- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

CompoSecure (CMPO): Evaluating Valuation Following Removal from the NASDAQ Composite Index

Reviewed by Kshitija Bhandaru

CompoSecure (CMPO) was recently dropped from the NASDAQ Composite Index, a move that tends to raise questions about potential impacts on the stock’s trading dynamics and investor sentiment in the near term.

See our latest analysis for CompoSecure.

The recent removal from the NASDAQ Composite Index comes as CompoSecure’s stock has generally moved sideways after an uneven year, with performance showing only modest momentum and a 1-year total shareholder return of about 0.76%. Market reactions may reflect investors weighing both risks and pockets of growth potential on the horizon.

If index changes have you curious about what else is unfolding in the market, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

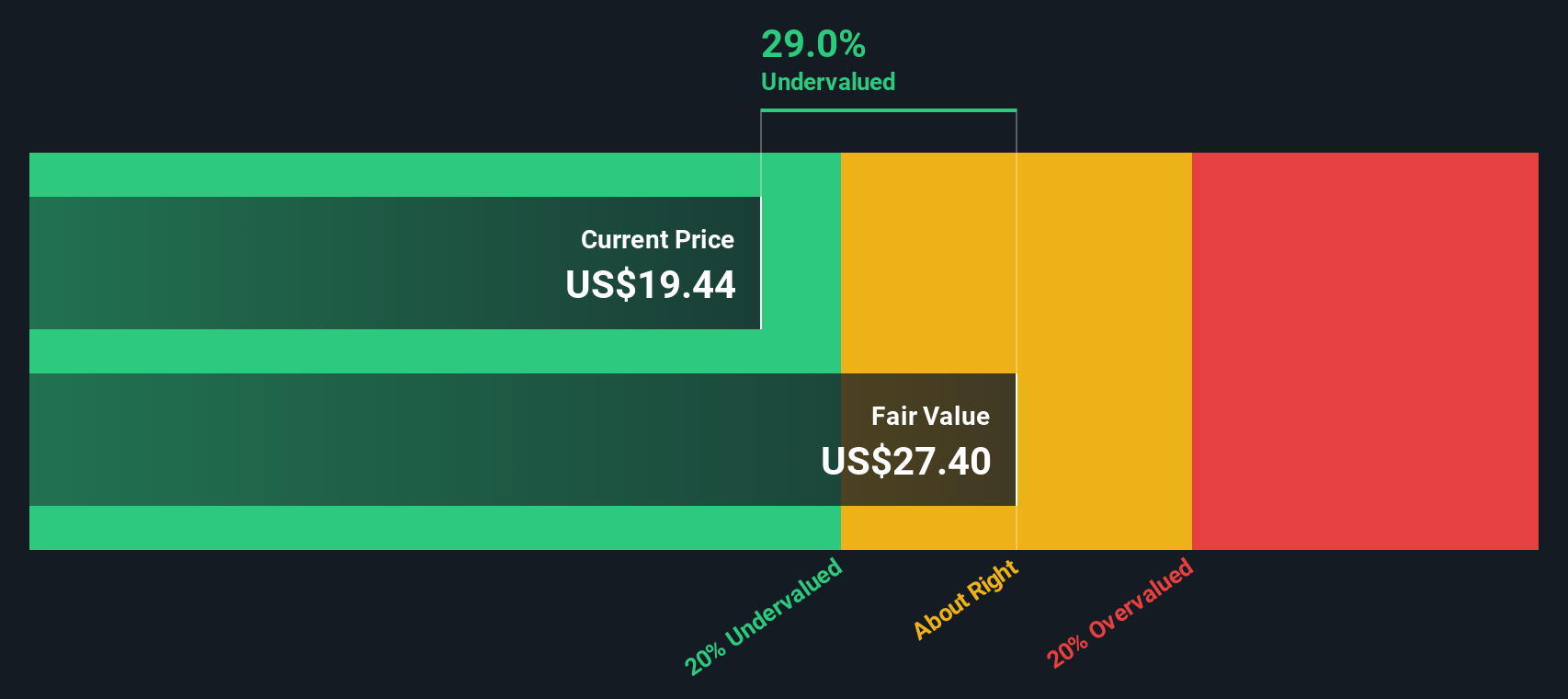

With the recent index drop and mixed returns on the table, investors are left to wonder whether CompoSecure is currently undervalued and presenting a buying window, or if the market has already accounted for every inch of its expected growth.

Most Popular Narrative: 7% Overvalued

CompoSecure’s most popular narrative sees its fair value slightly below the last close, suggesting the current price may be running ahead of expectations. With analyst consensus targeting a discount to today’s market price, investors are left questioning whether the outlook can justify it.

Expanding premium card and digital security offerings, along with major partnerships, is broadening the customer base and establishing recurring, stable revenue streams. Operational efficiency initiatives are boosting profitability and sustaining margin growth. This is positioning the company for incremental gains across traditional and digital segments.

Curious what forecasts drive this cautious price target? One bold assumption sets the stage for explosive earnings and a profit margin transformation. The valuation model hinges on unexpected upside. Find out which projections make all the difference in the fair value estimate.

Result: Fair Value of $19.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if digital wallet adoption accelerates or reliance on a few major clients continues, these shifts could quickly undermine CompoSecure’s current growth outlook.

Find out about the key risks to this CompoSecure narrative.

Another View: SWS DCF Model Tells a Different Story

While analyst consensus suggests CompoSecure is currently overvalued, our SWS DCF model presents a sharply contrasting perspective. According to this method, the stock is actually trading 22.8% below its estimated fair value. Could this gap between market price and cash flow valuation signal an overlooked opportunity, or just different assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CompoSecure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CompoSecure Narrative

If you see things differently or want to dig into the numbers to form your own story, you can create a complete narrative yourself in under three minutes, and Do it your way.

A great starting point for your CompoSecure research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity never waits. Make your next move now by searching for breakout trends and untapped returns in the places others overlook.

- Tap into future-defining tech by scanning these 24 AI penny stocks that are poised to lead the artificial intelligence transformation and redefine industry standards.

- Boost your passive income with these 19 dividend stocks with yields > 3% which offer reliable yields and steady cash flows in today's volatile market.

- Stay ahead on digital frontiers by checking out these 78 cryptocurrency and blockchain stocks at the forefront of crypto innovation and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives