- United States

- /

- Insurance

- /

- NYSE:CIA

3 US Penny Stocks With Market Caps Over $200M

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge driven by big-tech rallies, investors are increasingly looking for opportunities beyond the usual large-cap stocks. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.42 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

TrueCar (NasdaqGS:TRUE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TrueCar, Inc. is an internet-based company providing information, technology, and communication services in the United States with a market cap of $3 billion.

Operations: The company's revenue segment includes Internet Information Providers, generating $170.68 million.

Market Cap: $300.01M

TrueCar's recent financial performance shows a narrowing net loss, with sales increasing to US$46.54 million in Q3 2024 from US$41.15 million a year ago, indicating some revenue growth despite ongoing unprofitability. The company remains debt-free and has ample short-term assets exceeding both its short and long-term liabilities, providing financial stability amid volatility concerns. A significant share buyback program has been completed, enhancing shareholder value without dilution over the past year. Additionally, takeover rumors have boosted stock interest recently; however, profitability is not expected in the near term according to analyst forecasts.

- Dive into the specifics of TrueCar here with our thorough balance sheet health report.

- Explore TrueCar's analyst forecasts in our growth report.

Aeva Technologies (NYSE:AEVA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aeva Technologies, Inc. designs, develops, manufactures, and sells LiDAR sensing systems and related software solutions for perception and autonomy across various regions including North America, Europe, the Middle East, Africa, and Asia with a market cap of $239.78 million.

Operations: The company's revenue primarily comes from its Industrial Automation & Controls segment, generating $7.98 million.

Market Cap: $239.78M

Aeva Technologies, with a market cap of US$239.78 million, is advancing its LiDAR technology with the recent unveiling of the Aeva Atlas™ Ultra sensor, designed for high-performance autonomous driving systems. Despite generating US$7.98 million in revenue from its Industrial Automation & Controls segment, Aeva remains unprofitable and not expected to achieve profitability within three years. The company benefits from a debt-free balance sheet and sufficient short-term assets to cover liabilities but faces challenges with insider selling and limited cash runway if cash flow continues to decline. Revenue growth is forecasted at 69.77% annually, offering potential upside amid financial constraints.

- Take a closer look at Aeva Technologies' potential here in our financial health report.

- Evaluate Aeva Technologies' prospects by accessing our earnings growth report.

Citizens (NYSE:CIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Citizens, Inc. offers life insurance products both in the United States and internationally, with a market cap of $230.57 million.

Operations: The company's revenue primarily comes from life insurance, generating $189.15 million, and home service insurance, contributing $58.22 million.

Market Cap: $230.57M

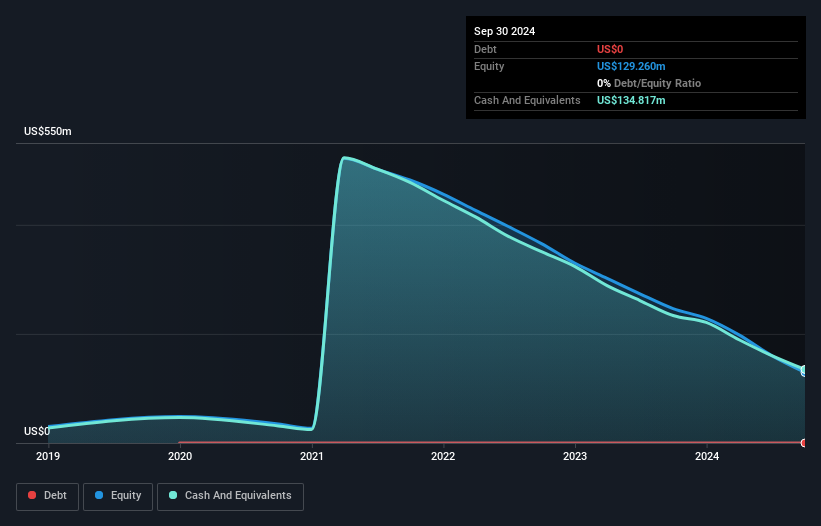

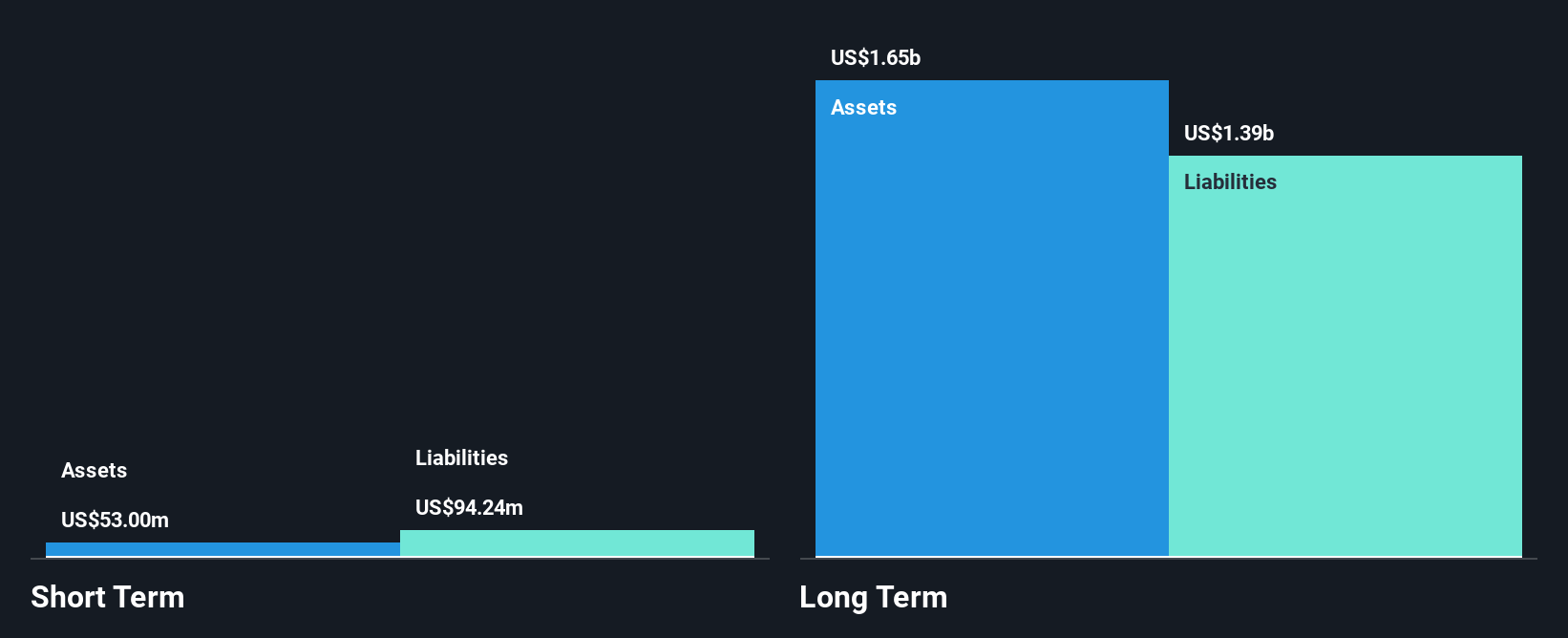

Citizens, Inc., with a market cap of US$230.57 million, primarily generates revenue from life insurance (US$189.15 million) and home service insurance (US$58.22 million). The company reported stable earnings for the third quarter of 2024 but experienced a decline in net income for the first nine months compared to last year. Despite having no debt and high-quality past earnings, Citizens faces challenges with short-term assets not covering liabilities and declining earnings growth projections over the next three years. Trading at a significant discount to its estimated fair value, it presents both opportunities and risks for investors in penny stocks.

- Click here to discover the nuances of Citizens with our detailed analytical financial health report.

- Assess Citizens' future earnings estimates with our detailed growth reports.

Make It Happen

- Unlock our comprehensive list of 709 US Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIA

Citizens

An insurance holding company, provides life insurance products in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives