- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

A closer look at Seagate Technology’s (STX) valuation after insider selling and renewed institutional buying interest

Reviewed by Simply Wall St

Insider selling after a 300% rally at Seagate Technology Holdings (STX) has grabbed attention, but the bigger story is that institutional buyers are still stepping in as analysts stay broadly constructive.

See our latest analysis for Seagate Technology Holdings.

That backdrop helps explain why the stock’s latest move, with a 1 day share price return of 5.68 percent and a 7 day share price return of 15.56 percent, comes on top of a powerful year to date share price return of 246.01 percent and a 3 year total shareholder return of 503.77 percent. This suggests momentum is still building rather than fading at the current 298.92 dollar share price.

If Seagate’s run has you thinking about what else could be setting up for a strong next leg, this is a good moment to explore high growth tech and AI stocks as potential next ideas.

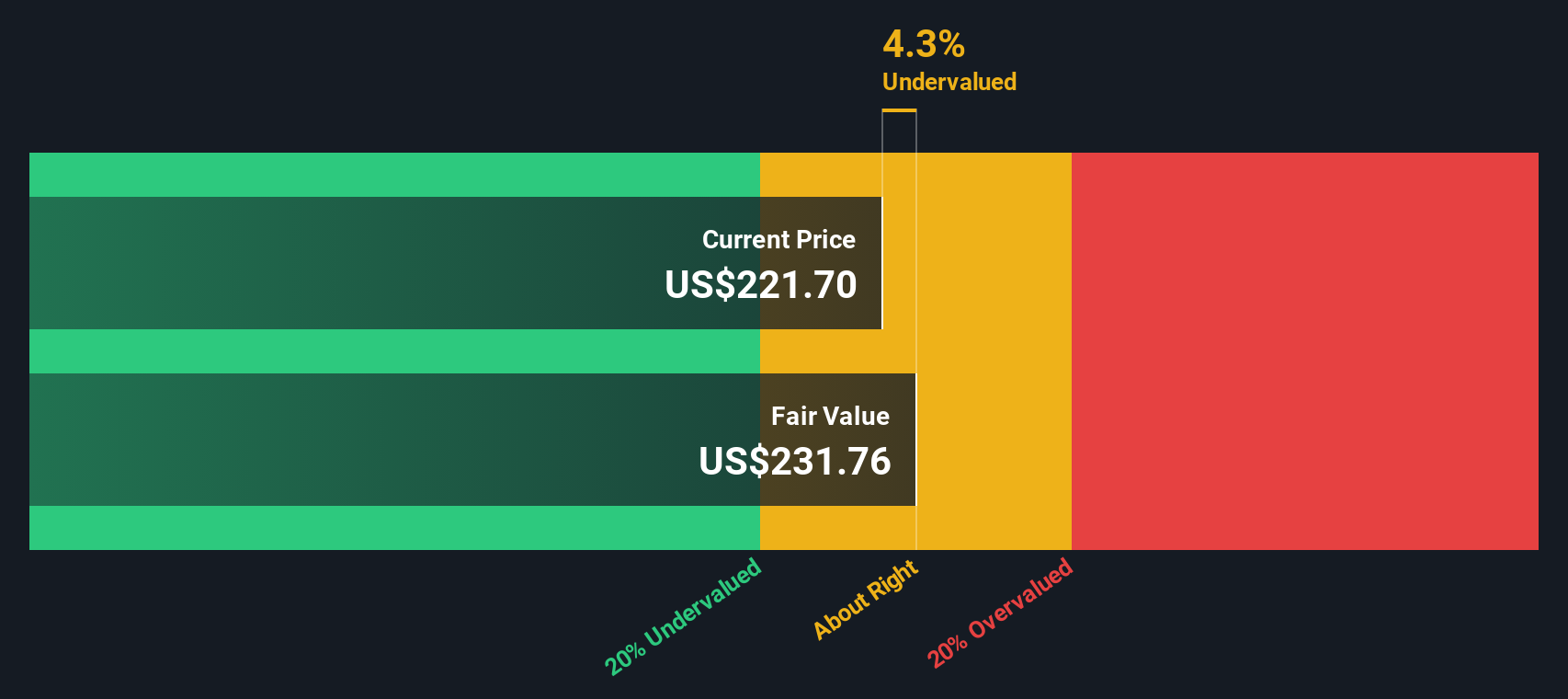

Yet with Seagate now trading slightly above the average analyst target but still at a double digit discount to some intrinsic value estimates, is this a late stage momentum bet, or a fresh entry point before markets fully price in future growth?

Most Popular Narrative: 3.3% Overvalued

With Seagate closing at 298.92 dollars against a narrative fair value of 289.24 dollars, expectations for AI driven storage growth are doing the heavy lifting.

The growing demand for mass capacity storage driven by the cloud CapEx investment cycle and data center build outs for AI transformation is likely to elevate Seagate's revenue streams. This increased demand aligns with ongoing cloud infrastructure expansion, suggesting positive impacts on earnings.

Want to see what kind of revenue climb and margin expansion could support this premium price tag? The narrative spells out an ambitious earnings runway and a future valuation multiple that assumes Seagate joins the elite tier of tech compounders. Curious which specific growth and profitability assumptions have to land for that fair value to hold up? Read on and test whether those numbers match your own expectations.

Result: Fair Value of $289.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged supply disruptions or a sharper than expected slowdown in AI infrastructure spending could quickly challenge today’s high growth and margin assumptions.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another View: Cash Flows Tell a Different Story

While the narrative model flags Seagate as 3.3 percent overvalued versus its 289.24 dollar fair value, our DCF model sees things differently. On a cash flow basis, Seagate at 298.92 dollars screens as 16.5 percent undervalued, which hints that long term cash generation could justify a richer price. Which lens feels more realistic to you: sentiment or cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seagate Technology Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seagate Technology Holdings Narrative

If this perspective does not quite line up with your own, or you prefer hands on research, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investment angle?

Do not stop with Seagate. Use the Simply Wall Street Screener to pinpoint fresh opportunities that match your strategy before the market fully catches on.

- Capitalize on potential mispricings by scanning these 907 undervalued stocks based on cash flows that may offer upside as cash flows and sentiment realign.

- Ride powerful innovation trends by targeting these 26 AI penny stocks positioned at the heart of automation, data intelligence, and productivity gains.

- Evaluate recurring income potential by reviewing these 12 dividend stocks with yields > 3% that combine yield with sustainable payout foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026