- United States

- /

- Communications

- /

- NasdaqGS:CRNT

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause after a strong rally, investors are keenly observing shifts in major indexes and sectors, particularly with recent developments in technology and AI-related stocks. For those considering investments beyond the well-trodden paths of large-cap equities, penny stocks—though an older term—still represent intriguing opportunities within smaller or emerging companies. By focusing on those with solid financial health and potential for growth, these stocks can offer both stability and the possibility of significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8562 | $6.22M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.83 | $11.49M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.97 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2874 | $10.58M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.51 | $49.83M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.47 | $60.21M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.32 | $23.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8902 | $80.06M | ★★★★★☆ |

Click here to see the full list of 705 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Talkspace (NasdaqCM:TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company operating in the United States with a market cap of approximately $540.55 million.

Operations: The company generates revenue from its Pharmacy Services segment, totaling $181.29 million.

Market Cap: $540.55M

Talkspace, Inc. is a virtual behavioral healthcare company with a market cap of US$540.55 million, generating significant revenue from its Pharmacy Services segment. Despite being unprofitable, Talkspace has improved its financial position by reducing losses over the past five years and maintaining a debt-free status for the same period. The company has sufficient cash runway for more than three years due to positive free cash flow growth. Recent developments include strategic M&A pursuits and partnerships like the one with Espresa to enhance workplace mental health services, reflecting an increasing demand for accessible mental health benefits in the workplace.

- Dive into the specifics of Talkspace here with our thorough balance sheet health report.

- Evaluate Talkspace's prospects by accessing our earnings growth report.

Clover Health Investments (NasdaqGS:CLOV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Clover Health Investments Corp. offers Medicare Advantage plans in the United States and has a market cap of $2.42 billion.

Operations: The company's revenue segment is derived entirely from the United States, amounting to $2.12 billion.

Market Cap: $2.42B

Clover Health Investments, with a market cap of US$2.42 billion, remains unprofitable yet has significantly reduced its losses over the past year, reporting a net loss of US$9.16 million for Q3 2024 compared to US$41.47 million in the previous year. The company has no debt and maintains sufficient cash runway for over three years, indicating financial resilience despite challenges. Clover's earnings are projected to grow substantially at 57.02% annually, though volatility remains stable at 8%. Recent activities include participation in major healthcare conferences and completing a share buyback program valued at US$1.76 million.

- Click here to discover the nuances of Clover Health Investments with our detailed analytical financial health report.

- Examine Clover Health Investments' earnings growth report to understand how analysts expect it to perform.

Ceragon Networks (NasdaqGS:CRNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. provides wireless transport solutions for cellular operators and other wireless service providers across various global regions, with a market cap of $422.48 million.

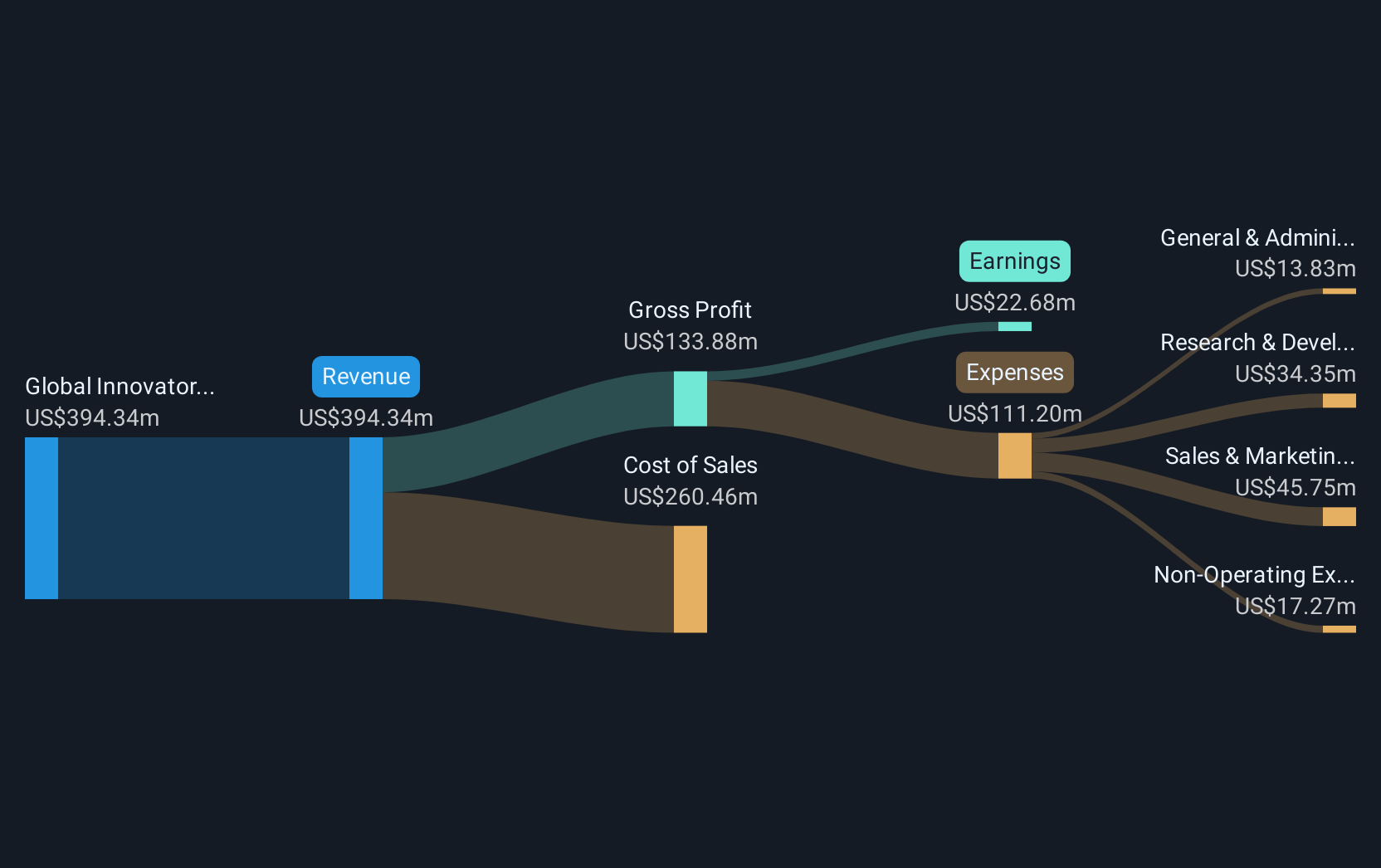

Operations: The company's revenue segment, as a global innovator and leading solutions provider of wireless transport, generated $377.62 million.

Market Cap: $422.48M

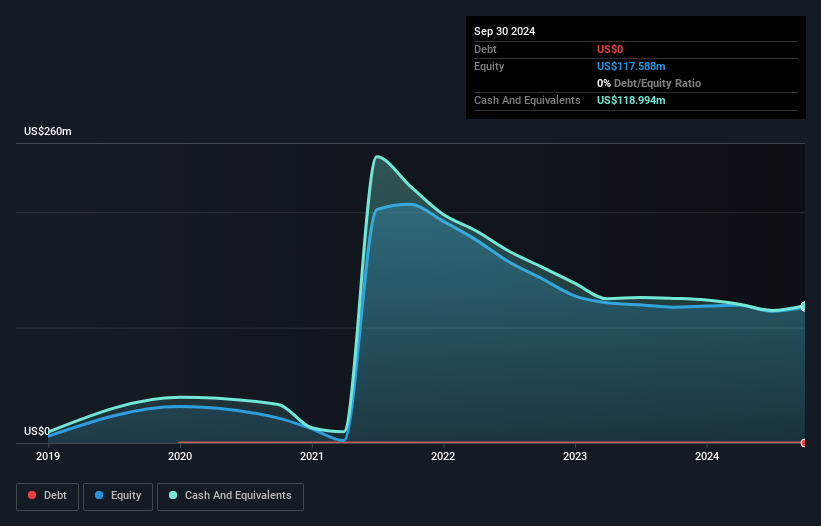

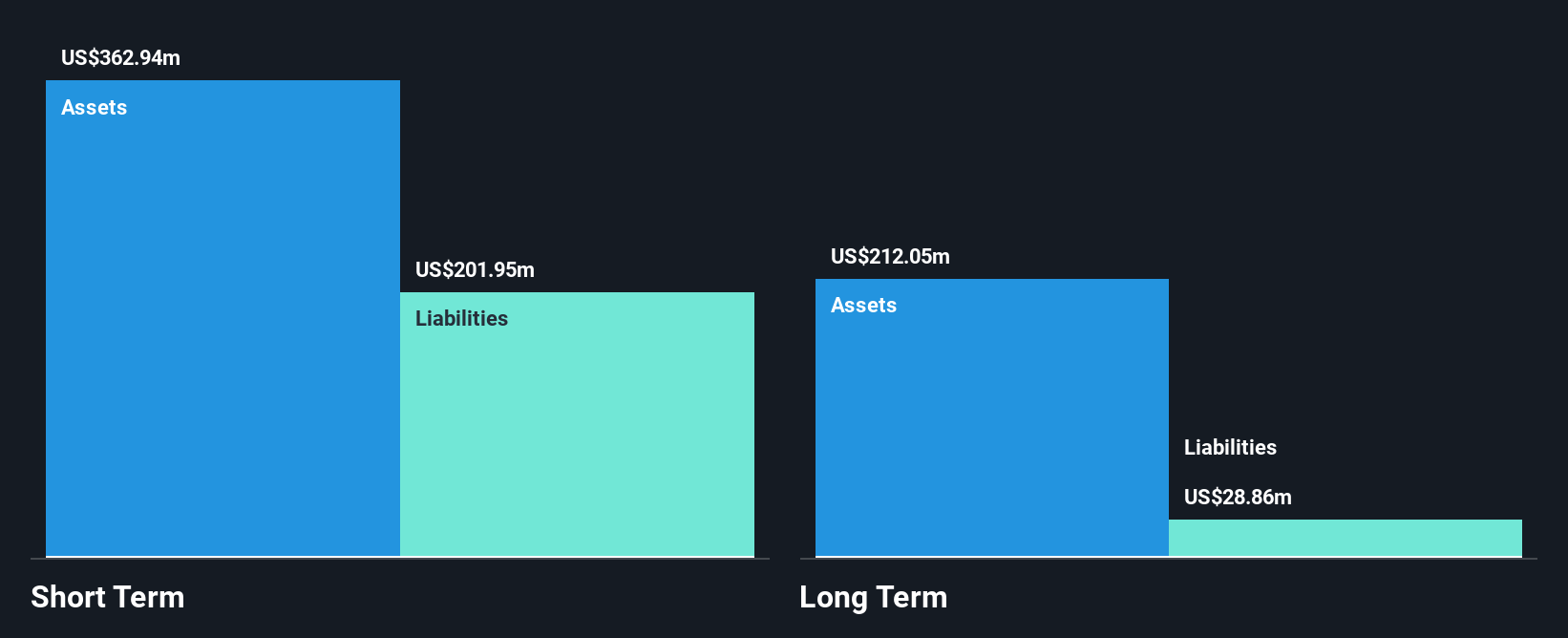

Ceragon Networks, with a market cap of US$422.48 million, has demonstrated robust financial performance by becoming profitable and reporting Q3 2024 sales of US$102.67 million, up from US$87.26 million the previous year. The company's earnings growth is noteworthy, with net income reaching US$12.22 million compared to US$3.37 million a year ago, reflecting high-quality earnings and strong operational efficiency as evidenced by interest coverage of 140.1x EBIT and cash flow covering debt at 143%. Despite increased debt levels over five years, Ceragon's short-term assets significantly exceed liabilities, supporting its financial stability in the volatile penny stock market segment.

- Click to explore a detailed breakdown of our findings in Ceragon Networks' financial health report.

- Gain insights into Ceragon Networks' future direction by reviewing our growth report.

Seize The Opportunity

- Discover the full array of 705 US Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNT

Ceragon Networks

Provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives