- United States

- /

- Software

- /

- NYSE:YOU

Will Clear (YOU) Expanding To More International Travelers Alter Its Path to Membership Growth?

Reviewed by Sasha Jovanovic

- Earlier this month, CLEAR announced it has expanded CLEAR+ enrollment to travelers from 40 additional countries, allowing international visitors to the U.S. to join its secure identity program and utilize expedited security lanes at over 60 airports nationwide.

- This move significantly increases the accessibility of CLEAR+ to millions of global travelers, highlighting the company's commitment to growing its platform and investing in seamless, tech-driven travel experiences.

- We'll examine how CLEAR's broadened reach for international travelers could influence its ongoing investment narrative and prospects for member growth.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Clear Secure Investment Narrative Recap

To be a shareholder in Clear Secure, you need to believe demand for tech-driven, seamless travel experiences will keep growing and position CLEAR as a key facilitator of airport security through ongoing innovation and enrollment expansion. The latest move to open CLEAR+ to travelers from 40 new countries could prove beneficial to short-term member growth, but it doesn’t meaningfully reduce execution risk stemming from recent leadership transitions, the biggest risk facing the company currently.

Among recent company announcements, the rollout of eGate pilots stands out for its relevance; by streamlining security checks even further, eGate supports CLEAR’s vision of expanding its footprint and may act as a near-term catalyst for adoption, particularly as global events increase airport traffic. When combined with CLEAR’s expanded international reach, this makes the ramp-up of airport automation a development to watch for top-line impact.

However, the greatest challenge may come from the uncertainty surrounding operational continuity as new executives settle in, and those seeking to understand why this matters to investors should keep in mind that...

Read the full narrative on Clear Secure (it's free!)

Clear Secure's narrative projects $1.1 billion revenue and $149.9 million earnings by 2028. This requires 9.7% yearly revenue growth and a $27 million earnings decrease from $176.9 million currently.

Uncover how Clear Secure's forecasts yield a $35.22 fair value, a 19% upside to its current price.

Exploring Other Perspectives

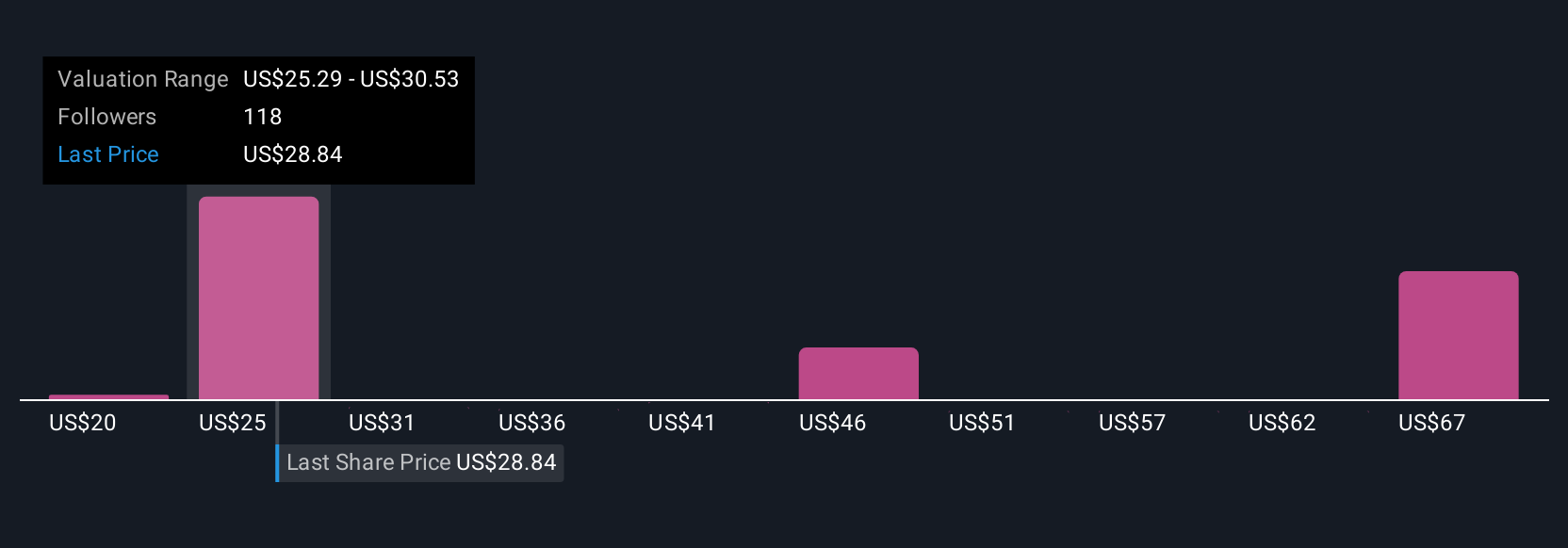

Thirteen fair value estimates from the Simply Wall St Community span from US$20.05 to US$71.35 per share. As you review these in relation to the company’s ongoing leadership transition risk, consider how widely views can diverge and explore several alternative perspectives on Clear Secure’s future.

Explore 13 other fair value estimates on Clear Secure - why the stock might be worth over 2x more than the current price!

Build Your Own Clear Secure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clear Secure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clear Secure's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives