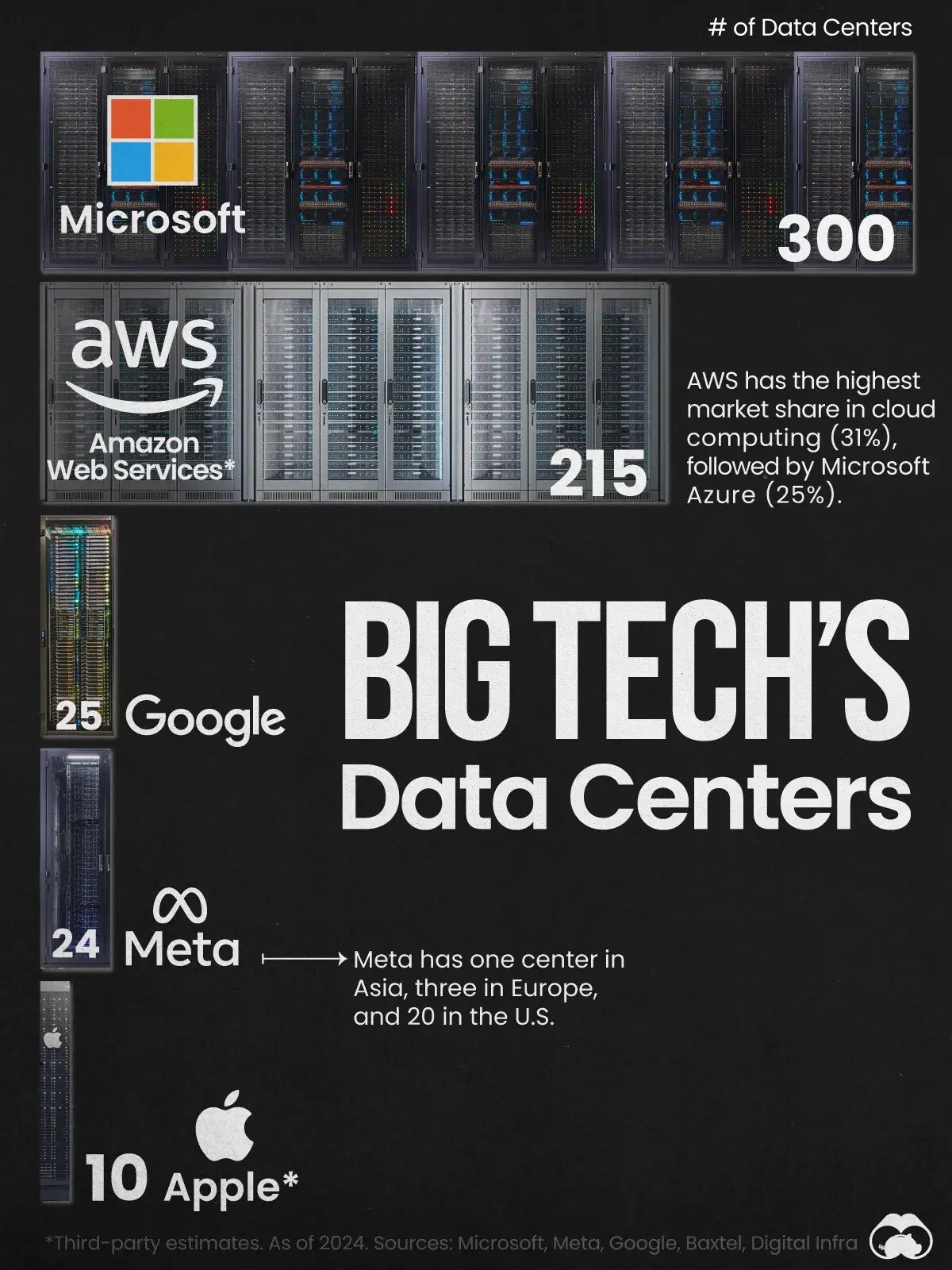

So the stakes are high. As of June this year, Microsoft had the most data centers, followed by Amazon , Google, Meta then Apple .

✨ So these Big Tech businesses, and those that rely on them, are built on data centers. That’s why finding a cheap, reliable, and green source of energy is so important to them.

It should come as no surprise then that the 3 biggest data center owners in the image above are the ones who have been in the news recently for their nuclear-related investments.

-

In September, Microsoft entered into a deal with Constellation Energy to restart the reactor at the Three Mile Island facility by 2028 where it will provide power to Microsoft for 20 years.

- Some energy advisers estimate that if Microsoft uses 135 terawatt-hours of generation over the life of the deal, it could bring Constellation Energy $13.5bn in revenue.

-

Amazon is committing $500m worth of capital to 3 different nuclear projects .

- It’s initiating Power Purchase Agreements (PPAs), AND it is investing in the technology. In October, it signed a deal with Dominion Energy to explore the development of a small modular nuclear reactor. Additionally, it signed a deal with Energy NorthWest in Washington State, where it will develop 4 small modular reactors (SMRs) that will power the local grid and Amazon’s operations. If that wasn’t enough, it also invested in X-Energy, a developer of SMRs and fuel.

-

Google signed a deal to purchase power generated from multiple SMRs built by Kairos Power. The deal will enable 500MW of power to U.S. electricity grids and will help power Google’s data centers.

Regulators from the U.S. Federal Energy Regulatory Commission (FERC) noticed these deals and said they were happy to see the promising signs. FERC Chairman Willie Phillips said the deals signaled "great hope and optimism" for SMRs to supply growing electricity demand.

With the explosion of AI showing no signs of slowing down, the number of data centers needed for this technology to work will keep growing as well ( not without some pushback from the public though ). The FERC's primary role is to deliver reliable, safe, and economically efficient energy to consumers at a reasonable cost, but more data centers and artificial intelligence energy demand pose a greater risk to those objectives.

Morgan Stanley Research estimates that generative AI’s power demands will skyrocket 70% annually. They estimate that by 2027, generative AI could use as much energy as Spain needed to power itself in 2022.

In line with that, Barclays researchers expect data centers to account for at least 9% of overall electricity demand by 2030, up from 3.5% today.

✨ So this raises an interesting question: Will nuclear energy supply be added quickly enough to meet the increased energy demands?

We’ll answer that in a moment, but for now, let’s talk about the 2nd catalyst driving increased nuclear energy investment and interest.

🏗️ Governments Want To Shore Up Their Energy Grids

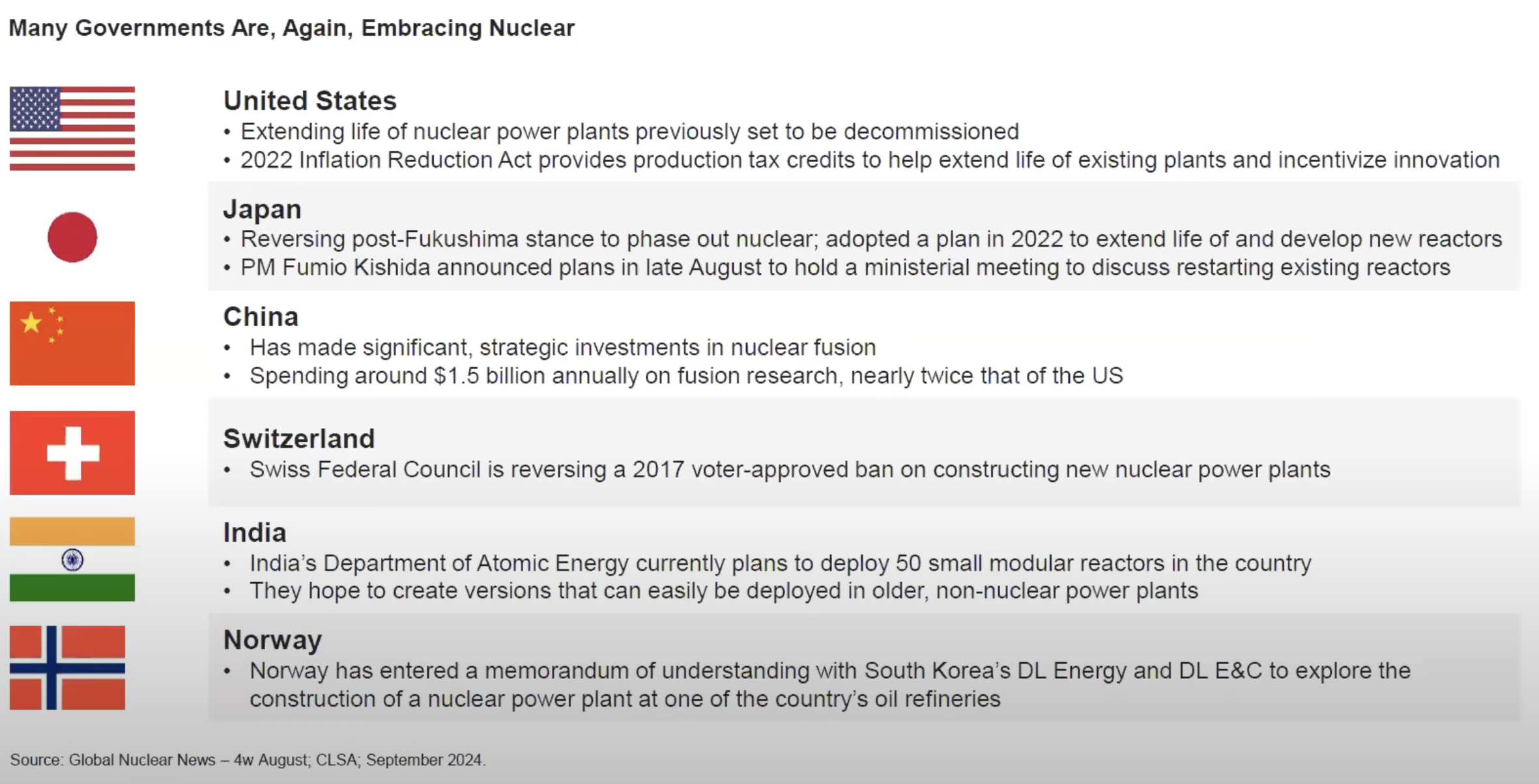

Following the Fukushima nuclear accident in 2011, many governments deprioritized their nuclear energy projects. This wasn’t really an issue back then because in that decade energy went from being scarce to relatively abundant , particularly for the US.

Now, though, many governments are embracing nuclear again. They have recognized the need to increase their energy independence and grid reliability given the energy challenges of the last few years.

Over the last 2 years, heads of state and regulatory bodies from around the world have met to discuss increasing the role that nuclear energy can play in their overall energy mix.

Whether it be the CO28 conference in December last year, the Nuclear Energy Summit held in Brussels in March this year, or the public joint meeting of the Nuclear Regulatory Commission and FERC in March, the importance of nuclear energy was discussed at these events and many others.

Nuclear energy is receiving bipartisan support amongst US lawmakers and new legislation is being pushed through. Last year, 22 countries committed to collaborating on tripling their nuclear energy capacity by 2050. At Climate Week in New York, 14 of the world’s biggest banks and financial institutions pledged to support these targets.

The COP28 conference, where the declaration was made, included countries like the United States, United Kingdom, Canada, United Arab Emirates, and Japan, who all acknowledged the role that nuclear energy will play in their respective energy needs.

Since then, many countries have taken action. Vaneck recently held a webinar where they discussed the case for investing in nuclear and covered the increased regulatory acceptance amongst different countries, and which actions they’ve taken.

Most governments simply adjust policy to provide funding, subsidies and incentives to drive change. With those changes, the plant operators and lenders have more incentive to take the risk, especially since some governments guarantee loans.

For example, the Energy Department’s Loans Programs Office told Axios that loan applications for U.S. advanced nuclear energy projects are on track to be 10x higher than they were in 2023, at $64.9bn.

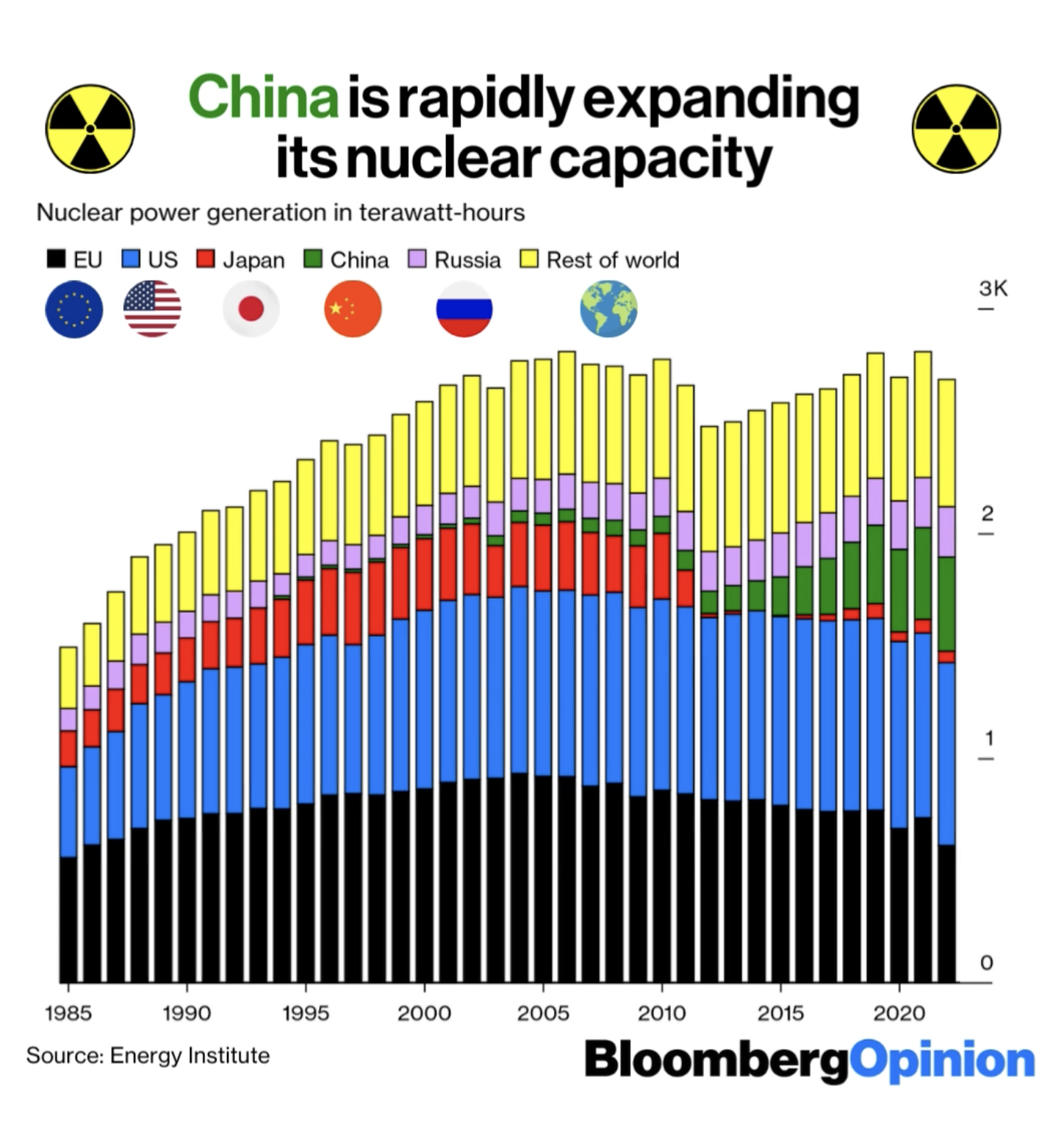

As of September, there are currently 60 reactors under construction in 16 countries, a further 110 are planned, and 300 more are proposed. Most of them are expected to be in Asia, given their fast-growing economies and rapidly growing energy demands.

However, building nuclear reactors is still not without its challenges.

⛰️ Some Challenges Still Remain

More investment and a friendly regulatory environment will help eventually reduce some of the hurdles in the nuclear energy space.

Until these investments start paying off, which may be years away, there are still some hurdles in the short-medium term that prevent nuclear from being an answer right now.

- 💰 Large initial capital outlay

- Nuclear power plants are more capital-intensive than other large-scale power plants because they take longer to construct and are much more complex. While this is offset by lower and more stable fuel costs, it is still a barrier to entry for now, considering these power plants cost in the tens of billions of dollars, and many are custom jobs.

- 📅 Construction delays

- Getting a nuclear power plant from planning to operation (PTO) is an incredibly time-intensive process. While reactors can take 6-8 years for the construction process (and quicker in some other regions), if you include the planning process, it can then take over a decade. If templates of existing reactor designs are used, build time and costs should reduce as efficiency is improved (rather than custom builds).

- 🏗️ SMRs are still years away

- While some big tech companies have reached PPA’s with these SMR developers, the first of these SMRs are only due in 2030. The fact that Big Tech is investing in SMRs is a move in the right direction toward commercialization of this new tech, but more orders need to be placed, and more challenges overcome. The NRC is working on streamlining the process, but if customers are all happy to buy “off-the-shelf” SMRs when they’re done, then we may see more commercialization of them, which is key to wider adoption.

Because of these challenges, investors have an interesting environment where there may be two ways to play this trend.

💡 The Insight: There’s Both A Long-Term And Short Term Opportunity Here

We always encourage our users to think in the long term, like 3+ years out, and it’s no different here. It’s clear that there are long-term tailwinds for nuclear, but since those challenges above remain, it won’t happen immediately.

We raised the question earlier: Will nuclear energy supply be added quickly enough to meet the increased energy demands?

Despite the improved landscape, the answer is probably yes in the long term, but not yet in the short to medium term.

Longer term, thanks to supportive government policy and further investment and project initiation from private enterprises, we’re on track to see more nuclear capacity added to energy grids globally.

However, while many projects are receiving funding and getting started, they will take years to finish, sometimes even more than a decade. In the meantime, energy demand is still going to continue climbing.

That means alternative sources of energy will be needed in the short to medium term to make up the difference. Research from S&P Global and Barclays indicates as much, and their reports point to natural gas as a beneficiary of this.

So if you’re looking for stocks in the energy sector that may benefit in the short-to-medium term from this energy supply/demand imbalance, we’ve created this screener that identifies US-listed oil and gas stocks with good earnings growth forecasts and manageable leverage .

As for the longer term nuclear play, here are some stocks that give you exposure to the nuclear energy supply chain.

Better yet, if you want to adjust the filters yourself, you can simply search for keywords like "nuclear energy" or "uranium mining" to create screeners like Global Nuclear Energy stocks (50 results!) and Global Uranium mining stocks (65 results)!

Key Events During the Next Week

The US election will be the big event this week - but there are also some key interest rate decisions and lots of trade data.

Tuesday

- 🇺🇸 US Presidential Election.

- 🇦🇺 The Reserve Bank of Australia will announce its interest rate decision. Economists expect the benchmark rate to remain at 4.35%.

- 🇨🇦 Canada’s trade deficit is forecast to widen from CA$1.1 bln to CA$1.3 bln.

Thursday

- 🇬🇧 The Bank of England will announce it interest rate decision, and is expected to lower the benchmark rate from 5% to 4.75%

- 🇦🇺 Australia’s trade surplus is forecast to widen from A$5.6 bln to A$ 8.2 bln.

- 🇨🇳 China’s trade surplus is expected to narrow further, falling from $82 bln to $66 bln

- 🇩🇪 Germany’s trade surplus is expected to fall from €22 bln to €18 bln

- 🇺🇸 The US Fed is expected to make its second rate cut. The Fed Funds Rate is forecast to fall 0.25% to 4.75%.

Friday

- 🇨🇦 Canada’s unemployment rate is expected to remain at 6.5%.

Earnings season continues with companies from most sectors reporting. The most prominent include:

- Qualcomm

- Arm Holdings

- NXP Semiconductor

- Fortinet

- The Trade Desk

- Airbnb

- Palantir Technologies

- Vertex Pharmaceuticals

- Gilead Sciences

- CVS Health

- McKesson Corporation

- Duke Energy Corporation

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.