- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (PSTG) Q3: Thin 3.7% Net Margin Tests High-Growth Bull Narrative

Reviewed by Simply Wall St

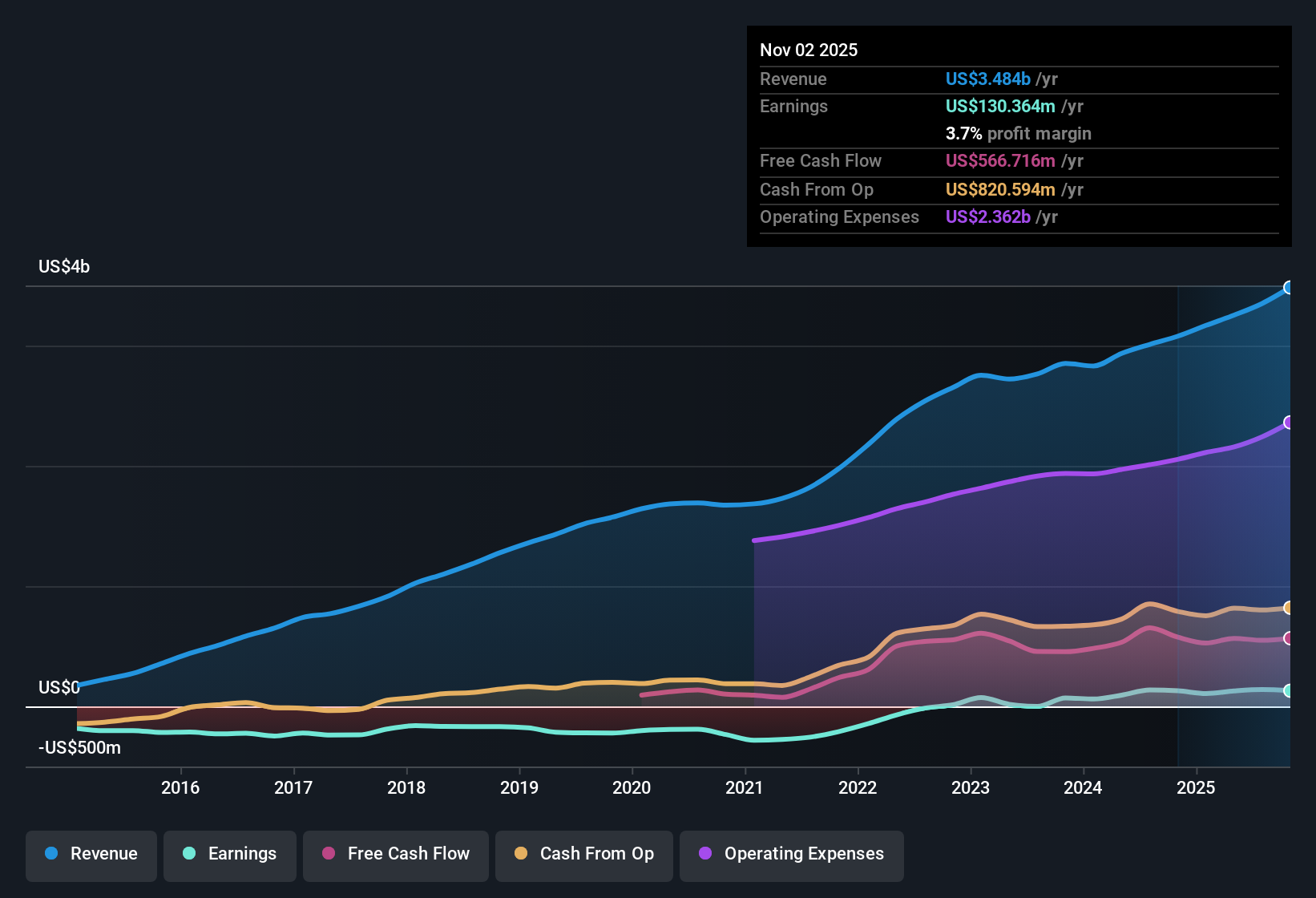

Pure Storage (PSTG) just posted its Q3 2026 numbers, with revenue of about $964 million and basic EPS of $0.17, alongside trailing 12 month revenue of roughly $3.5 billion and EPS of $0.40. These figures frame the latest quarter within a steadily scaling top line and consistent profitability. Over recent quarters the company has seen revenue move from $764 million in Q2 2025 to $862 million in Q2 2026, while basic EPS shifted from $0.11 to $0.14 over the same stretch. This sets up the latest print as another data point in a gradually maturing profit story where margins are very much in focus for investors.

See our full analysis for Pure Storage.With the numbers on the table, the next step is to see how this earnings run rate lines up with the main narratives around Pure Storage’s growth potential, profitability trajectory, and what that might mean for shareholders.

See what the community is saying about Pure Storage

TTM profit growth slows against five year pace

- Over the last 12 months, net income was about $130 million on $3.5 billion of revenue, and earnings grew just 0.4% compared with a 74.1% per year pace over the past five years.

- Consensus narrative sees accelerating adoption of Pure’s data cloud and subscriptions as a driver of long term earnings growth. However, the modest 0.4% trailing earnings growth and 3.7% net margin indicate that the step up in profitability implied by that story has not yet appeared in the reported numbers.

- Forecasts calling for roughly 35.7% annual earnings growth and revenue growth of about 14.1% per year contrast with the recent slowdown from the historical 74.1% per year earnings trajectory.

- Momentum in subscription offerings and data cloud architecture is highlighted as a growth engine, but today’s $3.5 billion revenue base and thin net margin suggest investors are still waiting for those higher margin streams to dominate the mix.

Thin 3.7 percent margin versus richer cloud story

- Trailing net profit margin sits at 3.7%, slightly below last year’s 4.2%, even as Q3 2026 net income grew to about $55 million from $47 million in Q2 2026.

