- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Insider Favorites High Growth Companies For October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape of record highs for the S&P 500 and Nasdaq amidst a prolonged government shutdown, investors are keenly observing how these conditions impact various sectors. In this environment, companies with strong growth potential and significant insider ownership can offer unique insights into market confidence and strategic direction.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.2% | 29.4% |

| Coastal Financial (CCB) | 13.9% | 45.5% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Let's review some notable picks from our screened stocks.

USA Rare Earth (USAR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: USA Rare Earth, Inc. focuses on mining, processing, and supplying rare earths and other critical minerals in the United States with a market cap of approximately $2.63 billion.

Operations: Revenue segments for USA Rare Earth, Inc. are not provided in the available text.

Insider Ownership: 17%

Revenue Growth Forecast: 63.4% p.a.

USA Rare Earth, Inc. stands out in the growth sector with significant insider ownership and a strategic focus on rare earth magnets. The company recently appointed Barbara Humpton as CEO, enhancing leadership with her extensive industry experience. Despite a volatile share price and negative equity, USAR's revenue is forecast to grow rapidly at 63.4% annually, surpassing market averages. Recent private placements and strategic alliances underscore its commitment to expanding production capabilities for neo magnets by 2026.

- Click here to discover the nuances of USA Rare Earth with our detailed analytical future growth report.

- Our expertly prepared valuation report USA Rare Earth implies its share price may be too high.

Duolingo (DUOL)

Simply Wall St Growth Rating: ★★★★★☆

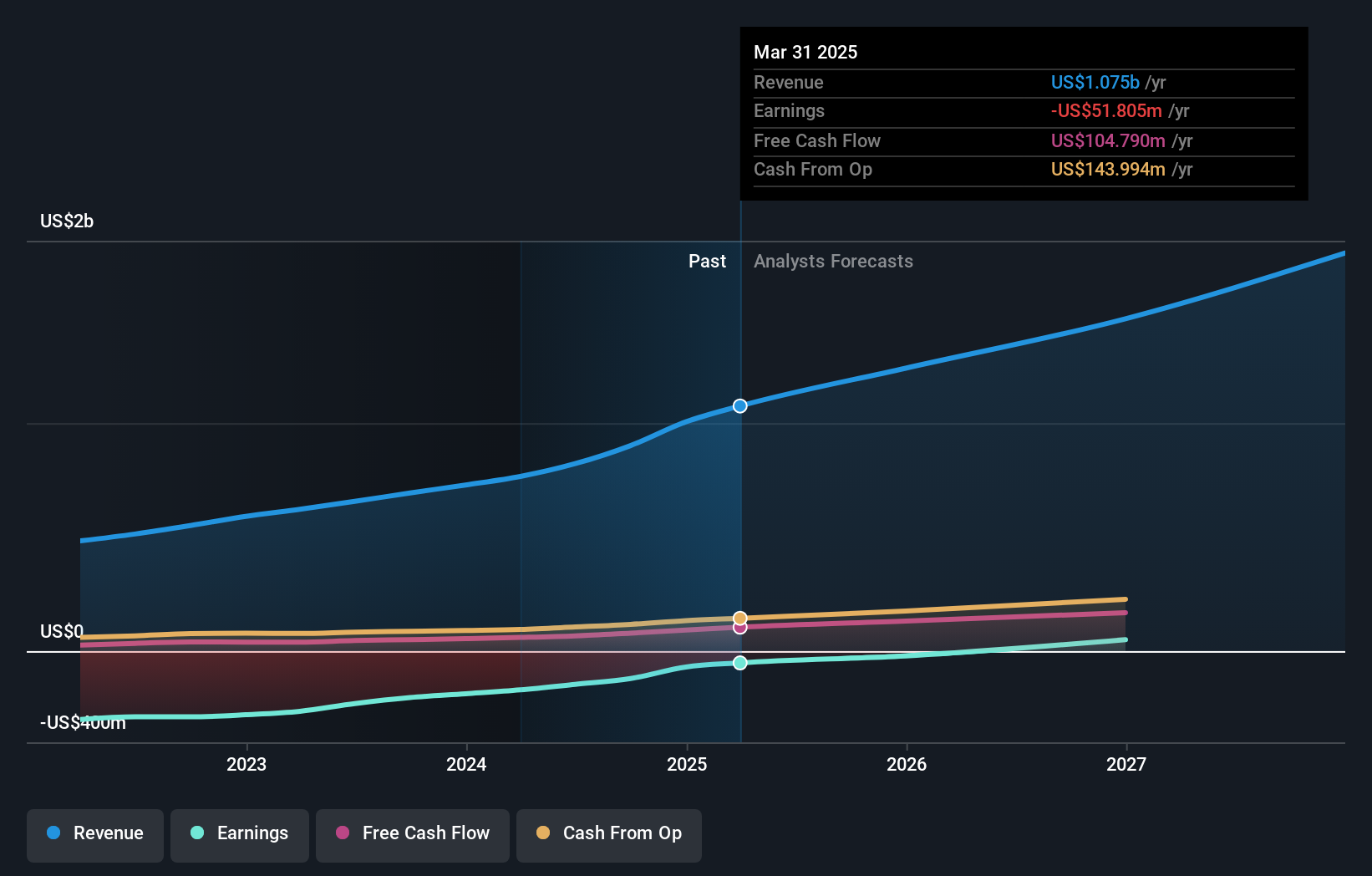

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally, with a market cap of $15.91 billion.

Operations: The company's revenue primarily comes from its educational software segment, which generated $885.15 million.

Insider Ownership: 14.0%

Revenue Growth Forecast: 20.8% p.a.

Duolingo's strong insider ownership aligns with its impressive growth trajectory, as evidenced by a 76.9% increase in earnings over the past year and forecasted annual profit growth of 31.8%. Recent product innovations, such as LinkedIn integration and Duolingo Chess expansion, highlight its evolution into a broader educational platform. Despite trading below estimated fair value and no substantial insider buying recently, Duolingo's revenue is expected to grow significantly faster than the US market average.

- Unlock comprehensive insights into our analysis of Duolingo stock in this growth report.

- According our valuation report, there's an indication that Duolingo's share price might be on the expensive side.

Zeta Global Holdings (ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of $4.71 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated $1.16 billion.

Insider Ownership: 17.6%

Revenue Growth Forecast: 15.2% p.a.

Zeta Global Holdings showcases significant insider ownership, aligning with its robust growth potential. The recent launch of Athena by Zeta™, a superintelligent agent, underscores its commitment to leveraging AI for marketing innovation. Despite high share price volatility, Zeta's revenue is forecasted to grow at 15.2% annually, outpacing the US market average. The company trades at a discount to estimated fair value and aims for profitability within three years, supported by strategic acquisitions like Marigold’s Enterprise Business and an active share buyback program worth US$200 million.

- Take a closer look at Zeta Global Holdings' potential here in our earnings growth report.

- The analysis detailed in our Zeta Global Holdings valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Reveal the 201 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Want To Explore Some Alternatives? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives