- United States

- /

- Software

- /

- NasdaqGS:ALLT

Exploring US High Growth Tech Stocks September 2025

Reviewed by Simply Wall St

As the United States stock market navigates the anticipation surrounding a potential interest rate cut by the Federal Reserve, key indices like the S&P 500 and Nasdaq have recently set new highs before experiencing slight pullbacks. In this dynamic environment, identifying high growth tech stocks involves assessing factors such as innovation potential, market adaptability, and resilience to economic shifts.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.94% | 26.66% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.10% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Circle Internet Group | 28.59% | 82.71% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 27.68% | 129.58% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Zscaler | 15.73% | 41.57% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

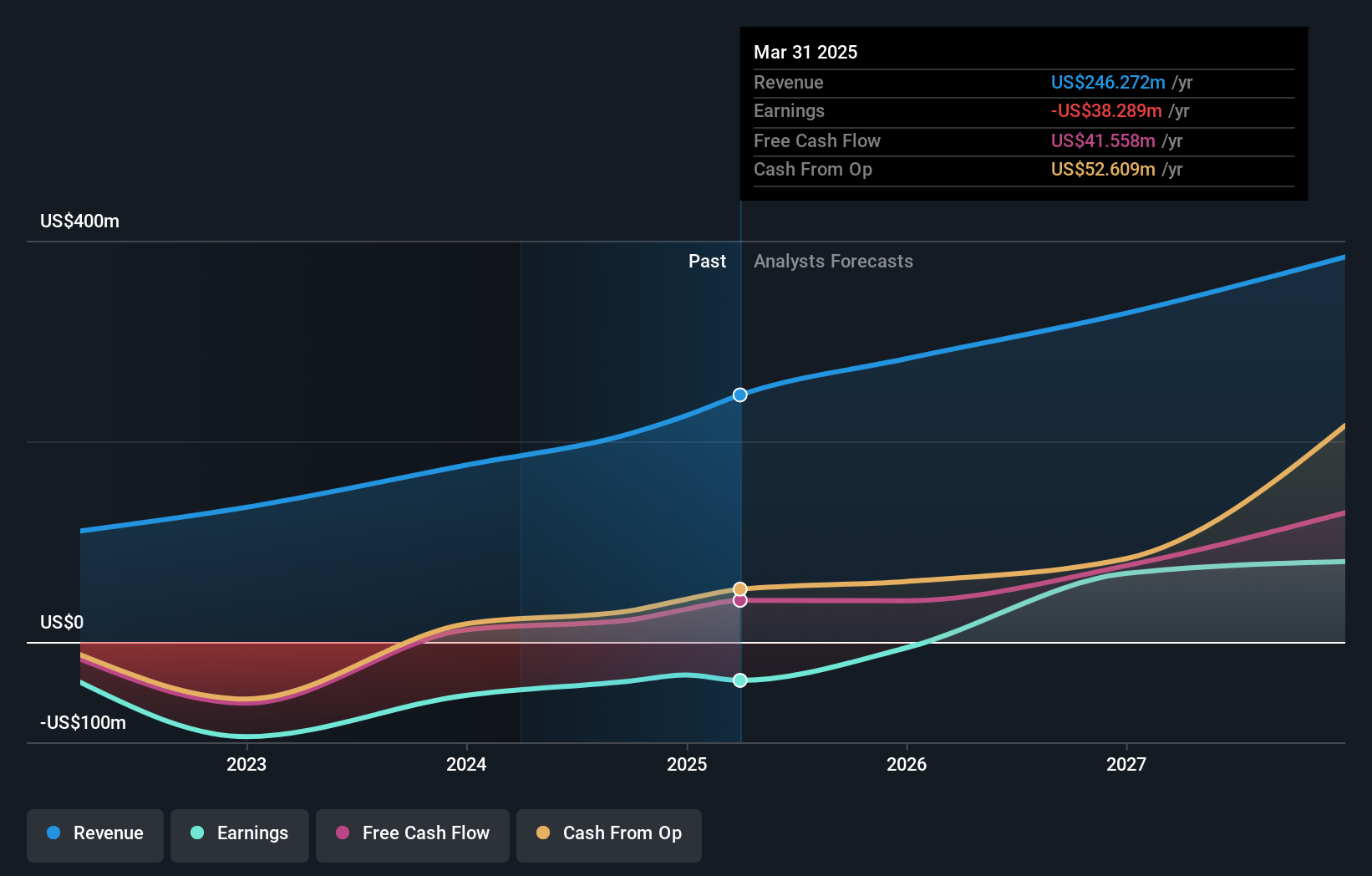

Allot (ALLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allot Ltd. is a company that develops, sells, and markets network intelligence and security solutions across various regions worldwide, with a market cap of $433.99 million.

Operations: The company generates revenue primarily from its optical networking equipment segment, which accounts for $95.34 million.

Allot recently projected a promising revenue range of $98 million to $102 million for 2025, signaling robust growth potential. This outlook is bolstered by strategic client acquisitions, such as Mas Movil Panama and Play, which have adopted Allot's advanced cybersecurity solutions like NetworkSecure and DNS Secure. These partnerships underscore Allot's capability to enhance network security dynamically, crucial in an era where cyber threats are escalating. Moreover, the company's R&D commitment is evident from its continuous product innovation and deployment of integrated solutions across diverse telecommunications platforms. This strategic focus not only addresses immediate cybersecurity needs but also positions Allot favorably in a competitive tech landscape where innovation drives market leadership.

- Click to explore a detailed breakdown of our findings in Allot's health report.

Review our historical performance report to gain insights into Allot's's past performance.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MNTN, Inc. operates a technology platform focused on performance marketing for Connected TV and has a market cap of approximately $1.44 billion.

Operations: The technology platform generates revenue primarily from Internet Software & Services, amounting to $259.91 million.

MNTN's integration with CallRail, enhancing its Performance TV platform by providing advertisers with precise attribution for calls and texts tied to CTV ads, demonstrates an innovative approach to bridging online and offline marketing channels. This capability is pivotal as it taps into the increasing demand for measurable advertising outcomes in a digital age. Additionally, MNTN's recent legal challenges involving patent infringement claims by Alpha Modus highlight potential risks but also underscore MNTN's significant role in evolving targeted advertising technologies. Despite these hurdles, the company’s expected revenue growth of 18% annually outpaces the US market projection of 9.7%, showcasing its robust position in a competitive sector.

- Unlock comprehensive insights into our analysis of MNTN stock in this health report.

Gain insights into MNTN's past trends and performance with our Past report.

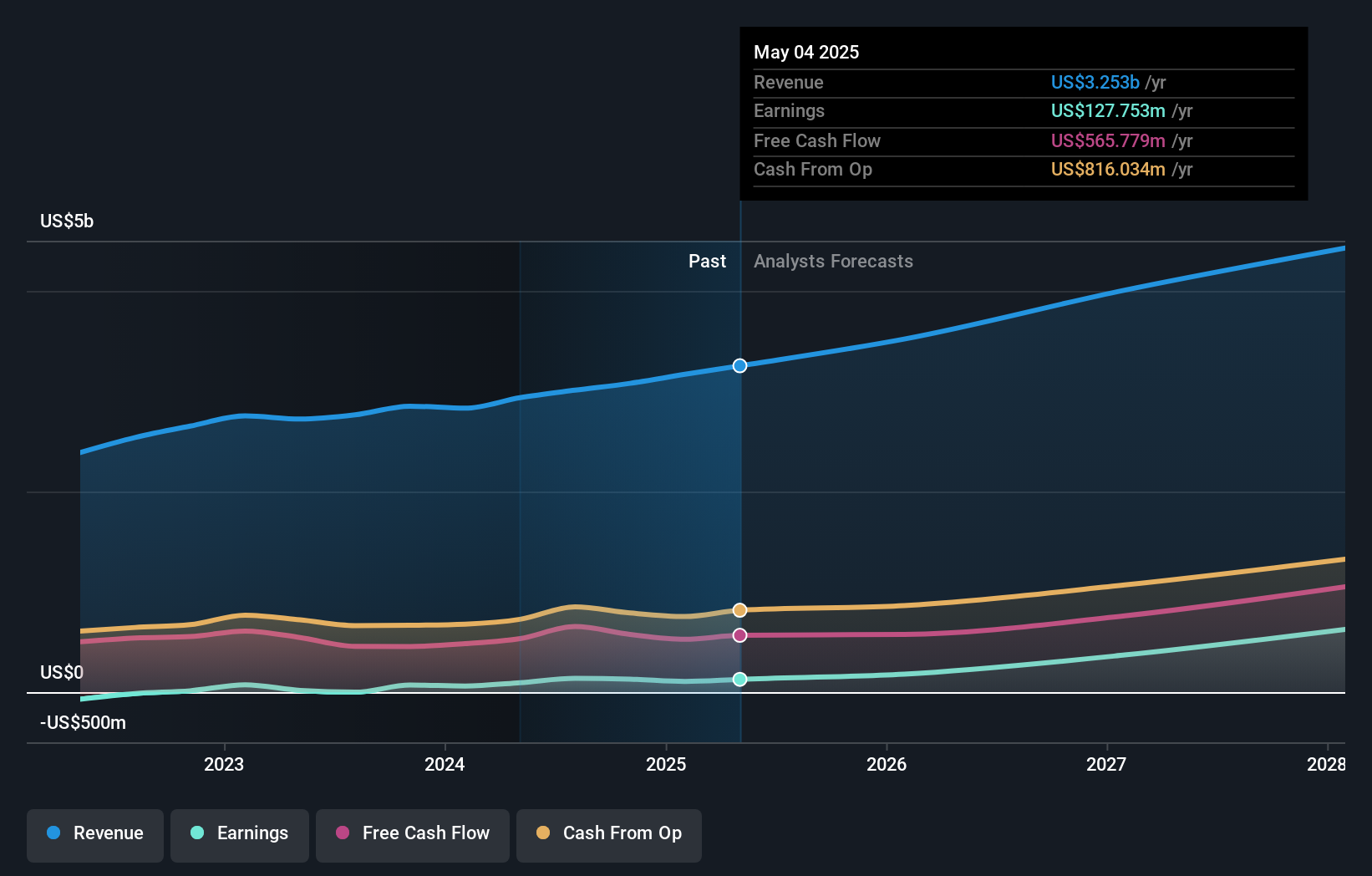

Pure Storage (PSTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pure Storage, Inc. offers data storage and management solutions globally with a market capitalization of $28.51 billion.

Operations: Pure Storage generates revenue primarily from its computer storage devices segment, which amounts to $3.35 billion. The company operates in both the U.S. and international markets, focusing on data storage and management technologies, products, and services.

With a robust annual revenue growth of 13.1% and an even more impressive earnings expansion at 33.7%, Pure Storage is demonstrating significant momentum in the tech sector. The company's strategic R&D investments, crucial for fostering innovation and staying competitive, have been substantial, aligning with its forward-looking guidance revisions which project revenues up to $3.63 billion for FY2026. Recent product launches like the Enterprise Data Cloud (EDC) highlight Pure Storage’s commitment to addressing modern data challenges through high-performance solutions that integrate AI, enhancing operational efficiency across diverse industries. This approach not only solidifies its market position but also caters effectively to evolving business needs in a data-driven landscape.

- Dive into the specifics of Pure Storage here with our thorough health report.

Assess Pure Storage's past performance with our detailed historical performance reports.

Key Takeaways

- Dive into all 67 of the US High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALLT

Allot

Develops, sells, and markets network intelligence and security solutions in Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)