- United States

- /

- Tech Hardware

- /

- NasdaqGM:TACT

Analysts Just Published A Bright New Outlook For TransAct Technologies Incorporated's (NASDAQ:TACT)

Celebrations may be in order for TransAct Technologies Incorporated (NASDAQ:TACT) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

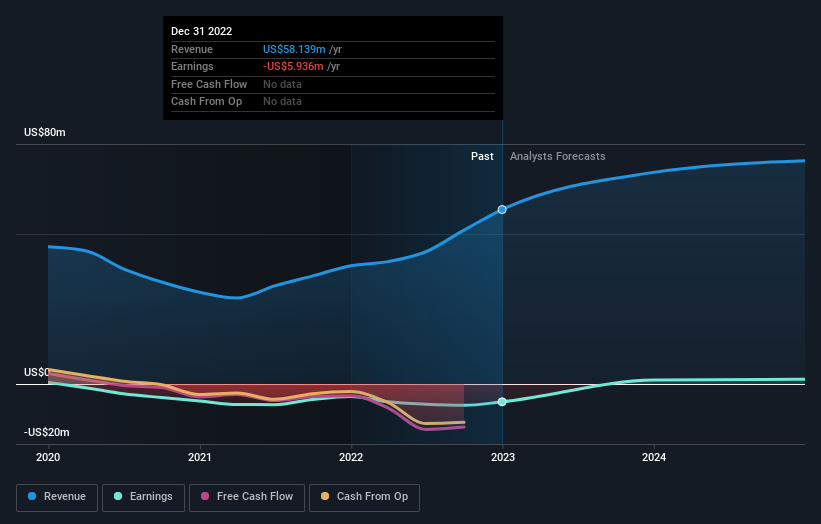

Following the upgrade, the current consensus from TransAct Technologies' two analysts is for revenues of US$71m in 2023 which - if met - would reflect a sizeable 21% increase on its sales over the past 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$0.13 per share this year. However, before this estimates update, the consensus had been expecting revenues of US$62m and US$0.36 per share in losses. So we can see that this has sparked a pretty clear upgrade to expectations, with higher revenues anticipated to lead to profit sooner than previously forecast.

Check out our latest analysis for TransAct Technologies

With these upgrades, we're not surprised to see that the analysts have lifted their price target 11% to US$9.75 per share. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values TransAct Technologies at US$10.00 per share, while the most bearish prices it at US$9.50. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that TransAct Technologies is forecast to grow faster in the future than it has in the past, with revenues expected to display 21% annualised growth until the end of 2023. If achieved, this would be a much better result than the 6.4% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 6.4% per year. So it looks like TransAct Technologies is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away from this upgrade is that the consensus now expects TransAct Technologies to become profitable this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, TransAct Technologies could be worth investigating further.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 2 potential warning sign with TransAct Technologies, including a short cash runway. For more information, you can click through to our platform to learn more about this and the 1 other warning sign we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if TransAct Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TACT

TransAct Technologies

Designs, develops, and markets transaction-based and specialty printers and terminals in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026