- United States

- /

- Communications

- /

- NasdaqGS:AUDC

Undiscovered Gems in the US Market to Explore This October 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to rise, setting fresh records despite concerns over a government shutdown and unexpected job losses, investors are increasingly looking toward small-cap stocks for potential opportunities. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and growth potential amidst broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.38% | 4.01% | 3.59% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Bitcoin Depot (BTM)

Simply Wall St Value Rating: ★★★★☆☆

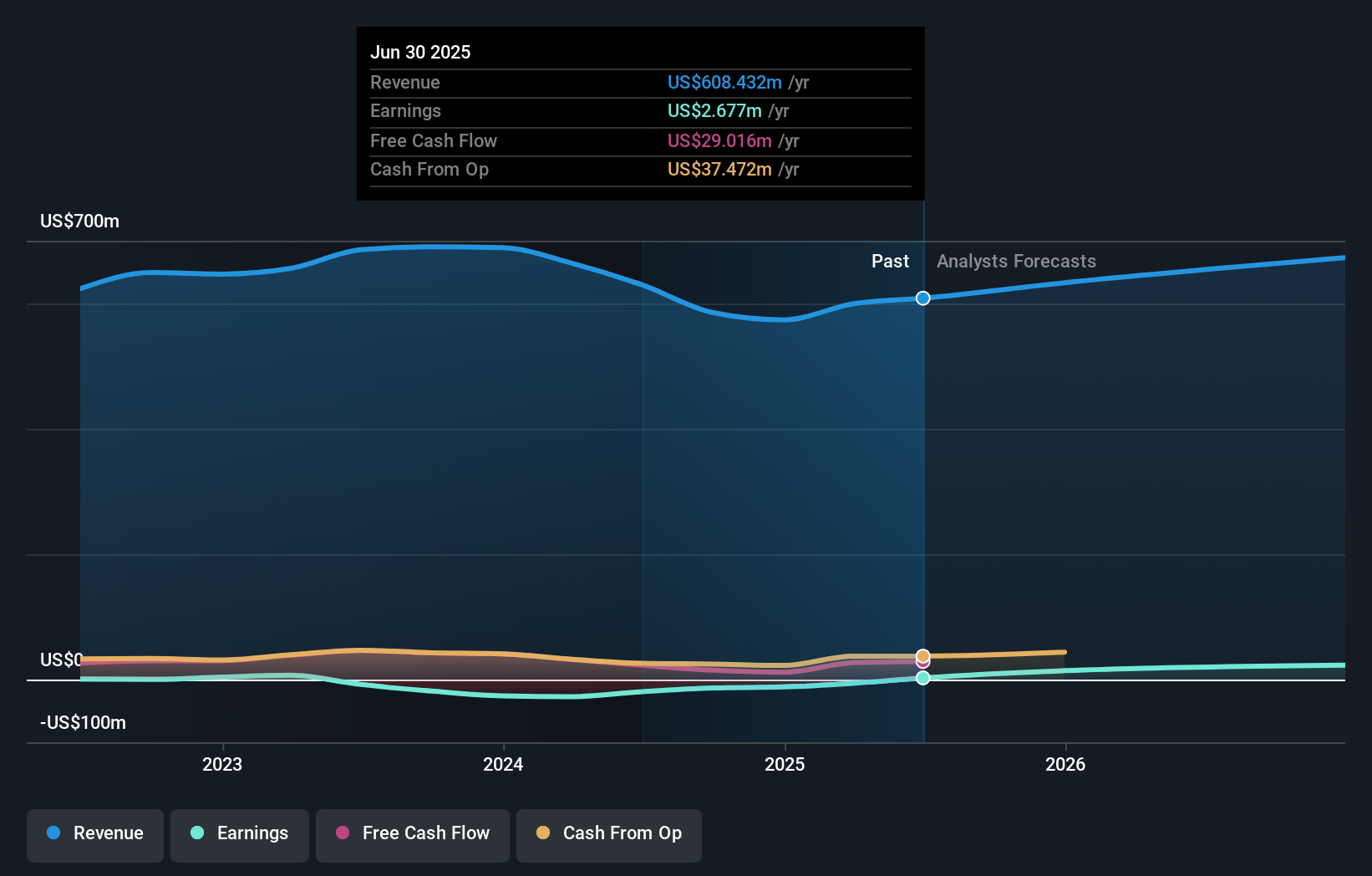

Overview: Bitcoin Depot Inc. operates a network of bitcoin ATMs across North America and has a market cap of $417.43 million.

Operations: The company generates revenue primarily through data processing, amounting to $608.43 million.

Bitcoin Depot, a burgeoning player in the crypto space, has shown notable financial progress lately. The company reported a net income of US$6.07 million for Q2 2025, compared to a net loss of US$2.56 million the previous year, reflecting its turnaround to profitability. With earnings per share climbing from a loss of US$0.13 to US$0.16 over the same period, it’s evident that Bitcoin Depot is on an upward trajectory financially. Despite its high debt level with a net debt-to-equity ratio at 382%, the company remains free cash flow positive and trades at nearly 30% below estimated fair value, suggesting potential investment appeal amidst rapid industry growth and strategic leadership changes like appointing Alex Holmes to its board for enhanced guidance in blockchain innovation and compliance strategies.

- Click here and access our complete health analysis report to understand the dynamics of Bitcoin Depot.

Gain insights into Bitcoin Depot's historical performance by reviewing our past performance report.

AudioCodes (AUDC)

Simply Wall St Value Rating: ★★★★★★

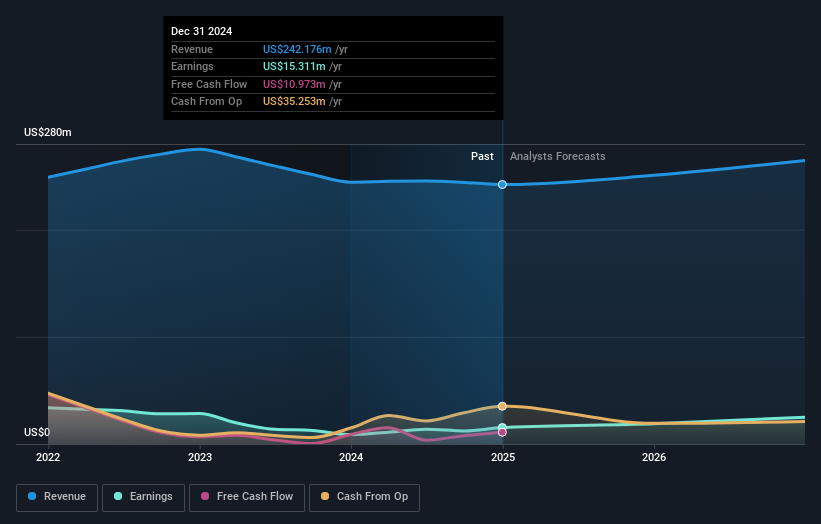

Overview: AudioCodes Ltd. offers advanced communications software, products, and productivity solutions for the digital workplace on a global scale, with a market cap of $276.31 million.

Operations: AudioCodes generates revenue primarily from its Communications Equipment segment, totaling $243.25 million. The company's market cap stands at $276.31 million.

AudioCodes, a nimble player in the communications sector, is making strategic moves to bolster its market presence. The company is debt-free, a significant shift from five years ago when its debt-to-equity ratio was 1.3%. Recent initiatives include the launch of AI Agents for Live Hub Voice CPaaS and participation in Cisco Webex Calling's program, potentially adding $5 million over three years. Despite trading at 87% below estimated fair value and repurchasing 6.33% of shares for $18.1 million this year, challenges loom with earnings forecasted to dip by an average of 87% annually over the next three years.

PCB Bancorp (PCB)

Simply Wall St Value Rating: ★★★★★★

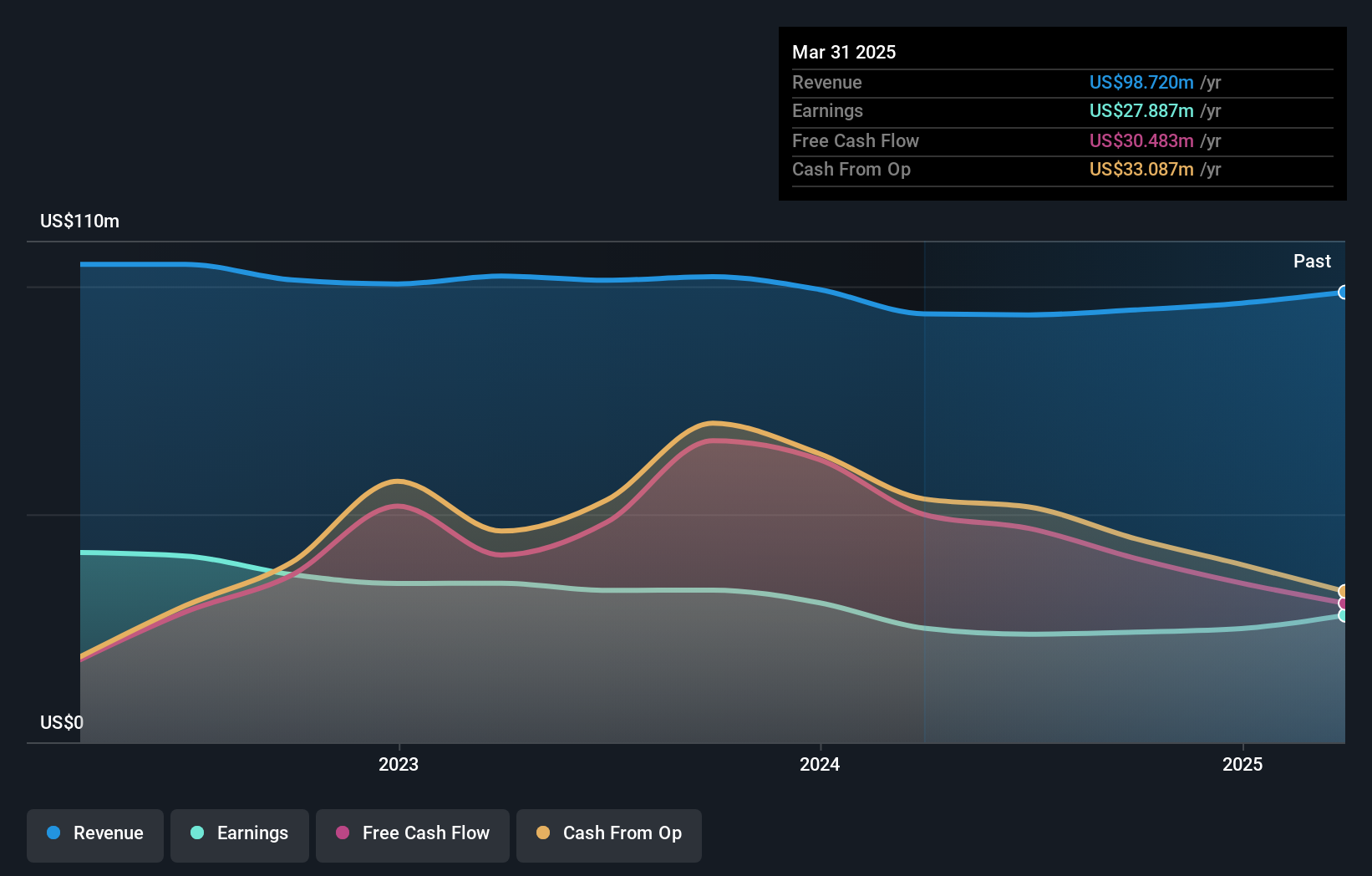

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle market businesses and individuals, with a market cap of $298.09 million.

Operations: PCB Bancorp generates revenue primarily from its banking operations, with reported earnings of $102.26 million. The company's net profit margin is a key indicator of its financial performance, reflecting the efficiency in managing expenses relative to its income.

PCB Bancorp, with total assets of US$3.3 billion and equity of US$376.5 million, showcases a solid financial base. The bank's deposits and loans both stand at US$2.8 billion, reflecting balanced growth in its core operations. Its net interest margin is 3.2%, indicating efficient earnings from lending activities. PCB has a robust allowance for bad loans at 0.3% of total loans, highlighting prudent risk management practices alongside high-quality past earnings performance marked by a 29% rise last year, outpacing the industry average of 13%. The company recently repurchased shares worth US$4.93 million as part of its ongoing buyback plan extension through July 2026, while also affirming quarterly dividends to maintain shareholder value.

- Click to explore a detailed breakdown of our findings in PCB Bancorp's health report.

Gain insights into PCB Bancorp's past trends and performance with our Past report.

Taking Advantage

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 281 more companies for you to explore.Click here to unveil our expertly curated list of 284 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUDC

AudioCodes

Provides advanced communications software, products, and productivity solutions for the digital workplace worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives