- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (YOU) Expands TSA PreCheck Enrollment With New Location In Aventura Mall

Reviewed by Simply Wall St

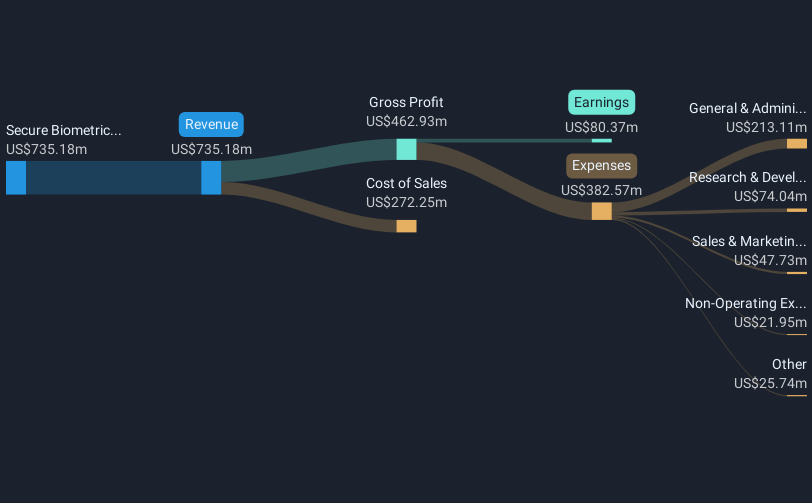

Clear Secure (YOU) recently expanded its footprint beyond airports with a new enrollment site at Aventura Mall in Florida, further bolstering its TSA PreCheck program. This business expansion could have added weight to the company's share price increase of 19.6% over the last quarter. Along with this, Clear Secure's strong financial performance, highlighted by a positive earnings report and a robust share buyback program, likely reinforced investor confidence. The market's growth, with an increase of 1.7% in the last 7 days and 18% over the past year, might also have supported the broader upward trend in the company's stock price.

The recent expansion into retail locations, like Aventura Mall, signifies Clear Secure's aggressive push to diversify its operations beyond the airport-centric model. This move could align with its strategy to increase revenue through broader market penetration and improved member retention from the added convenience. Clear's recent 19.6% share price increase aligns with these efforts, while analysts predict an 8.6% annual revenue growth over the next few years, albeit slower than the broader market expectation of 9%.

Over the past year, Clear Secure delivered a total return of 52.23%, reflecting strong investor sentiment compared to the US Software industry return of 28.6% and the US market return of 17.7%. These figures highlight the company's superior performance within its industry and the broader market. However, with a current share price of US$30.80, Clear trades slightly above the average analyst price target of US$29.25. This suggests that the market might be pricing in more optimistic growth prospects than analysts anticipate.

The company's revenue and earnings forecasts may benefit from its NextGen Identity platform and automation initiatives, driving operational efficiencies and potentially improving feature adoption. However, new leadership and pricing strategies introduce uncertainties that could impact earnings, especially as profit margins are expected to decline from 22% to 14.7% over the next few years. Despite these risks, Clear remains attractive based on its Return on Equity and value multipliers, trading at a PE ratio of 16.2x, well below the US Software industry average of 42.8x and peer average of 57x.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives