The AI Capex Cycle Shows No Signs Of Slowing Down

Reviewed by Michael Paige, Bailey Pemberton

Quote of the Week : “Early AI was mainly based on logic. You're trying to make computers that reason like people. The second route is from biology: ‘You're trying to make computers that can perceive and act and adapt like animals.’” - Geoffrey Hinton

It’s now been almost two years since ChatGPT was introduced to the world, igniting an AI-fueled rally that is still continuing.

We thought it would be a good time to check in on the industry and have a look at the winners, losers, and those still building for the future (which, to be honest, is most of them). Plus, we’ll discuss why periods of heavy capex can provide great opportunities.

Also, while the US election was a few days ago, we're. going to do a deep dive on it next week and what it means for investors.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🏛️ Markets lean toward "Trump trades" as election results start to trickle in ( Reuters )

- What’s our take?

- It didn’t take the market long to react to Donald Trump’s re-election. News that the election was being called in the Republicans’ favour triggered a surge in the US dollar and stock futures.

- The S&P 500 rose 1.7% and the Russell 2000 closed 4.4% higher as investors placed optimistic bets on the potential for lower taxes. It seems that investors were more encouraged by possible reductions in taxes than they were dissuaded by the likelihood of rates staying higher for longer.

- While the market reacted positively, analysts were more concerned, flagging issues with Trump’s proposed economic policies. In particular, analysts took issue with his intentions to implement widespread tariffs placed on US trade partners.

- The impacts here could be quite multi-faceted. Tariffs would undoubtedly have an inflationary effect on the US economy and restrict the Fed’s ability to lower rates in the future, but it’s also likely that trade relations will be negatively impacted.

- The impacts could differ on a sector-by-sector basis, the financials and energy sectors would benefit from the tax cuts and some deregulation. Other sectors that have greater exposure to international trade could struggle if additional tariffs are placed on imports.

- Uncertainty seems to be an apt description of how things are likely to play out over the next four years.

- What’s our take?

-

💰 Berkshire’s cash soars to $325 billion as Buffett sells Apple, BofA; operating profit falls ( CNN )

- What’s our take?

- Buffett’s clearly not done building up his financial fortress.

- In Q3, Berkshire further reduced its stake in Apple and Bank of America. It has now sold more than $120bn worth of Apple stock in 2024 alone, yet the company is still its biggest holding.

- The company’s quarterly operating profits declined 6% due to underwriting losses from Hurricane Helen and a strengthening USD. Thankfully, Berkshire Energy, BNSF and GEICO all reported improved profitability to somewhat offset this.

- Berkshire has been a net seller of stocks for 8 quarters now, and he is not even buying his own stock back. So clearly, he still thinks market valuations are too high.

- What’s our take?

-

⚡ Chipmaker TSMC hit by Taiwan’s soaring energy prices and growing outages ( FT )

- What’s our take?

- Taiwan’s cheap power is no longer one of its competitive strengths.

- Taiwan Power Company, a state-owned utility company, has had to deal with increasing losses over the last two years. Russia’s invasion of Ukraine caused a surge in global fossil fuel prices, and the lack of alternatives meant that the power company struggled to pay the increasing bills, despite increasing power prices 4 times since 2022.

- Industrials are copping the brunt of the energy price increases compared to households, however TSMC only expects gross margins to decline by 1 percentage point.

- Companies in Taiwan need predictable power to plan long-term investments, and being at the mercy of government policy and volatile imported energy makes that increasingly difficult.

- What’s our take?

-

🏎️ Luxury goods slump catches up with Ferrari ( Barrons )

- What’s our take?

- Their F1 team is on the rise, but the same can’t be said for Ferrari’s share price.

- Ferrari’s stock slipped 5.4% on Tuesday, despite reporting better-than-expected results for Q3. While the results said one thing, investors were undoubtedly concerned by a decrease in car shipments and weakened demand in China.

- Ferrari’s adjusted earnings rose 12.5% compared to last year, but shipments came in below the mark. Total car shipments fell 2% to 3,383 units, which isn’t anything significant, but the more worrying figure is that shipments to mainland China, Hong Kong and Taiwan dropped 29%.

- China’s post-COVID recovery has been a little sluggish, which has dragged down consumption of luxury goods in the region, and with how popular luxury brands are in China, this is expected to weigh heavily on the sector's earnings.

- Ferrari’s new halo car, the F80, is due to begin shipping in late 2025, and the market was quite optimistic following the announcement of the car. We’ll have to check in a year from now, as there’s a possibility that the $3.9 Million price tag and the V6 powertrain could fail to land with consumers expecting a passionate V12 sound for that amount of money.

- What’s our take?

-

✂️ 5 US REITs suspend dividends amid 2024 cuts ( S&P Global )

- What’s our take?

- Stock prices often give up far more than the yield when dividends are cut.

- 5 US REITs have suspended dividend payments in 2024, while 6 have reduced their dividends. There are over 160 listed REITs in the US, so the percentage cutting distributions is still low. Most of the companies cutting dividends are very small, and mostly in the retail, office, hotel and diversified segments. These cuts were anticipated too, so the impact on stock prices was limited.

- The sustainability of dividends is a crucial factor to consider before you invest in any company, including REITs. Yields of 5 to 10% can be tempting - but the stock price can fall two or three times that if the dividend gets cut.

- Some companies really are profitable enough to pay generous dividends - but others are forced to offer high yields to attract investments. It’s important to figure out why the yield is what it is.

- What’s our take?

-

🏦 Federal Reserve cuts interest rates by a quarter point ( CNBC )

- What’s our take?

- There’s some relief in sight for homeowners, but as Chubby Checker said, how low can you go?

- The US Federal Reserve approved its second consecutive interest rate cut overnight, lowering the benchmark borrowing rate by a further 25 basis points to a target range of 4.50%-4.75%.

- The decision was unanimous as officials emphasised the importance of supporting employment targets while still trying to keep inflation under control.

- The latest cut was well received by the market, with the Nasdaq up 1.5% and the S&P 500 closing at record highs following the news. Treasury yields fell after the interest rate decision, further indicating optimism amongst investors.

- While the Fed was clear-cut in its justification of the rate cut, mixed economic signals sparks a bit of uncertainty. While GDP growth for the third quarter was slightly below expectations, the macroeconomy has still been posting solid growth. With inflation still on consumers’ minds, there’s concern over how far the Fed could go with rate cuts while still not being ‘out of the woods’.

- What’s our take?

🏆 AI: The Winners and Losers so Far

In February, we covered generative AI in three newsletters - you can access them here:

- Is The AI Rally A Bubble?

- The Risks And Opportunities Across The AI Value Chain

- Generative AI - Use Cases And Limitations

At the time, we mentioned that McKinsey & Company identified 6 levels within the AI value chain:

- 💽 Hardware: AI chips, servers and networking equipment

- ☁️ Cloud Platforms: Cloud providers and the data centers they operate.

- 🤖 Foundational Models: The LLMs that power AI applications like OpenAI’s GPT-4o and Google’s Gemini .

- 🏗️ Model hubs and ML Ops: Companies that provide tools and platforms to help developers build and manage applications.

- 📱 Applications: The AI-powered applications used by businesses and consumers. This layer is the point of it all.

- ⚒️ Services: Consulting and training services to help companies leverage AI.

✨ The first three layers provide the infrastructure that enables applications to run. Most of the many billions of dollars that have been invested so far have gone into these three layers.

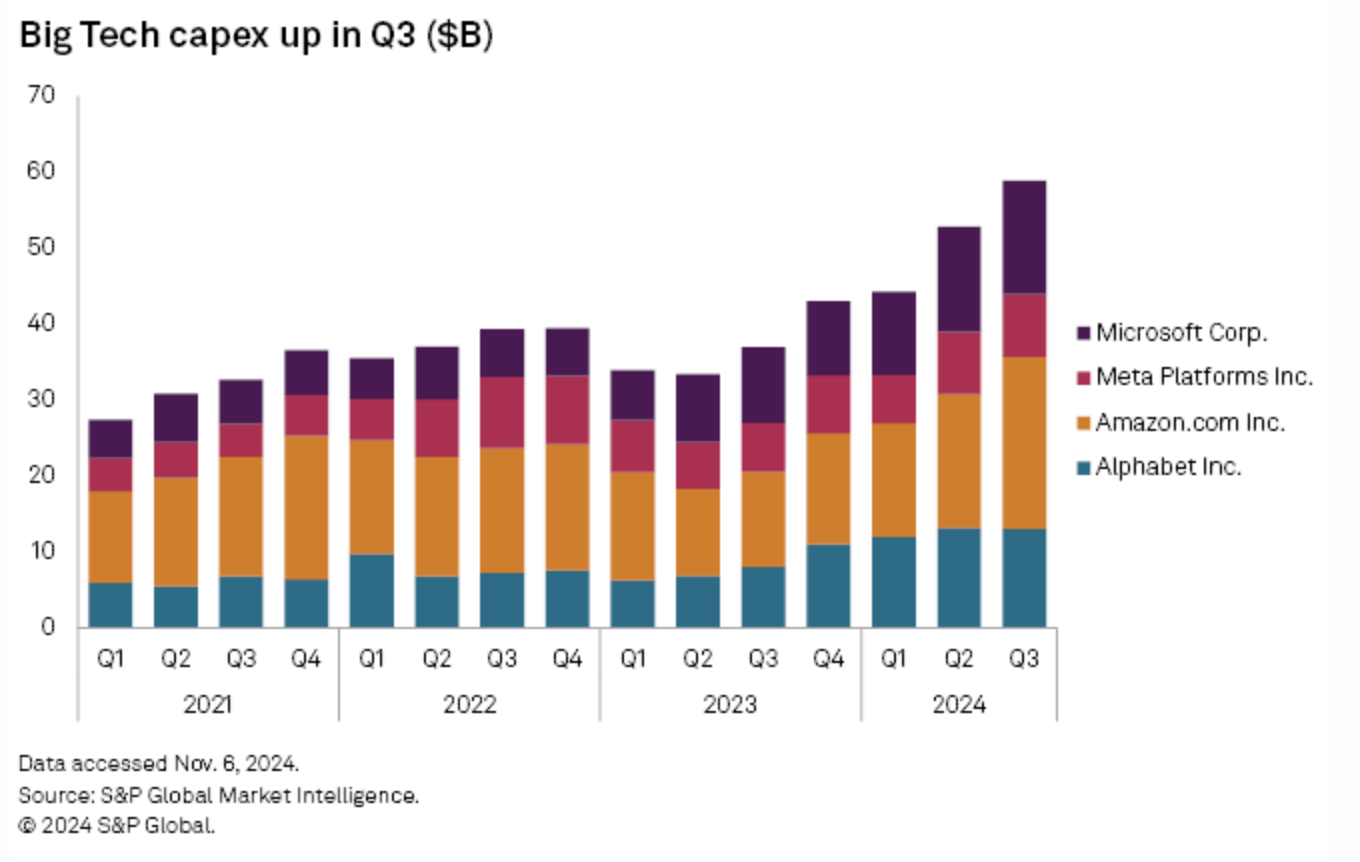

Building this infrastructure is still very much a work in progress. Capital expenditure at Microsoft , Meta , Alphabet and Amazon reached a combined $60 billion in the third quarter. But companies warned that the spending isn’t going to end anytime soon.

Big 4 Capex by Quarter - S&P Global

Microsoft said despite all its investments in infrastructure, it was struggling to meet demand. Meta raised its capex target for 2025 to $40 billion.

On the positive side, cloud providers are beginning to see increased demand and engagement due to their AI investments. Some are also benefiting from lower costs as they deploy AI tools internally. Alphabet said 25% of its code is now generated by AI.

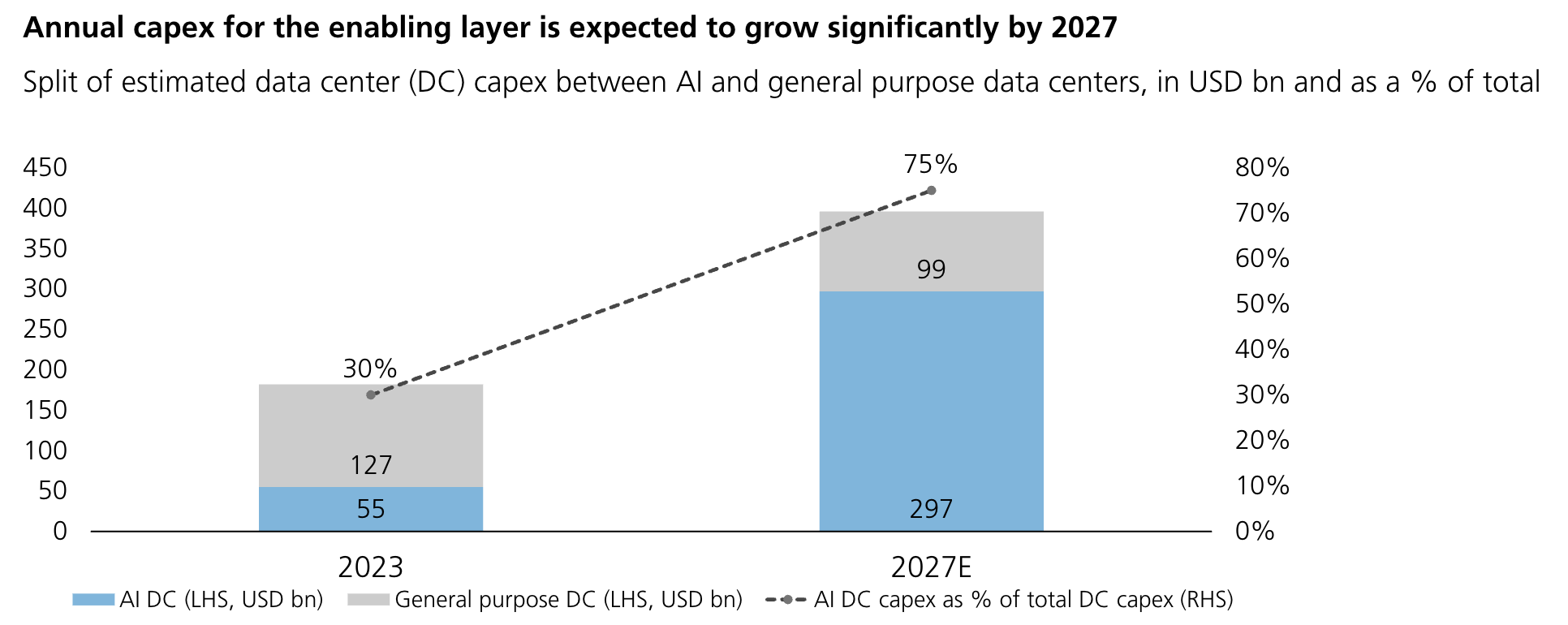

In a recent report, UBS estimated that the current investment phase will continue through 2027 and that AI spending would dwarf general-purpose cloud infrastructure.

The fact that capex spending doesn’t appear to be slowing down is great news for the companies supplying chips and other hardware to data centers - i.e. Nvidia , Broadcom, AMD, TSMC and others.

When it comes to data center suppliers, margins are something to keep in mind.

The sector has become a lot more competitive and capacity has increased over the last two years. This is less of a problem for Nvidia, which has a very strong competitive advantage. But, the companies that supply more generic equipment will struggle to maintain margins. Super Micro Computer (which supplies servers) is now embroiled in an accounting scandal - but its margins were already under pressure before that story broke.

🖥️ The Application Layer

If generative AI evolves like previous technologies, the application layer is where most of the value will be created. So far, there isn’t a lot of evidence that this is happening - yet. But the way cloud providers are pouring billions into infrastructure suggests they are very confident it’s coming.

One software company that has struck gold is AppLovin Corp . Its share price is up 500% year-to-date, and EPS is $3.42, up from $0.28 a year ago. AppLovin helps developers monetize their apps with targeted advertising, via its AI-powered platform.

Beyond AppLovin, most companies in the digital ad space are also leveraging generative AI. This is nothing new as digital ads have always led the way when it comes to monetizing AI. Meta and Alphabet have always used AI to optimize the way they target ads to users. Now they can use new AI tools to help advertisers create ads, and to personalize those ads for consumers.

Several SaaS companies are also managing to improve engagement with AI, and as mentioned, some seem to be reducing costs and improving productivity. So, while there aren’t many examples of ‘killer apps’, many companies are benefiting to some degree.

✨ If Microsoft can’t keep up with demand, you may be wondering where all that demand is coming from. The answer is that hundreds (if not thousands) of start-ups, and most large companies are building and testing AI powered apps.

One example is Visa, which has deployed 500 generative artificial intelligence applications, and continues to build more. If you listen to almost any earnings call you’ll discover that most companies are building and testing apps, both internally and with customers.

Some, possibly many, of those apps won’t amount to anything - but a couple probably will improve engagement or productivity, or reduce costs.

🤖 2025: The Year Of The AI Agent?

If there’s going to be a game-changing AI app in the near future, it could come in the form of an AI agent. These are like chatbots or personal assistants that help customers or employees complete or automate tasks.

On the consumer side, Amazon and Apple are revamping Alexa and Siri. These personal assistants have generally been a disappointment in the past - but maybe that’s all about to change.

In the B2B space, Salesforce has launched Agentforce which allows customers to automate workflows and augment human capabilities. ServiceNow has launched Now Assist , with similar capabilities.

Chatbots and tools to automate tasks aren’t new, but perhaps they are getting to the point where they are powerful enough to be truly impressive.

🏇 The Other Winners and Losers

Palantir has become a market leader once again. This may have as much to do with increased defense spending than its AI capabilities - as it’s always been an AI focussed company.

Cybersecurity companies like CrowdStrike also continue to leverage AI - but that’s also not new.

One group of software companies struggling to leverage AI are the data management apps like Snowflake and MongoDB.

Data is a very valuable commodity in the world of AI. But you have to own the data, rather than provide the tools to store and manage it. The other problem these companies face is that it's a very competitive industry with quite a few competitors - so it might need to consolidate before one or two can thrive.

✨ If you're interested in finding more companies finding their stride in this AI boom, be sure to check out the Simply Wall St Screener . Here's one for the Top US Artificial Intelligence stocks. You can browse the list or even change the country to find more compaies from around the world!

💡 The Insight: Get Ready For Depreciation To Hit A Few Income Statements

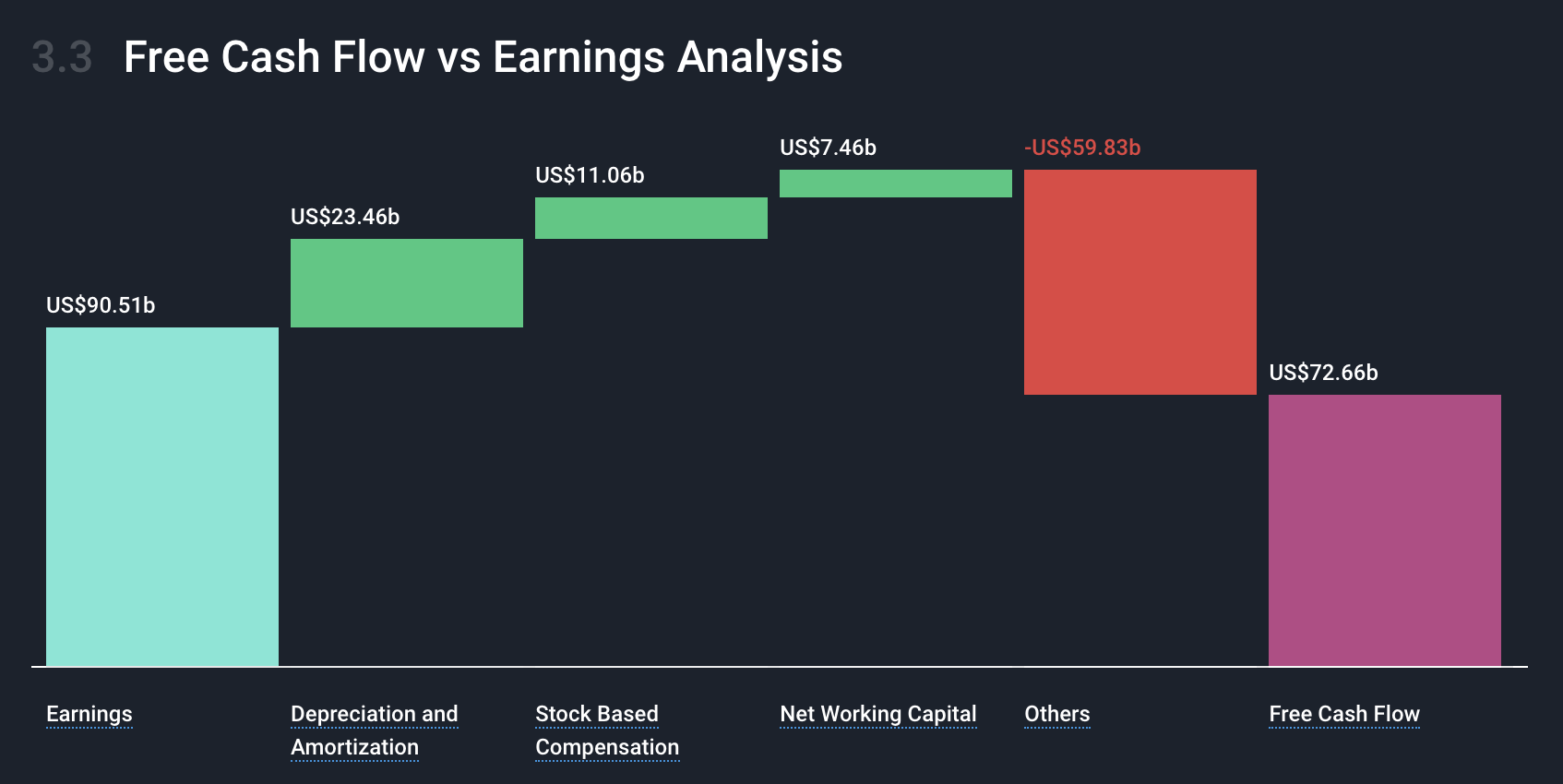

The massive infrastructure investments that big tech companies are making are recorded as capital expenditures. When these investments are made, they don’t show up on the income statement, but they are recorded as assets on the balance sheet. The amounts really just move from the ‘cash’ section of the balance sheet to the ‘ long-term assets’ section.

However, hardware like GPUs and servers, are depreciated over the following five years. The depreciation charge is recorded as a non-cash expense on the income statement, so it reduces net income.

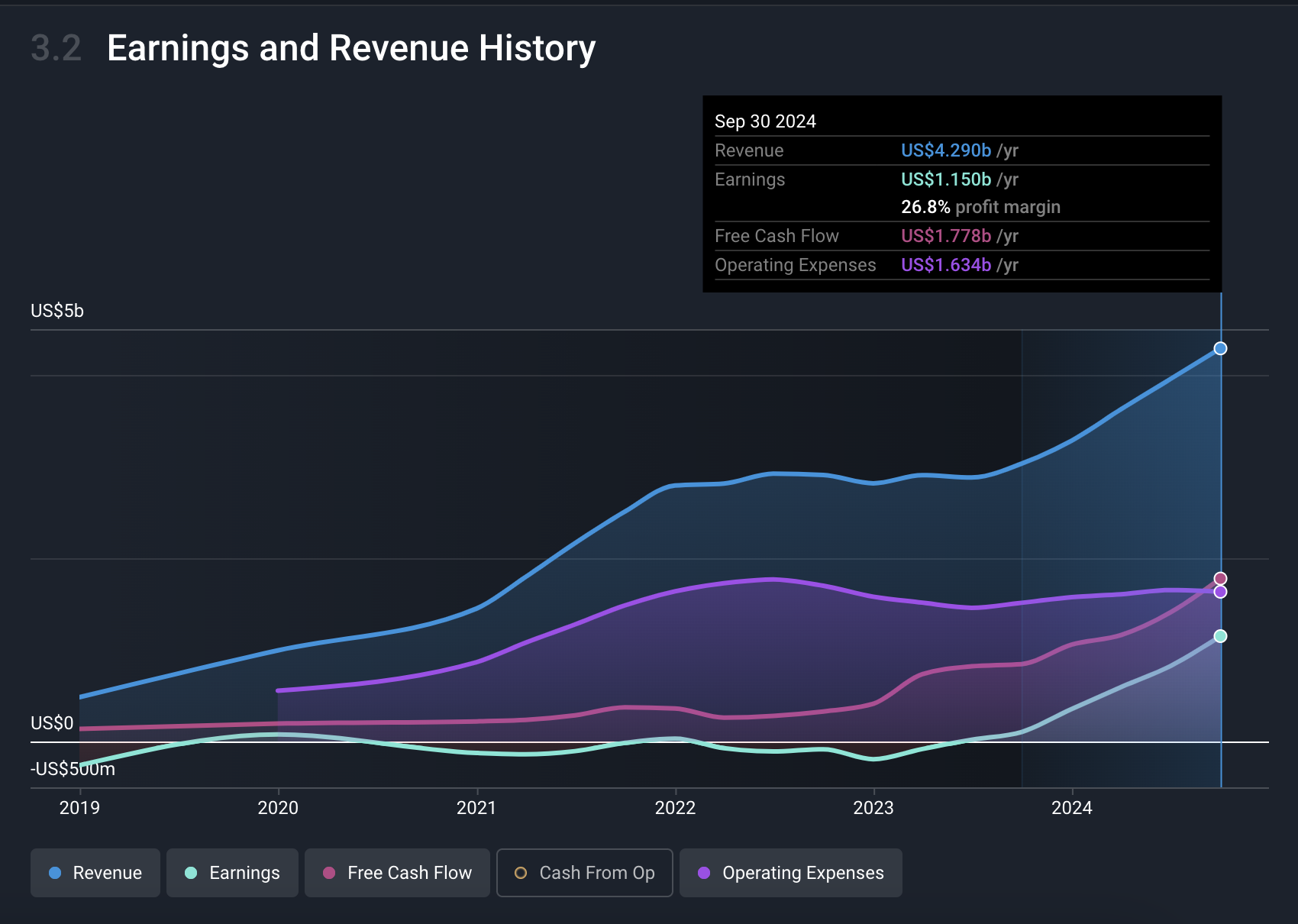

In Q3 last year, Microsoft’s total depreciation and amortization expense was $3.9 billion. This year it was $7.4 bln in Q3. You can see below that depreciation over the last 12 months was $23 billion, or around 25% of net income. A year ago that percentage was 18%, and in the recent quarter, it was 31%.

As Microsoft and the other cloud providers continue to invest in data center capacity, they’ll be recording increasing depreciation charges. These charges can be barely noticeable when revenue is rising, or when other cost increases are low. But they could have a big impact if revenue growth stagnates.

The other side of this coin is that when assets are fully depreciated, they have no more impact on earnings, but they can still provide value to the company. This can lead to a delayed improvement in margins.

Capital expenditure is a necessary part of investing in future growth - but it’s important to anticipate the effect on earnings. Capex cycles can also create opportunities if the hit to earnings results in lower share prices. This happened to Amazon a few years ago when investments in warehouses hit its margins. In Q3, Amazon reported a record net income margin of 9.65%.

Key Events During The Next Week

Tuesday

- 🇬🇧 UK Unemployment is forecast to rise from 4 to 4.1%.

Wednesday

- 🇺🇸 US consumer inflation data will be published. CPI is expected to rise from 2.4 to 2.6%. The core inflation rate is forecast to remain at 3.3%.

Thursday

- 🇬🇧 Preliminary estimates for the UK’s 3rd quarter GDP will be published. Economists expect year-on-year GDP growth to be 0.6%, compared to 0.7% in Q2.

- 🇺🇸US month-on-month producer price inflation data will be published. PPI is also expected to rise slightly, from 0% to 0.2%.

- 🇺🇸 US initial jobless claims are expected to increase slightly to 225k.

Friday

- 🇯🇵 Japan’s preliminary estimate for Q3 GDP growth is expected to show the economy expanding by 0.3%, down from 0.8% in Q2.

- 🇺🇸 US retail sales are expected to show a slight slowdown, from 0.4% to 0.3%.

Earnings season continues with companies in most sectors reporting:

- Home Depot

- Walt Disney

- Applied Materials

- Cisco

- Shopify

- Spotify

- Alibaba

- Sea Limited

- AstraZeneca PLC

- Occidental Petroleum

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.