- Bulls argue that high gross margins from all flash hardware and subscription services will increasingly support profitability. The current 3.7% net margin, however, shows that operating costs and investment needs are still absorbing much of the benefit from that premium positioning.

- Consensus narrative points to strong gross margins and a shift toward Evergreen and other recurring offers, yet the dip from 4.2% to 3.7% net margin underlines that scaling these newer lines has not yet translated into visibly stronger bottom line leverage.

- Expectations that profit margins could rise meaningfully in coming years sit alongside the reality that recent quarterly EPS, at about $0.17 in Q3 2026, is only modestly ahead of $0.14 in Q2 2026 and below the stronger $0.19 seen in Q3 2025.

Premium 7.2x sales multiple needs delivery

- Pure Storage trades on a price to sales ratio of 7.2x, versus 1.7x for the broader US tech industry and 2.4x for peers, with the share price around $75.87 and a DCF fair value estimate of $75.73.

- Bears focus on this rich valuation and thin margins. The combination of a 7.2x sales multiple and 3.7% net margin means the stock already prices in substantial improvement in profitability that has not yet appeared in the trailing numbers.

- Analyst targets implying upside toward 95.16 highlight optimism about roughly 14.1% revenue growth and 35.7% earnings growth per year, but those expectations must be weighed against the modest trailing earnings growth of 0.4%.

- The gap between Pure’s multiple and the 1.7x industry average underscores why skeptics see limited room for disappointment, especially with net margin slightly below last year’s 4.2% despite revenue rising from about $3.0 billion to $3.5 billion over recent trailing periods.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pure Storage on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a moment to test your own view against the data, shape it into a concise narrative, then Do it your way.

A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Pure Storage’s lofty sales multiple, slowing earnings growth, and thin margins indicate that expectations are high, while tangible profitability progress remains limited.

If you are uneasy paying a premium for that uncertainty, you may wish to shift your focus to these 905 undervalued stocks based on cash flows and look for companies where cash flows more clearly justify the current price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026