- United States

- /

- Professional Services

- /

- NasdaqGM:IBEX

IBEX And 2 Other Undiscovered Gems With Solid Fundamentals

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.1% decline, yet it has shown a robust 21% increase over the past year with earnings projected to grow by 15% annually. In this dynamic environment, identifying stocks with solid fundamentals can offer investors opportunities for growth and stability; IBEX and two other lesser-known companies exemplify these qualities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

IBEX (NasdaqGM:IBEX)

Simply Wall St Value Rating: ★★★★★★

Overview: IBEX Limited offers comprehensive technology-enabled customer lifecycle experience solutions globally, with a market cap of $283.32 million.

Operations: The company generates revenue primarily from its Business Process Outsource segment, amounting to $513.68 million.

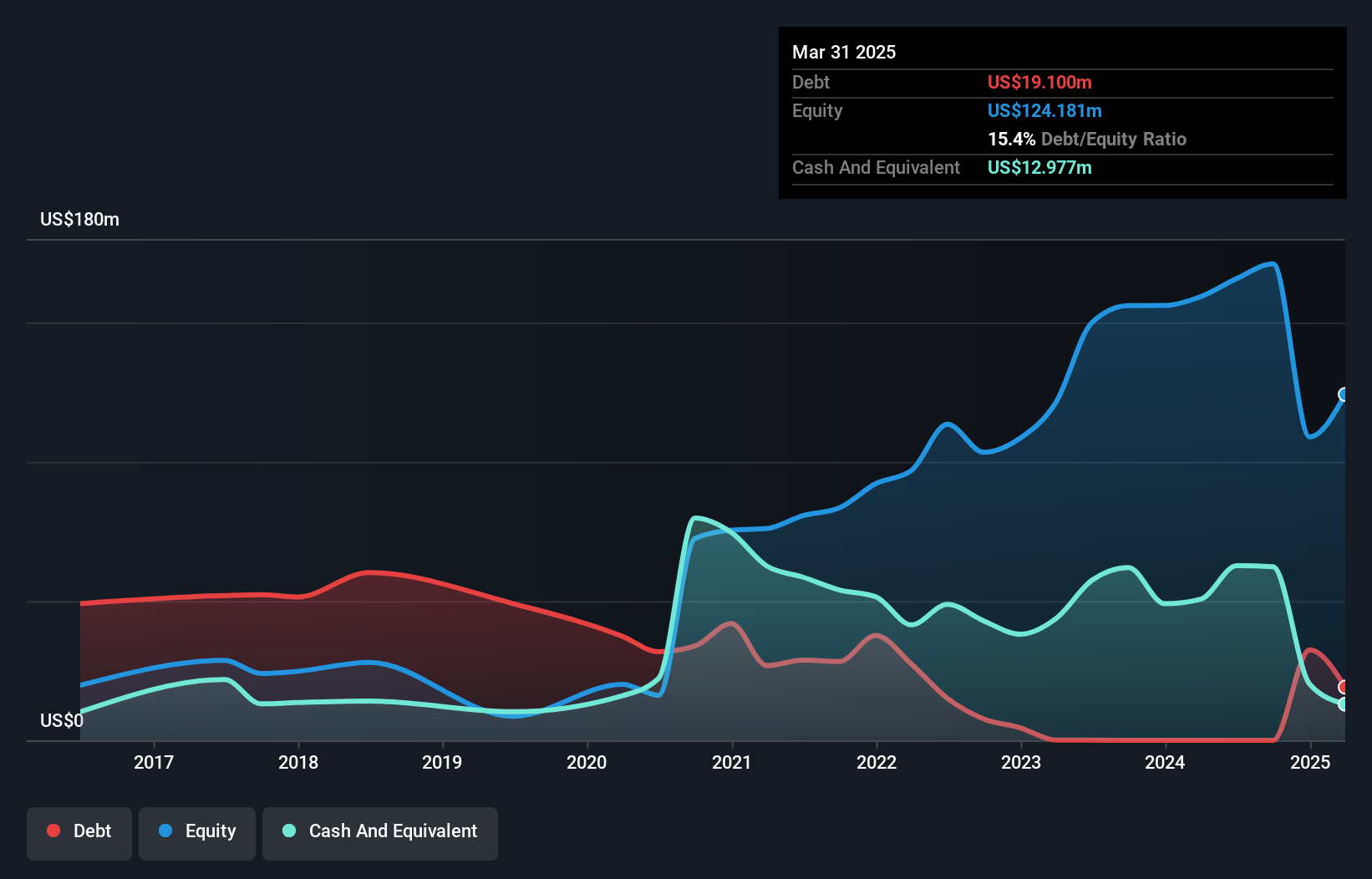

IBEX, a dynamic player in the professional services sector, has demonstrated robust financial health with no debt, contrasting its past debt to equity ratio of 361.6% five years ago. Over the last five years, earnings have surged by 41%, showcasing high-quality past earnings despite recent insider selling activity. The company is trading at nearly 20% below its fair value estimate and has been actively repurchasing shares; recently buying back 282,129 shares for US$4.67 million between July and September 2024. With a forecasted annual earnings growth of over 10%, IBEX seems poised for continued progress amidst leadership changes and innovative AI product launches like the Wave iX AI Virtual Agent.

Logility Supply Chain Solutions (NasdaqGS:LGTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Logility Supply Chain Solutions, Inc. develops, markets, and supports computer business application software products globally and has a market capitalization of approximately $357.01 million.

Operations: Logility generates revenue primarily from its Supply Chain Management segment, which includes ERP, amounting to $100.48 million. The company's market capitalization is approximately $357.01 million.

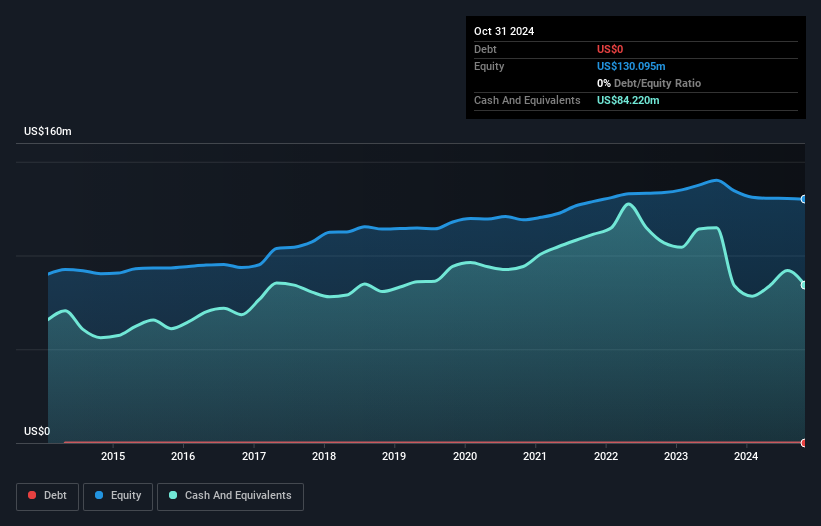

Logility, a US$400 million company in the supply chain software space, has seen its earnings grow 7.5% annually over five years while remaining debt-free. The price-to-earnings ratio of 34.8x is competitive within the industry, although recent results were impacted by a US$3.9 million one-off gain. Despite underperforming peers with a 9.9% growth last year compared to the industry's 30.2%, Logility's strategic initiatives include new AI capabilities for supply chain optimization set for release in Spring 2025 and ongoing discussions around potential sale options following investor activism and M&A rumors.

Yalla Group (NYSE:YALA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalla Group Limited operates a social networking and gaming platform primarily in the Middle East and North Africa region, with a market capitalization of approximately $618 million.

Operations: Yalla Group generates revenue from its social networking and entertainment platform, amounting to $329.77 million. The company's financial performance is reflected in its net profit margin, which stands at 20%.

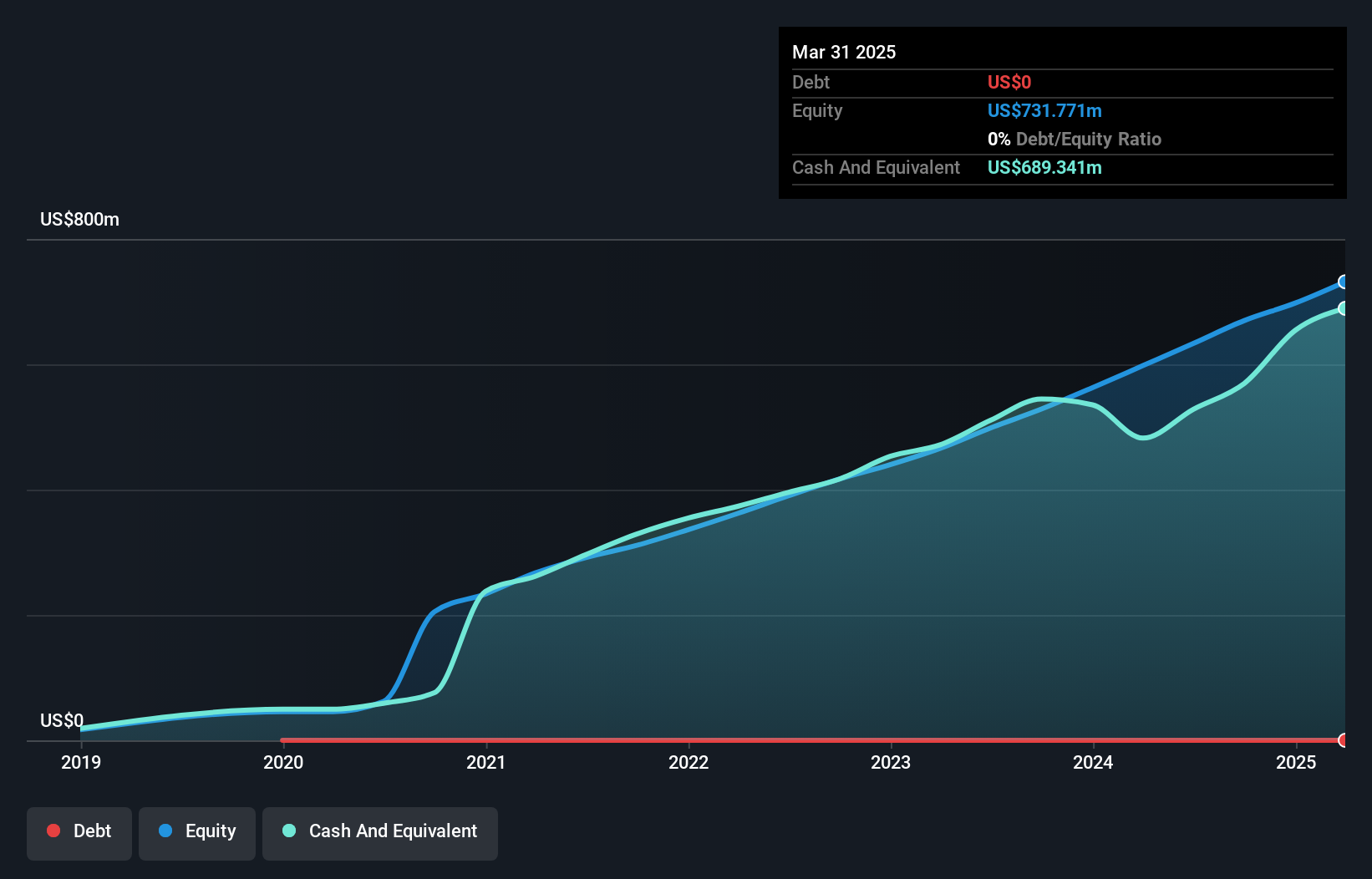

Yalla Group, a nimble player in the interactive media space, has outpaced its industry with a 32% earnings growth over the past year. The firm is debt-free, enhancing its financial flexibility and reported net income of US$39.85 million for Q3 2024, up from US$36.23 million the previous year. Despite shareholder dilution and rising costs due to new UAE tax laws, Yalla's strategic move into MENA gaming markets shows promise for revenue enhancement. Trading at US$4.04 per share and repurchasing shares worth US$42.51 million suggests potential value upside against an analyst target of US$6.1 per share.

Seize The Opportunity

- Click through to start exploring the rest of the 248 US Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade IBEX, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IBEX

IBEX

Provides end-to-end technology-enabled customer lifecycle experience solutions in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives