- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (NYSE:YOU) Expands With New TSA PreCheck Location In San Francisco

Reviewed by Simply Wall St

Clear Secure (NYSE:YOU) recently launched its first non-airport location at the Salesforce Transit Center in San Francisco, marking a strategic shift into urban settings for TSA PreCheck services. This move, alongside the expansion of TSA PreCheck enrollment facilities at multiple airports and non-airport locations, likely contributed to a rise in convenience and accessibility, enhancing customer engagement and potentially driving the company's stock price up 12% over the past month. Despite broader market declines amid economic concerns and tariff uncertainties, Clear Secure's expansion efforts may have played a significant role in its positive performance.

Buy, Hold or Sell Clear Secure? View our complete analysis and fair value estimate and you decide.

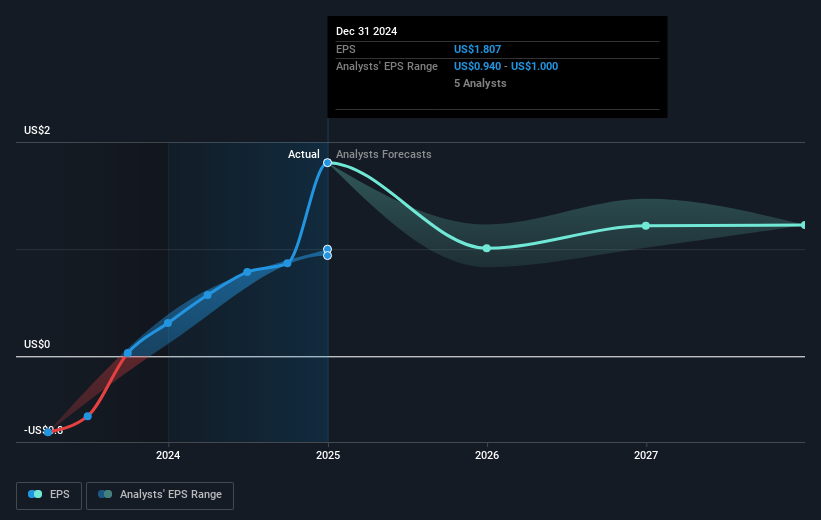

Over the past year, Clear Secure (NYSE:YOU) achieved a total shareholder return of 28.48%, outpacing both the US Software industry, which saw a 3% decline, and the broader US market, which rose by 5.8%. The company's performance can be linked to several key developments. Notably, the launch of numerous TSA PreCheck locations, including non-airport stations such as the Salesforce Transit Center in San Francisco, broadened its market reach significantly. Moreover, the extension of a partnership with American Express, offering cardholders enhanced benefits, likely contributed positively to customer engagement and membership growth.

Additionally, Clear Secure's introduction of the NextGen Identity platform and significant improvements in its biometric solutions promoted efficiency and supported revenue gains. The 2024 earnings report highlighted robust growth in sales to US$770.49 million, accompanied by a substantial increase in net income, signaling strong operational execution. These factors, alongside shareholder-friendly actions like a special cash dividend and expansion of an equity buyback plan, underline the positive sentiment around the company over the past year.

Gain insights into Clear Secure's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives