- United States

- /

- Software

- /

- NYSE:YOU

Will CLEAR’s (YOU) Global Enrollment Drive Transform Its Competitive Edge in Seamless Travel Security?

Reviewed by Sasha Jovanovic

- CLEAR recently announced the expansion of its CLEAR+ enrollment program to travelers from 40 additional countries across Europe, Asia, and the Americas, enabling more international visitors to access expedited biometric screening at over 60 U.S. airports.

- This development significantly widens CLEAR's international membership pool and comes as the company prepares for major events like the World Cup and America’s 250th anniversary, highlighting its focus on scaling secure and seamless travel experiences.

- We’ll explore how this broadened eligibility for CLEAR+ may influence Clear Secure's long-term positioning and growth projections.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Clear Secure Investment Narrative Recap

To be a Clear Secure shareholder, you need to believe that the company will successfully scale its secure identity and biometric screening platform, broadening both its member base and use cases. The recent expansion of CLEAR+ eligibility to travelers from 40 new countries bolsters Clear Secure’s growth catalyst of increasing its addressable market. However, the move does not materially reduce the company's most important short-term risk: management’s operational execution amid recent leadership transitions, which remains a key factor for revenue and earnings consistency.

Among recent announcements, the nationwide rollout of eGate technology stands out as closely connected to CLEAR’s international expansion. This innovation supports the same catalyst of enhancing operational efficiencies and member experience, building momentum ahead of major global events expected to drive travel volume and platform utilization.

Yet, in contrast, one issue to watch is how volatility in quarterly revenue and earnings, tied to membership renewals and seasonality, could still impact results...

Read the full narrative on Clear Secure (it's free!)

Clear Secure is projected to reach $1.1 billion in revenue and $149.9 million in earnings by 2028. This outlook assumes annual revenue growth of 9.7% and a decrease in earnings of $27 million from current earnings of $176.9 million.

Uncover how Clear Secure's forecasts yield a $35.22 fair value, a 12% upside to its current price.

Exploring Other Perspectives

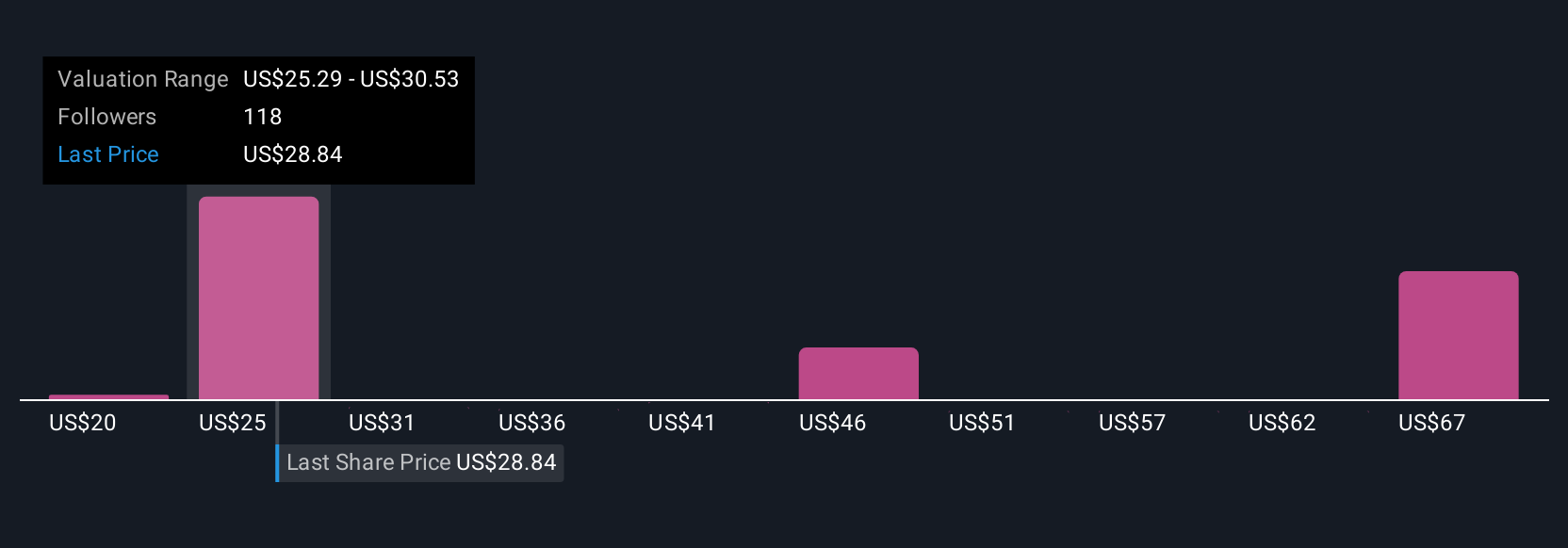

Thirteen private investors in the Simply Wall St Community valued Clear Secure between US$20.05 and US$70.92 per share. Still, many are watching how management’s ability to execute operations and control seasonality may affect future performance, strong differences remain, so consider a variety of views.

Explore 13 other fair value estimates on Clear Secure - why the stock might be worth over 2x more than the current price!

Build Your Own Clear Secure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clear Secure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clear Secure's overall financial health at a glance.

No Opportunity In Clear Secure?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives