- United States

- /

- Banks

- /

- NYSE:TFC

3 Prominent Value Stocks Estimated To Be Up To 48% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge with major indices like the Dow Jones, S&P 500, and Nasdaq Composite climbing on positive earnings reports and anticipation over tariff developments, investors are keenly observing opportunities that may be undervalued amidst this rally. In such a climate, identifying value stocks—those trading below their intrinsic value—can offer potential for significant returns as these equities may gain traction when broader market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Renasant (NYSE:RNST) | $31.11 | $60.65 | 48.7% |

| MetroCity Bankshares (NasdaqGS:MCBS) | $28.41 | $56.26 | 49.5% |

| Royal Caribbean Cruises (NYSE:RCL) | $207.50 | $403.26 | 48.5% |

| CI&T (NYSE:CINT) | $5.16 | $10.15 | 49.1% |

| Shift4 Payments (NYSE:FOUR) | $80.22 | $158.37 | 49.3% |

| Curbline Properties (NYSE:CURB) | $23.40 | $46.01 | 49.1% |

| Verra Mobility (NasdaqCM:VRRM) | $22.25 | $43.26 | 48.6% |

| RXO (NYSE:RXO) | $13.40 | $26.30 | 49.1% |

| First Advantage (NasdaqGS:FA) | $13.87 | $27.25 | 49.1% |

| CNX Resources (NYSE:CNX) | $30.59 | $60.39 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Corning (NYSE:GLW)

Overview: Corning Incorporated operates in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences sectors globally with a market cap of approximately $35.77 billion.

Operations: The company's revenue segments include Optical Communications at $4.66 billion, Display Technologies at $3.87 billion, Specialty Materials at $2.02 billion, Environmental Technologies at $1.67 billion, and Life Sciences contributing $979 million.

Estimated Discount To Fair Value: 24.2%

Corning is trading at US$42.97, below its estimated fair value of US$56.67, suggesting undervaluation based on discounted cash flows. Despite high debt levels and a dividend not well covered by earnings, the company's earnings are forecast to grow significantly at 23.9% annually, surpassing market averages. Recent strategic initiatives in AI and quantum computing sectors highlight Corning's innovation potential, which may enhance future cash flow prospects despite current financial challenges.

- Upon reviewing our latest growth report, Corning's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Corning with our comprehensive financial health report here.

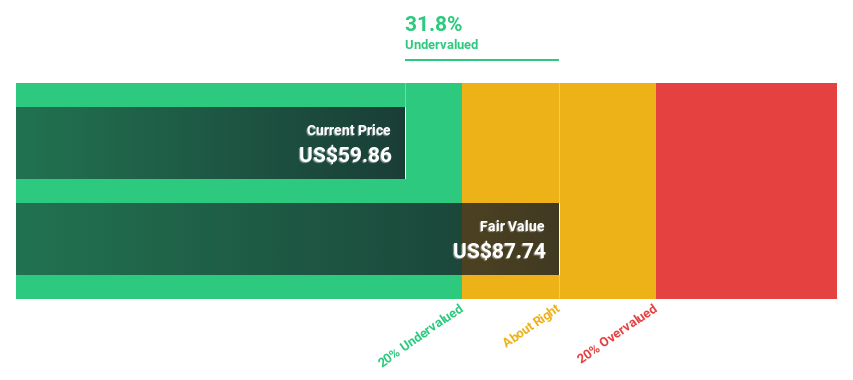

Somnigroup International (NYSE:SGI)

Overview: Somnigroup International Inc., along with its subsidiaries, is engaged in the design, manufacture, distribution, and retail of bedding products both in the United States and internationally, with a market cap of $12.69 billion.

Operations: The company's revenue segments include $1.14 billion from international operations, including Sealy, and $3.79 billion from North American operations, also including Sealy.

Estimated Discount To Fair Value: 29.8%

Somnigroup International is trading at US$61.74, which is below its estimated fair value of US$87.9, indicating it may be undervalued based on discounted cash flows. Despite high debt levels not well covered by operating cash flow and recent shareholder dilution, earnings are forecast to grow 19.1% annually, outpacing the US market average of 13.3%. Recent executive changes and index inclusion could influence strategic direction and investor interest positively.

- In light of our recent growth report, it seems possible that Somnigroup International's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Somnigroup International.

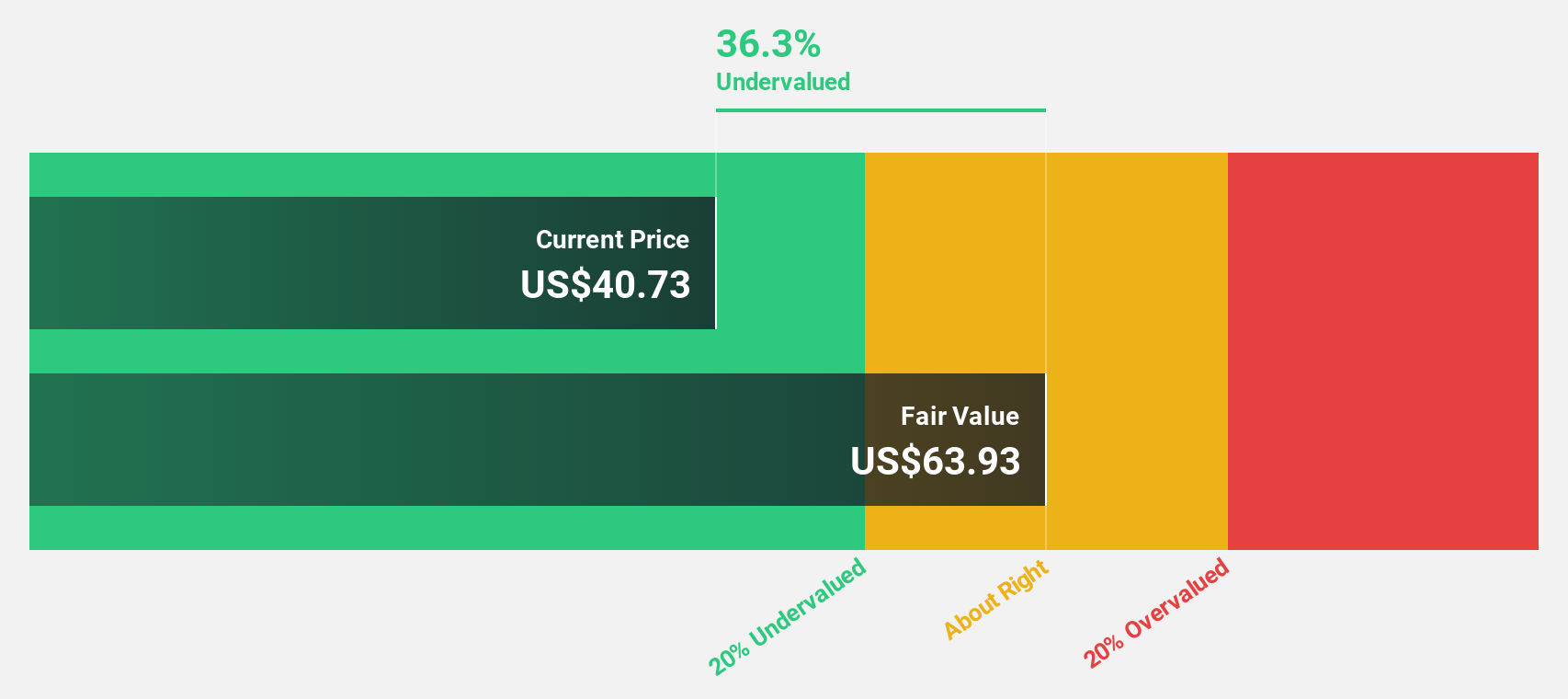

Truist Financial (NYSE:TFC)

Overview: Truist Financial Corporation is a financial services company offering banking and trust services in the Southeastern and Mid-Atlantic United States, with a market cap of approximately $47.59 billion.

Operations: The company's revenue is primarily derived from Consumer and Small Business Banking at $11.04 billion and Wholesale Banking at $10.12 billion, while Treasury & Corporate contributes a negative amount of -$9.62 billion.

Estimated Discount To Fair Value: 48%

Truist Financial trades at US$37.14, significantly under its estimated fair value of US$71.43, suggesting it is undervalued based on discounted cash flows. Recent earnings showed net interest income and net income growth, but the dividend yield of 5.6% raises sustainability concerns due to coverage issues. Analysts anticipate a 23.7% stock price rise despite lower-than-market revenue growth forecasts and a projected low return on equity in three years.

- According our earnings growth report, there's an indication that Truist Financial might be ready to expand.

- Take a closer look at Truist Financial's balance sheet health here in our report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 183 more companies for you to explore.Click here to unveil our expertly curated list of 186 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion