- United States

- /

- Healthtech

- /

- NasdaqGM:LFMD

US High Growth Tech Stocks to Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, yet it remains up by 9.1% over the past year with earnings forecasted to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies with strong innovation potential and robust financial health that align well with these positive long-term growth prospects despite short-term fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.62% | 66.56% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

LifeMD (NasdaqGM:LFMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LifeMD, Inc. is a direct-to-patient telehealth company facilitating connections between consumers and healthcare professionals for medical care in the United States, with a market cap of $524.01 million.

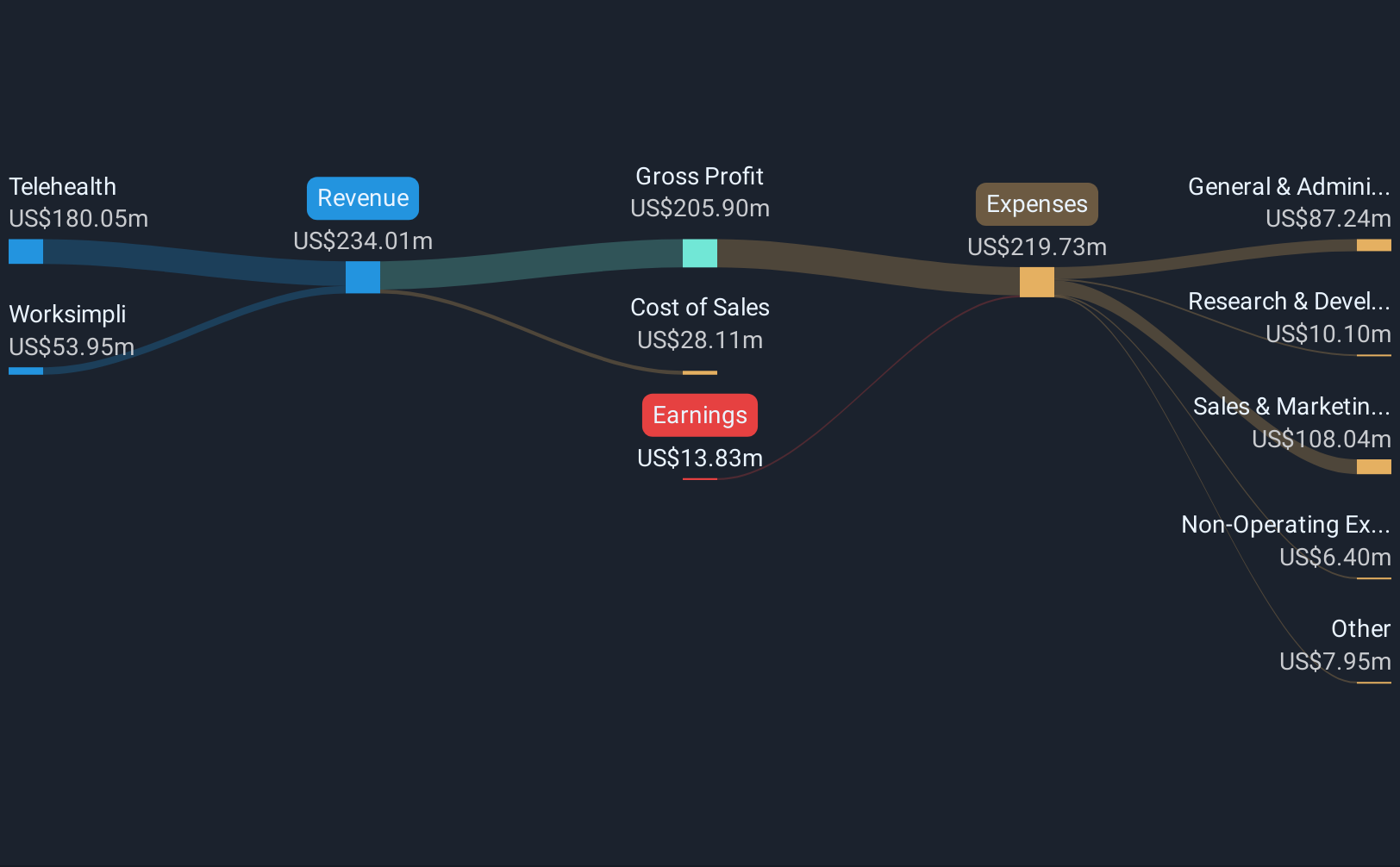

Operations: The company generates revenue primarily from its telehealth services, accounting for $180.05 million, and Worksimpli segment contributing $53.95 million.

LifeMD's strategic maneuvers, including its recent partnership with Novo Nordisk and integration with NovoCare Pharmacy, underscore its commitment to expanding access to weight management treatments. This collaboration not only enhances LifeMD's product offering but also solidifies its position in the telehealth market by providing a comprehensive care model from virtual consultations to prescription fulfillment. Financially, LifeMD has shown significant progress; Q1 2025 revenue surged to $65.7 million from $44.14 million year-over-year, and it flipped a net loss of $6.77 million into a net income of $1.38 million. Looking ahead, the company raised its full-year revenue forecast for 2025 to between $268 million and $275 million, reflecting confidence in continued growth driven by innovations in healthcare delivery and patient engagement strategies.

- Click here to discover the nuances of LifeMD with our detailed analytical health report.

Assess LifeMD's past performance with our detailed historical performance reports.

Exodus Movement (NYSEAM:EXOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exodus Movement, Inc. is a financial technology company focused on the blockchain and digital asset industry in the United States, with a market cap of $1.01 billion.

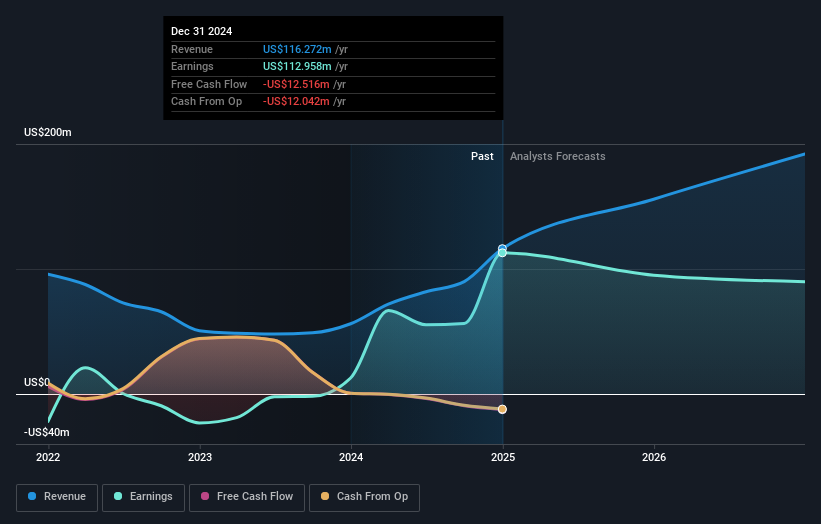

Operations: Exodus Movement generates revenue primarily through data processing, amounting to $123.21 million.

Exodus Movement's recent launch of XO Pay, a self-custody wallet service, marks a significant stride in enhancing user autonomy by eliminating third-party exchanges. This innovation not only streamlines the crypto transaction process but also positions Exodus at the forefront of user-focused financial solutions in the tech space. Financially, despite a challenging quarter with a net loss reported at $12.87 million for Q1 2025, annual revenue growth remains robust at 26.1%. The company's strategic acquisitions and optimistic outlook on future growth underscore its commitment to expanding and diversifying its offerings within the high-growth tech sector.

Calix (NYSE:CALX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Calix, Inc. offers cloud and software platforms, systems, and services globally with a market capitalization of approximately $3.03 billion.

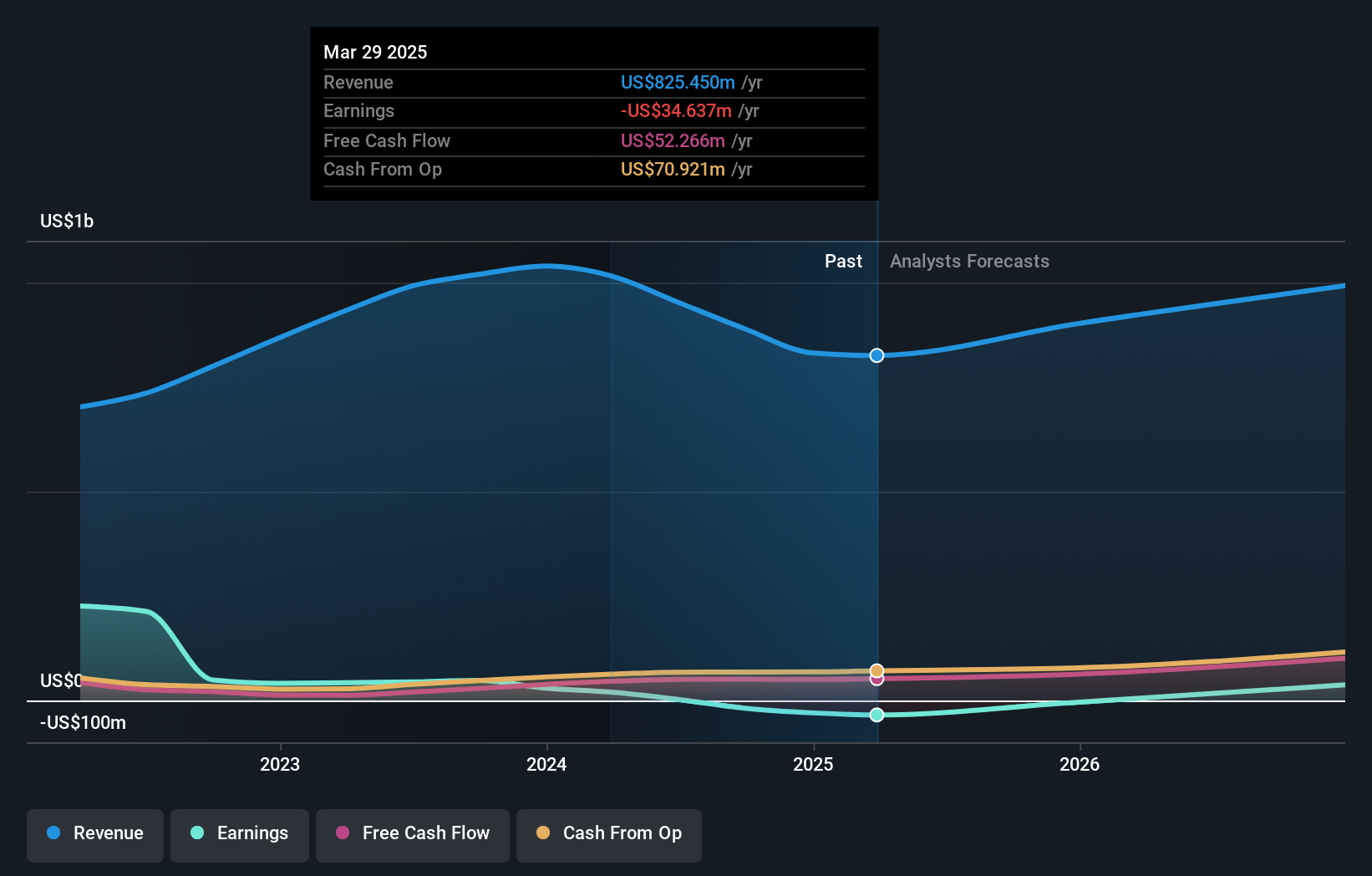

Operations: Calix generates revenue primarily through developing, marketing, and selling communications access systems and software, amounting to $825.45 million.

Calix's recent product launches, including the GigaSpire® 7u6m Wi-Fi 7 extender, underscore its strategic focus on enhancing broadband service capabilities and subscriber experiences. This innovation is part of Calix's broader effort to empower broadband service providers (BSPs) with flexible, advanced managed services through its Unlimited Subscriber™ portfolio. Financially, despite a net loss of $4.79 million in Q1 2025, the company has shown resilience with a robust annual revenue growth rate of 10.5%. Moreover, Calix's commitment to R&D is evident as it continues to invest in new technologies and platforms that support scalable growth and service excellence in highly competitive markets.

- Dive into the specifics of Calix here with our thorough health report.

Review our historical performance report to gain insights into Calix's's past performance.

Summing It All Up

- Embark on your investment journey to our 233 US High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LFMD

LifeMD

Operates as a direct-to-patient telehealth company that connects consumers to healthcare professionals for medical care in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives