- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:BELF.A

Bel Fuse (BELF.A): Assessing Valuation After a Strong Multi‑Month Share Price Rally

Reviewed by Simply Wall St

Bel Fuse (BELF.A) has quietly put up a strong run lately, with the stock gaining about 22% over the past month and more than 31% in the past 3 months.

See our latest analysis for Bel Fuse.

Zooming out, the recent rally fits into a much bigger move, with a strong year to date share price return helping push Bel Fuse to around $155.40 as investors warm to its growth trajectory and reassess risk.

If Bel Fuse’s momentum has you rethinking your tech exposure, it might be a good moment to scan other potential winners with high growth tech and AI stocks and see what else stands out.

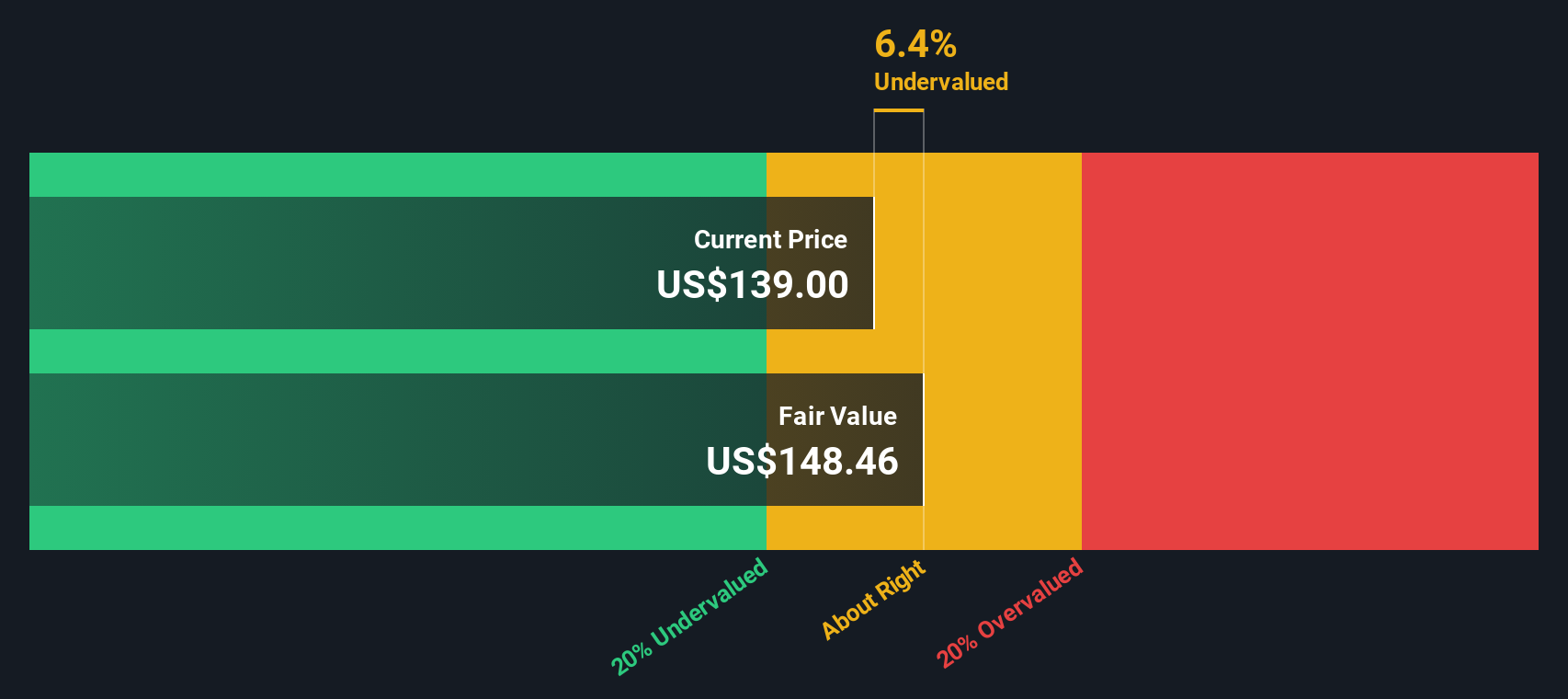

With shares up sharply but trading only slightly above estimated intrinsic value, the real question now is whether Bel Fuse still offers mispriced upside or if the market is already baking in the next leg of growth.

Most Popular Narrative: 41.3% Overvalued

Against the narrative fair value of $110 and a last close of $155.40, the story leans heavily on long term growth and margin expansion.

The recent acquisition of Enercon has diversified Bel Fuse’s end markets, especially in aerospace and defense (A&D), contributing $32.4 million to Power segment sales in Q1 '25. This diversification is poised to support future growth and revenue stability amidst market challenges.

Want to see what powers this confident valuation? It reflects ambitious revenue growth, rising margins, and a future earnings multiple that suggests potential for upgrades. Click in to see how those moving parts add up.

Result: Fair Value of $110 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff pressures and weakening demand in networking and e-mobility could crimp margins and stall the upbeat growth path that analysts are modeling.

Find out about the key risks to this Bel Fuse narrative.

Another Angle on Valuation

Our DCF model paints a milder picture, putting Bel Fuse’s fair value at about $159.81, slightly above the $155.40 share price. That implies the stock is a touch undervalued, not dramatically overhyped. So which story do you trust as the cycle unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bel Fuse for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bel Fuse Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bel Fuse.

Looking for more investment ideas?

Do not stop with Bel Fuse, use the Simply Wall Street Screener to surface fresh, data-backed stock ideas that could quietly reshape your portfolio’s return profile.

- Capture early-stage potential by scanning these 3608 penny stocks with strong financials that already back their stories with solid financial foundations.

- Position for the next wave of innovation through these 25 AI penny stocks that apply artificial intelligence to real, scalable business models.

- Lock in quality at sensible prices with these 907 undervalued stocks based on cash flows that screen for strong cash flow support behind each valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bel Fuse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BELF.A

Bel Fuse

Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026