- United States

- /

- Software

- /

- NYSE:TDC

Can Teradata’s Recent 10% Rally Signal a Turning Point for Investors in 2025?

Reviewed by Bailey Pemberton

If you have been watching Teradata's stock lately, you are probably wondering whether now’s the right time to make a move. After all, despite some choppy long-term performance, Teradata is fresh off a 3.8% gain in the past week and nearly 10% over the last month. Investors are beginning to take notice of shifting sentiment, driven by broader optimism across tech and analytics companies, especially as businesses double down on data-driven strategies. Yet, the sting of a nearly 25% drop year-to-date still lingers for those who have held the stock, with a similar pattern over the past year. Over the long haul, Teradata’s five-year return stands at a modest 4.8%, suggesting there have been a few bumps in the road but also resilience when the market pivots in its favor.

So what makes Teradata such an interesting case right now? It’s all about value. Using our standard checklist, Teradata passes 5 out of 6 valuation checks, earning a solid value score of 5. That is not something you see every day for a company blending established offerings with new innovation. Of course, the trick is figuring out exactly what those value signals mean for your investment decisions.

In the sections ahead, we will break down each valuation approach and see how Teradata stacks up against the competition. But there’s another perspective that can help investors see the story even more clearly, so stick around as we uncover a smarter way to think about valuation at the end of this article.

Why Teradata is lagging behind its peers

Approach 1: Teradata Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This method is especially useful for businesses like Teradata, as it focuses on the company’s ability to generate cash into the future, adjusted for risk and time.

For Teradata, the latest reported Free Cash Flow (FCF) is $264 million. While analysts have provided estimates up to five years ahead, projections for the next decade are extrapolated using a reasonable growth rate close to 3% each year. By 2035, Teradata's FCF is expected to reach approximately $368 million, showing steady if not spectacular growth.

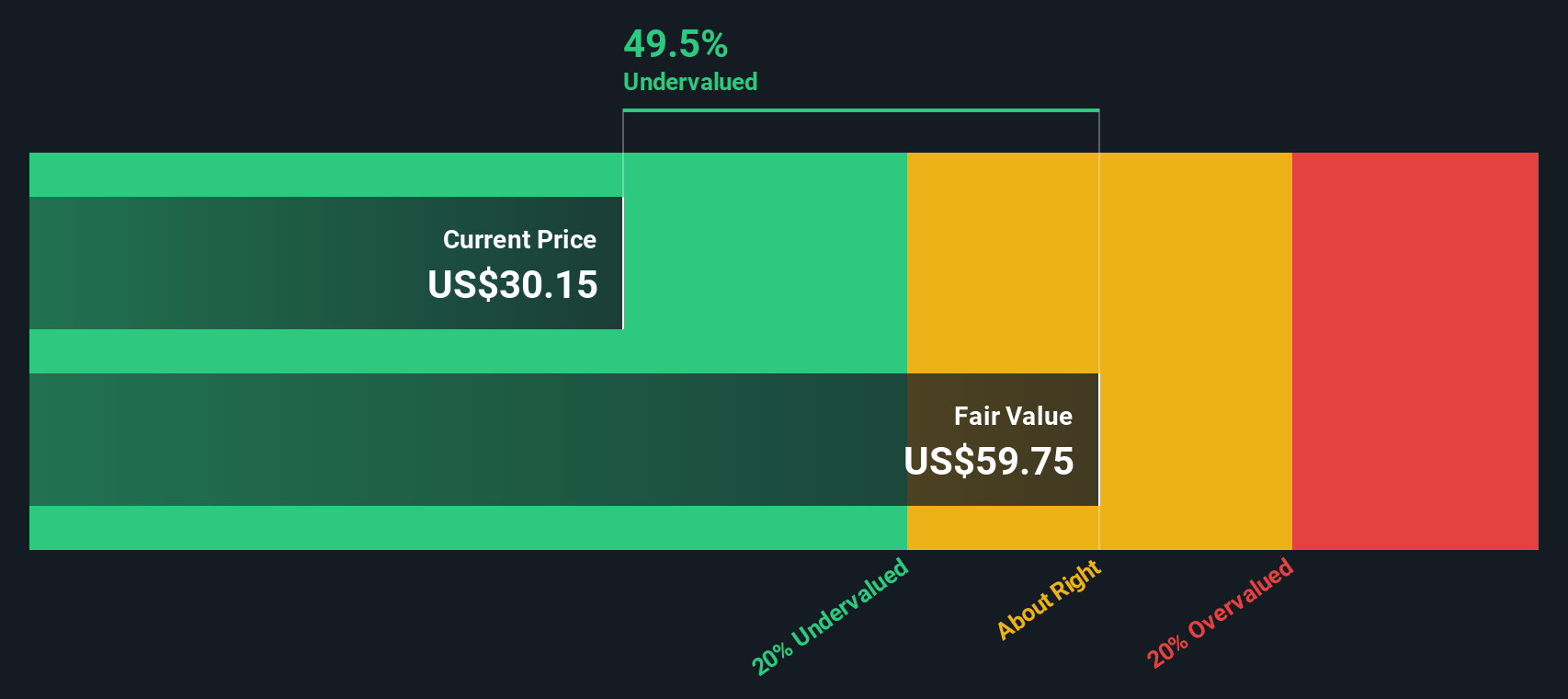

On this basis, Teradata’s fair value per share works out to $47.89. When compared to the current share price, this implies a substantial 51.9% intrinsic discount. According to the DCF approach, this suggests Teradata is significantly undervalued by the market at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Teradata is undervalued by 51.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Teradata Price vs Earnings

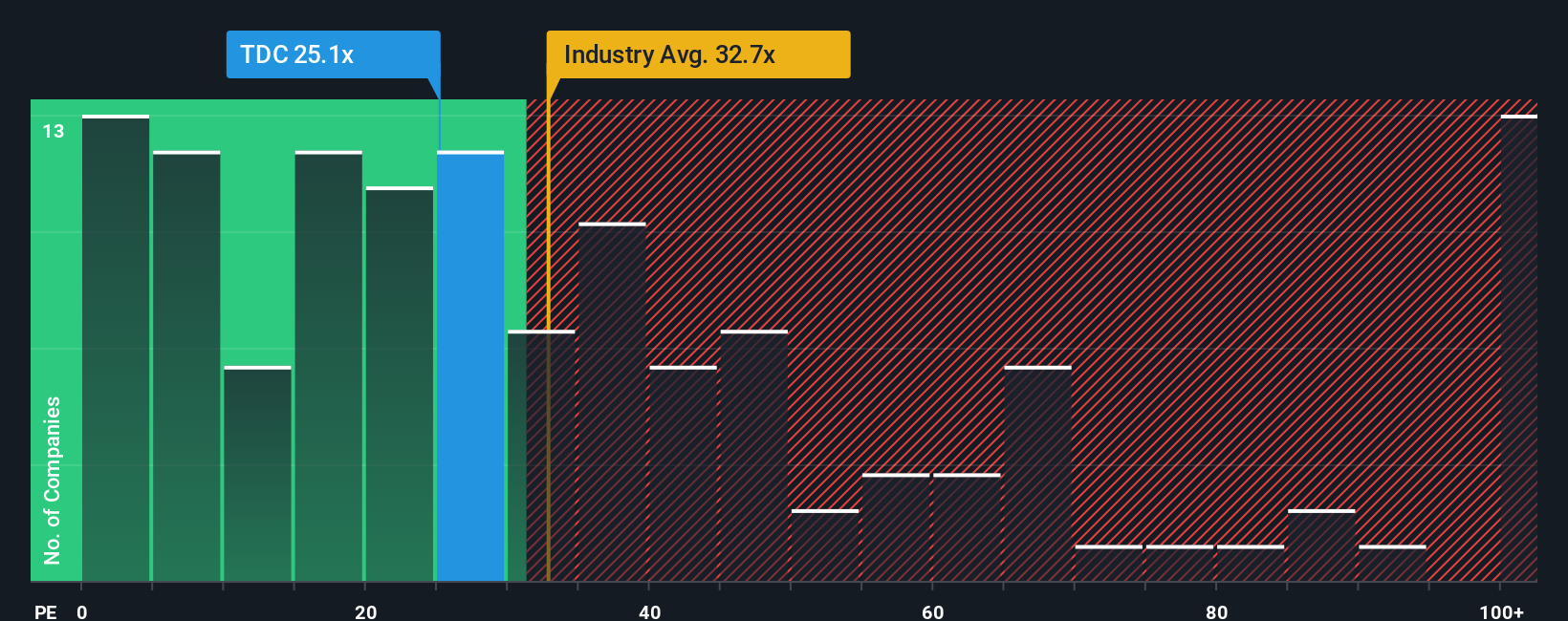

For profitable tech companies like Teradata, the Price-to-Earnings (PE) ratio is often the most relevant valuation yardstick. The PE ratio allows us to see how much investors are willing to pay today for each dollar of current earnings, making it useful for comparing companies within the same sector that are generating steady profits.

A company’s fair or “normal” PE ratio depends on factors such as its future growth prospects, risk profile, and the strength of its earnings. Higher growth expectations typically justify a higher PE, while greater uncertainty or cyclical earnings might result in a lower, more cautious multiple.

Teradata currently trades at a PE of 19.8x, notably lower than the software industry average of 36.1x and the average of its closest peers at 43.6x. However, comparing to broader benchmarks can be misleading, since every company faces different opportunities and challenges.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric adjusts for Teradata’s specific circumstances, including its expected earnings growth, profit margins, industry group, and market capitalization, providing a more tailored view of value. For Teradata, the Fair Ratio is calculated at 21.4x. This is only modestly above the current PE, suggesting the price is almost aligned with what would be considered reasonable for the company when all key factors are considered.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Teradata Narrative

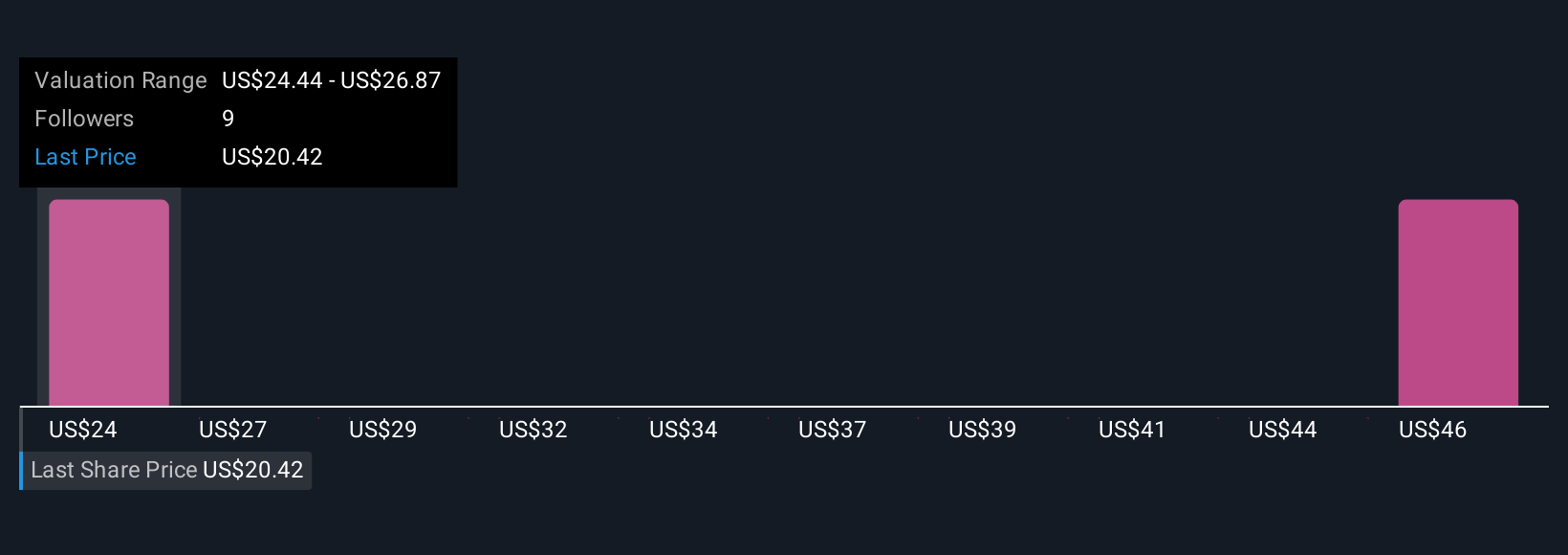

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story behind the numbers, your perspective on a company’s future, including what you think it will earn, its growth potential, and what is changing in its industry.

With Narratives, you directly connect a company’s business story to your forecast for things like future revenue, margins, or fair value. You can quickly see how your outlook translates into an investment case. This approach is easy and available right now on Simply Wall St’s Community page, where millions of investors actively share and compare Narratives in real time.

Using a Narrative helps you decide when to buy or sell, particularly by checking if your personal Fair Value is higher or lower than today’s price. Because Narratives update automatically with new news or earnings, your view stays relevant as the facts change.

For example, some Teradata Narratives expect robust AI-driven demand and margin expansion, supporting a fair value as high as $28 per share. Others are more conservative, predicting ongoing revenue headwinds and a fair value closer to $22. This serves as a powerful reminder that every investor’s story and strategy can be unique.

Do you think there's more to the story for Teradata? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teradata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDC

Teradata

Provides a connected hybrid cloud analytics and data platform in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)