- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

CompoSecure (CMPO): Evaluating Valuation as Leadership Momentum Builds with New CFO Appointment

Reviewed by Kshitija Bhandaru

CompoSecure (CMPO) just brought in Mary Holt as its new Chief Financial Officer, tapping into her three decades of financial leadership. This strategic move is making investors watch the company's next chapter closely.

See our latest analysis for CompoSecure.

The appointment of Mary Holt comes as CompoSecure is enjoying strong momentum, with a 3-month share price return of 36.2% and an impressive 1-year total shareholder return of nearly 65%. While shares came off slightly in the last week, the broader trend remains positive, and long-term holders have seen exceptional gains. This suggests investor optimism around the company’s evolving leadership and financial outlook.

If leadership changes are prompting you to look beyond CompoSecure, now’s an ideal moment to discover fast growing stocks with high insider ownership.

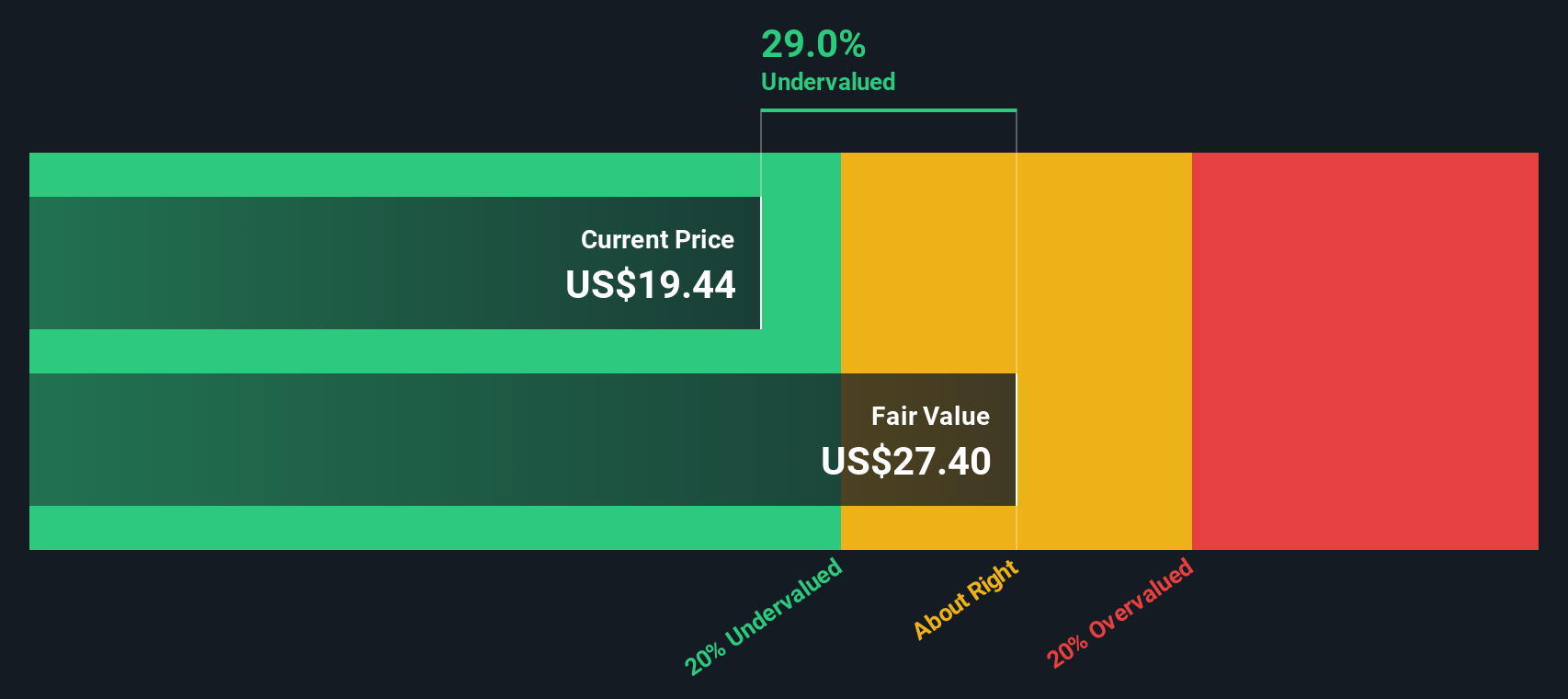

But with CompoSecure’s recent run-up and robust earnings momentum, the big question remains: is the stock still undervalued, or is the market already pricing in more years of growth from this point?

Most Popular Narrative: 2.9% Overvalued

CompoSecure's narrative valuation lands at $19.00 per share, just above its latest close of $18.91, revealing only a slim premium. This sets the stage to explore exactly what is fueling such an ambitious outlook on future growth and profit potential.

The penetration of metal cards remains less than 1% of the global payment card market. Issuer and consumer demand for premium products continues to increase, positioning CompoSecure to capture significant market share and drive long-term revenue growth. Recent and ongoing investments in operational efficiency (via the CompoSecure Operating System) are contributing to improved gross margins and EBITDA. Management indicates further opportunities for cost efficiencies, supporting sustainable margin expansion and higher earnings.

Wondering what assumptions could justify such an aggressive valuation? The most popular narrative points to remarkable projected gains, driven by rapid sales acceleration, dramatic profit margin expansion and a steep climb in future earnings per share. Only by reading the full narrative will you uncover the key quantitative levers behind this premium price target.

Result: Fair Value of $19.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating adoption of digital wallets or shifts in consumer sustainability preferences could challenge CompoSecure’s optimistic growth outlook in the future.

Find out about the key risks to this CompoSecure narrative.

Another View: Discounted Cash Flow Perspective

Looking through the lens of our DCF model, CompoSecure's stock appears to be trading about 26% below its estimated fair value of $26.43. This suggests an undervalued opportunity. However, can this estimate remain accurate if real-world growth and profitability fall short of forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CompoSecure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CompoSecure Narrative

Feel the analysis misses something, or want a hands-on look at the numbers? You can quickly shape your own perspective on CompoSecure in just minutes. Do it your way

A great starting point for your CompoSecure research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment opportunities?

Don’t miss out by limiting yourself to just one stock. Use Simply Wall St’s powerful tools to spot top growth and value ideas tailored for smart, future-focused investors.

- Supercharge your income strategy by looking into these 19 dividend stocks with yields > 3%, which offers yields above 3% and has robust financials.

- Be ahead of the curve in AI innovation by starting your search with these 24 AI penny stocks, where transformative companies are reshaping the tech landscape.

- Pinpoint value gems by tracking these 893 undervalued stocks based on cash flows, based on real cash flow so you stay one step ahead of the market crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives