- United States

- /

- Software

- /

- NasdaqGS:INTA

Exploring High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.1%, though it has risen by 21% over the past year with earnings forecast to grow by 15% annually. In light of these conditions, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability in an evolving market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.58% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Travere Therapeutics | 29.58% | 61.86% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Intapp (NasdaqGS:INTA)

Simply Wall St Growth Rating: ★★★★☆☆

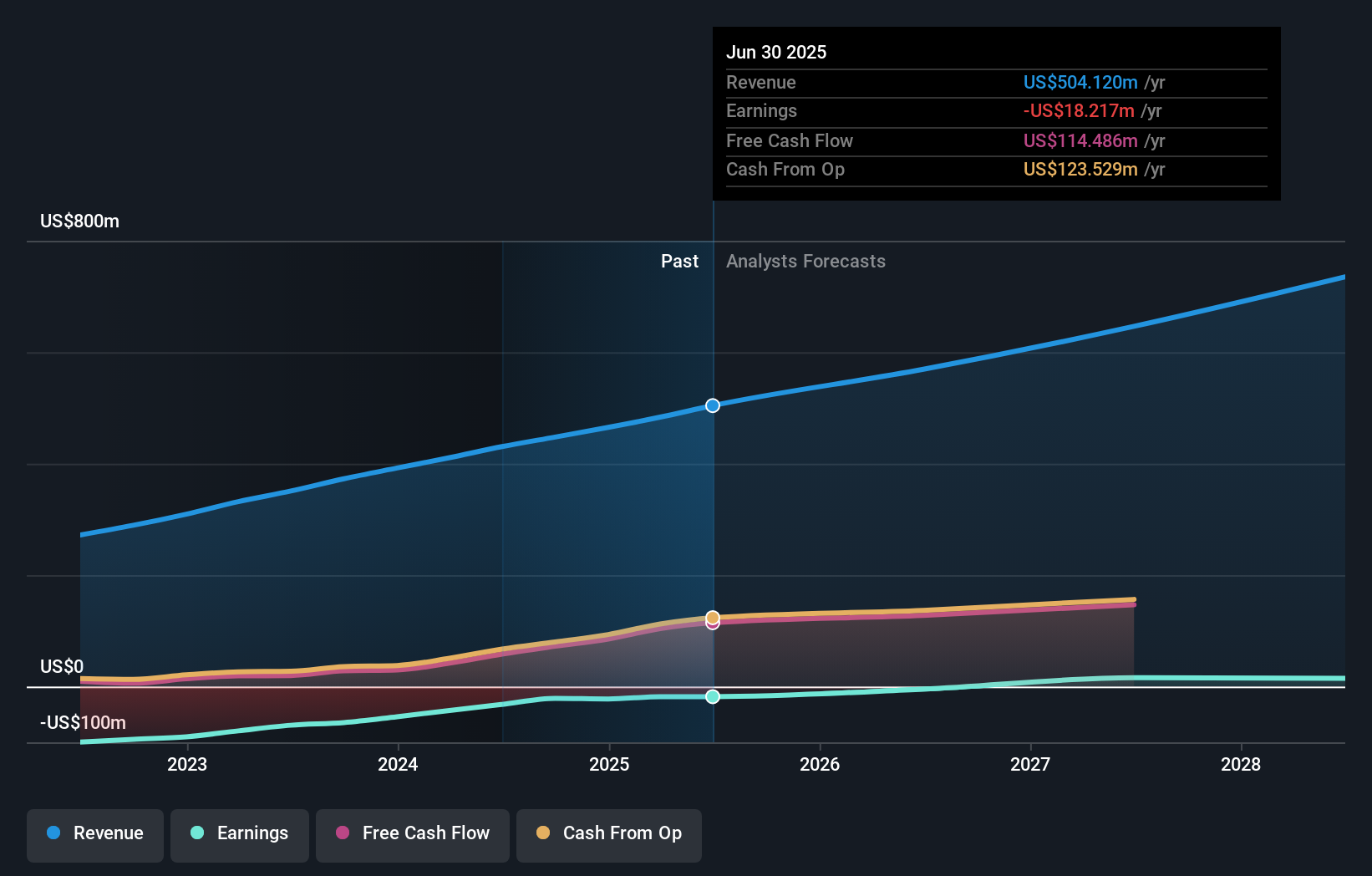

Overview: Intapp, Inc., through its subsidiary Integration Appliance, Inc., offers AI-powered solutions across the United States, the United Kingdom, and internationally with a market capitalization of approximately $5.19 billion.

Operations: Intapp generates revenue of approximately $447.75 million from its Software & Programming segment, focusing on AI-powered solutions.

Intapp, despite its current unprofitability, is navigating a transformative path in the tech industry with strategic client partnerships and significant investments in R&D. Recently, U.K. accounting firm Milsted Langdon adopted Intapp's collaboration solutions to enhance their Microsoft 365 platform, underscoring Intapp's commitment to evolving enterprise software solutions that streamline workflows and improve compliance. This move aligns with broader industry trends towards cloud-based service models and could bolster Intapp's market position as it projects revenue growth of 13.8% annually—outpacing the US market average of 9%. Moreover, the company anticipates a robust annual earnings growth rate of 79.08%, signaling potential profitability within three years. These developments suggest a strategic positioning that may enable Intapp to leverage emerging opportunities within the tech sector effectively.

- Click here to discover the nuances of Intapp with our detailed analytical health report.

Assess Intapp's past performance with our detailed historical performance reports.

Smartsheet (NYSE:SMAR)

Simply Wall St Growth Rating: ★★★★★☆

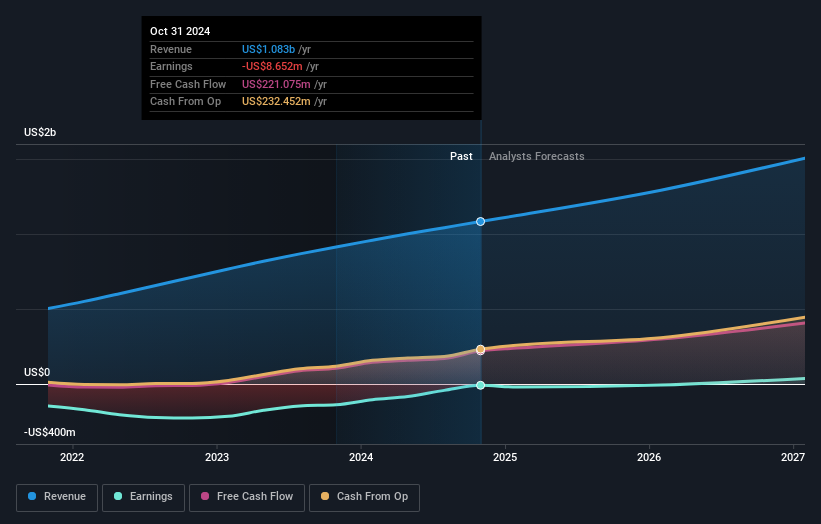

Overview: Smartsheet Inc. offers an enterprise platform designed to help teams and organizations plan, capture, manage, automate, and report on work with a market capitalization of approximately $7.89 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling approximately $1.08 billion. The platform facilitates work management and automation for teams and organizations, contributing to its financial performance.

Smartsheet's recent pivot towards profitability is underscored by a robust revenue jump to $286.87 million in Q3 2024, up from $245.92 million the previous year, complemented by a swing to net income of $1.32 million from a loss of $32.43 million. This performance aligns with an industry trend towards enhanced software solutions that cater to dynamic business needs. The company's strategic R&D investment is pivotal, fostering innovation and supporting its projected annual revenue growth of 14%. Moreover, Smartsheet's decision to repurchase shares worth $50.01 million reflects confidence in its financial health and future prospects, even as it navigates challenges like the proposed $8.4 billion acquisition which has stirred shareholder activism due to concerns over valuation fairness.

- Click here and access our complete health analysis report to understand the dynamics of Smartsheet.

Evaluate Smartsheet's historical performance by accessing our past performance report.

Shutterstock (NYSE:SSTK)

Simply Wall St Growth Rating: ★★★★☆☆

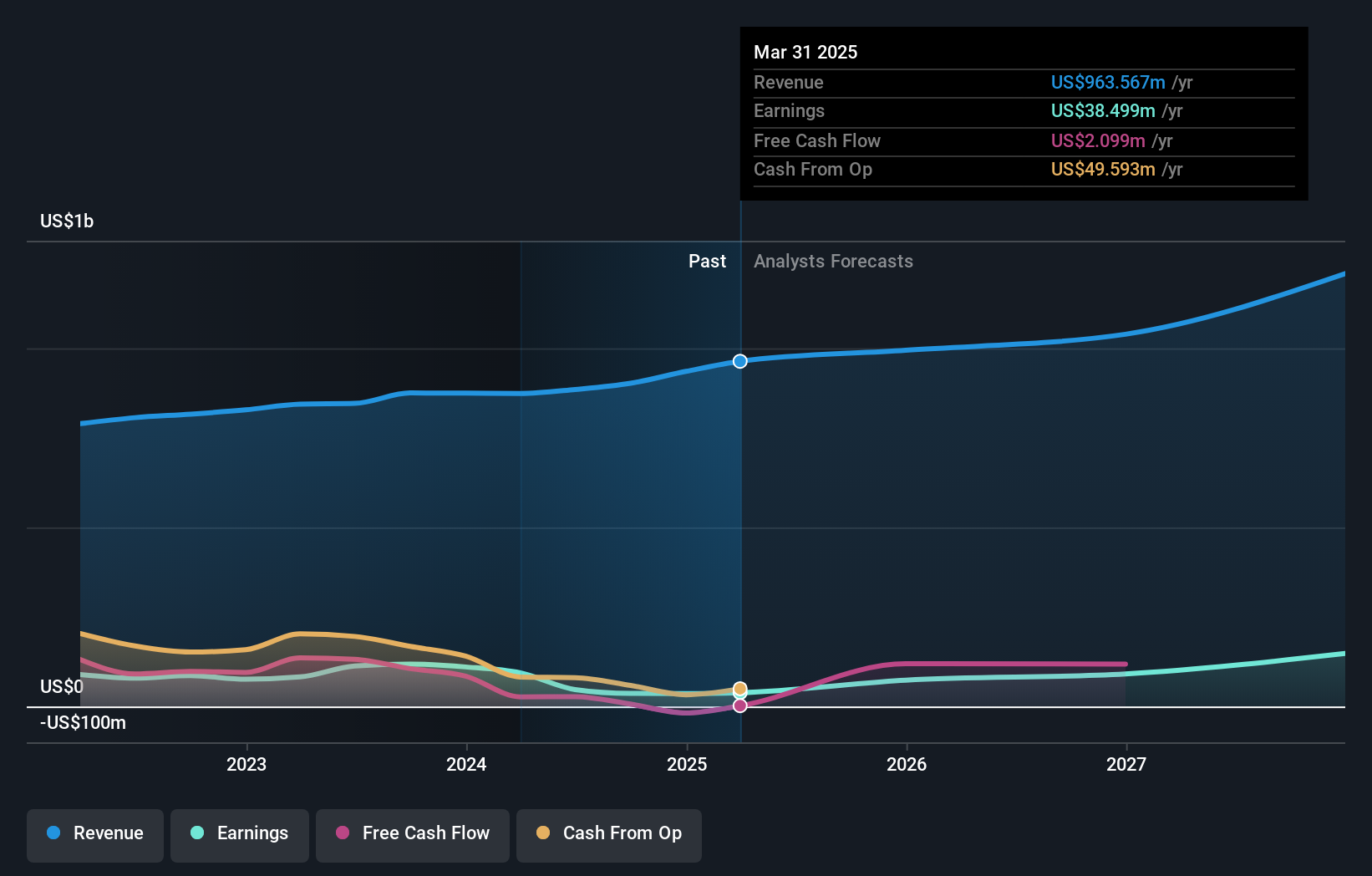

Overview: Shutterstock, Inc. operates a platform that connects brands and businesses with high-quality content globally, with a market capitalization of $1.07 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, which brought in $902.18 million. The platform serves markets in North America, Europe, and internationally.

Shutterstock's recent performance and strategic decisions underscore its adaptability in the high-growth tech landscape, marked by a notable annual revenue increase of 9.4% and an impressive earnings growth forecast of 48.1% per year. The company's commitment to innovation is evident from its R&D investments, aligning with industry shifts towards digital content and AI integration. Additionally, the upcoming merger with Getty Images, valued at $1.2 billion, could further enhance its market position by combining resources and expanding customer base, despite a recent dip in net profit margins to 4%. This strategic move is expected to realize significant cost synergies between $150 million and $200 million by the third year post-merger, potentially accelerating future growth trajectories in an increasingly competitive sector.

Where To Now?

- Click through to start exploring the rest of the 232 US High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.