- United States

- /

- Software

- /

- NYSE:YOU

How Investors May Respond To Clear Secure (YOU) Expanding CLEAR1 Into Healthcare and Property Management

Reviewed by Simply Wall St

- In August 2025, Snappt and Tampa General Hospital each announced new integrations of CLEAR Secure’s CLEAR1 identity platform to enhance fraud detection for property managers and automate identity access management in healthcare, respectively.

- The partnerships reflect growing enterprise demand for CLEAR’s digital verification services across sectors, merging high-accuracy fraud detection and high-assurance biometrics to improve operational efficiency and security.

- We'll examine how CLEAR1's expanded adoption in property management and healthcare could influence Clear Secure's investment outlook and future growth assumptions.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

Clear Secure Investment Narrative Recap

Investors considering Clear Secure typically focus on the company’s ability to expand its identity platform across new enterprise markets, with short-term investor sentiment often hinging on the momentum of CLEAR1 deployments and the ability to show real business value from new partnerships. The recent integrations with Snappt and Tampa General Hospital strengthen the narrative around enterprise adoption but are not expected to materially shift the immediate catalysts or address key risks such as execution amid new leadership.

The Tampa General Hospital partnership is particularly relevant, as it illustrates how CLEAR1 can directly improve operational efficiency and security in large, complex organizations. The integration's rapid deployment and measurable benefits, such as automating 80 percent of password recovery requests and speeding resolution times, highlight the platform’s potential to deliver compelling enterprise use cases, which aligns with ongoing catalysts for long-term earnings growth.

Yet, in contrast to these promising new deployments, the potential impact of leadership transitions on execution and financial stability is a factor investors should be aware of...

Read the full narrative on Clear Secure (it's free!)

Clear Secure's outlook forecasts $1.1 billion in revenue and $149.9 million in earnings by 2028. Achieving this would require a 9.7% annual revenue growth rate, but also reflects a $27 million decrease in earnings from current levels of $176.9 million.

Uncover how Clear Secure's forecasts yield a $34.00 fair value, a 5% downside to its current price.

Exploring Other Perspectives

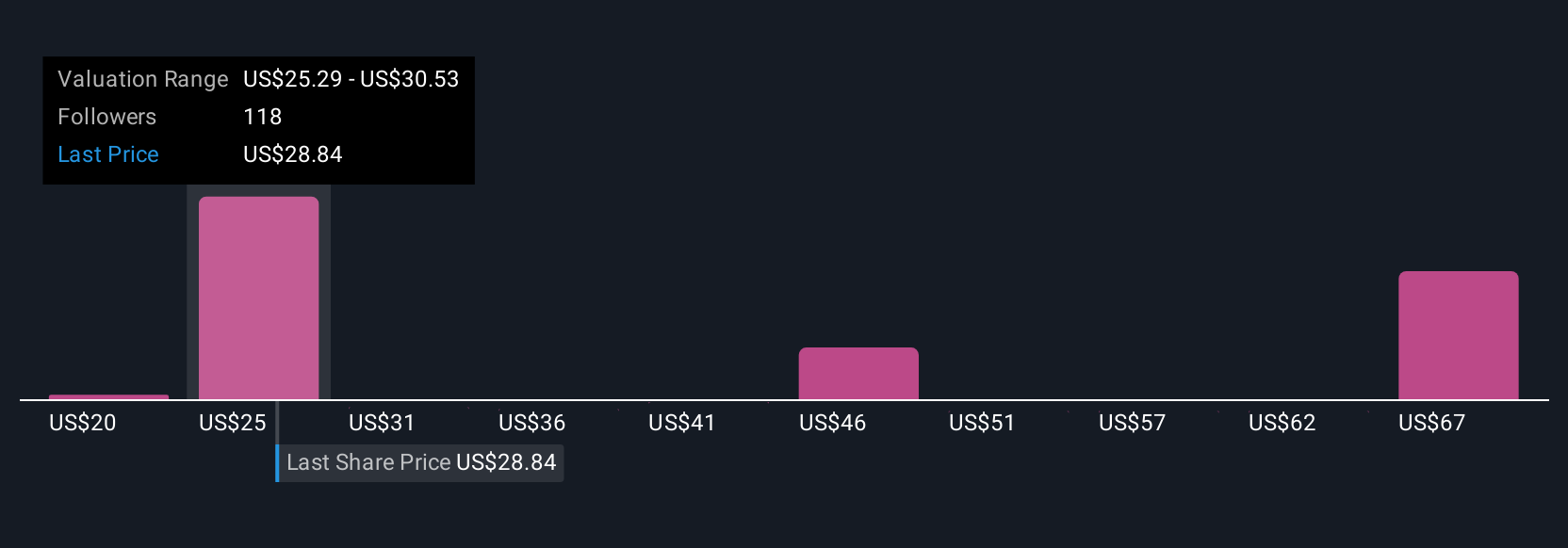

Simply Wall St Community members contributed 13 fair value estimates for Clear Secure, ranging from US$20.05 to US$69.26. While the latest enterprise partnerships support new revenue streams, opinions still diverge as operational stability under new management remains in focus.

Explore 13 other fair value estimates on Clear Secure - why the stock might be worth as much as 93% more than the current price!

Build Your Own Clear Secure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clear Secure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clear Secure's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives