- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

3 US Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market grapples with heightened volatility, driven by surging Treasury yields and a robust labor market, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In such an environment, identifying stocks that are undervalued can provide a strategic advantage, offering potential for growth despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $26.72 | $53.44 | 50% |

| CareTrust REIT (NYSE:CTRE) | $26.08 | $51.10 | 49% |

| Richardson Electronics (NasdaqGS:RELL) | $13.02 | $25.75 | 49.4% |

| Cadence Bank (NYSE:CADE) | $33.51 | $65.12 | 48.5% |

| Afya (NasdaqGS:AFYA) | $14.95 | $29.44 | 49.2% |

| Palomar Holdings (NasdaqGS:PLMR) | $101.51 | $194.71 | 47.9% |

| Constellium (NYSE:CSTM) | $10.35 | $20.64 | 49.8% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $38.37 | $75.19 | 49% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.63 | $30.72 | 49.1% |

| Annaly Capital Management (NYSE:NLY) | $18.14 | $35.15 | 48.4% |

Let's uncover some gems from our specialized screener.

AeroVironment (NasdaqGS:AVAV)

Overview: AeroVironment, Inc. specializes in designing, developing, and supporting robotic systems and related services for government agencies and businesses globally, with a market cap of approximately $4.62 billion.

Operations: The company's revenue segments consist of Maccready Works at $77.97 million, UnCrewed Systems at $422.42 million, and Loitering Munitions Systems at $261.11 million.

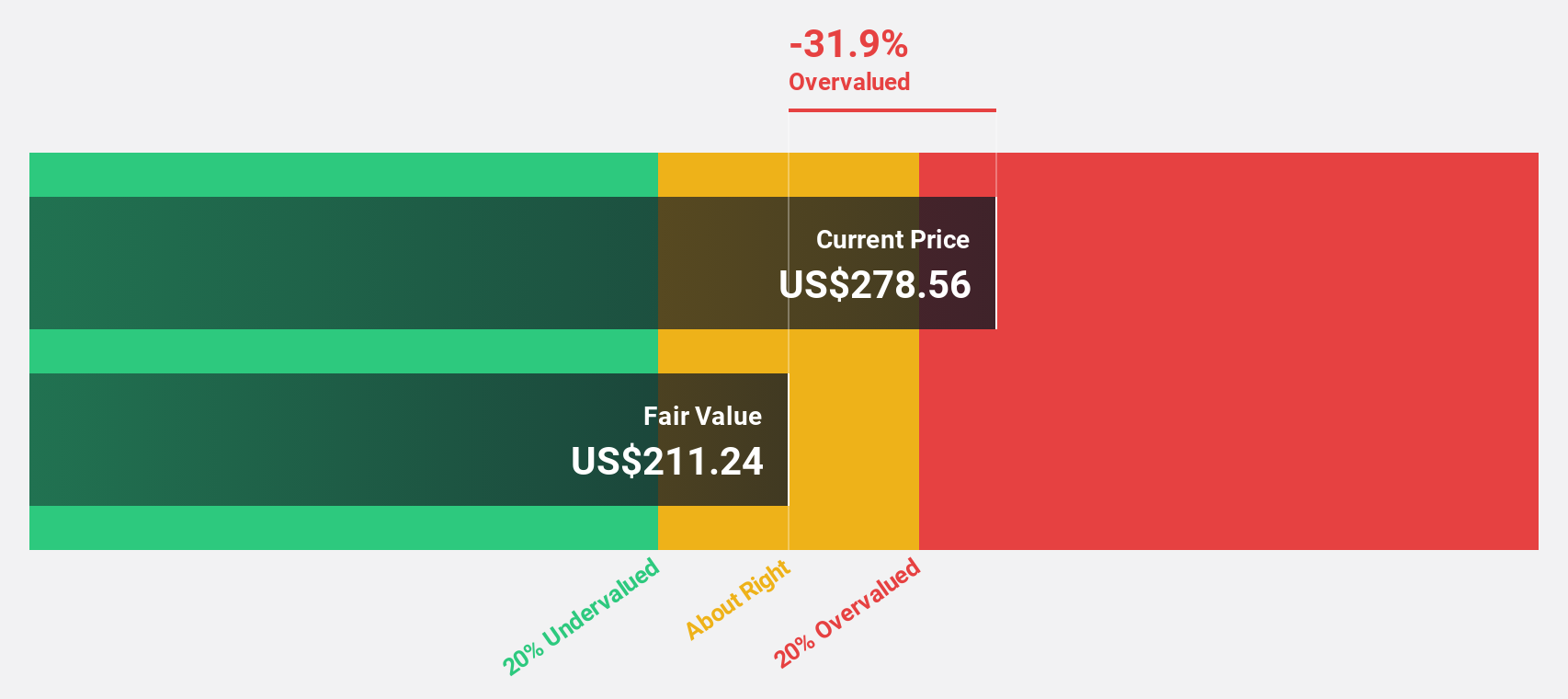

Estimated Discount To Fair Value: 41.3%

AeroVironment is trading at US$165.03, significantly below its estimated fair value of US$281.12, indicating potential undervaluation based on cash flows. Recent developments include a reaffirmed US$990 million contract for its Switchblade systems and innovative software upgrades enhancing the capabilities of its Puma UAS. Despite a decrease in net income to US$7.54 million for Q2 2024, earnings are forecast to grow substantially over the next three years, outpacing market averages.

- In light of our recent growth report, it seems possible that AeroVironment's financial performance will exceed current levels.

- Get an in-depth perspective on AeroVironment's balance sheet by reading our health report here.

Intapp (NasdaqGS:INTA)

Overview: Intapp, Inc., through its subsidiary Integration Appliance, Inc., offers AI-powered solutions across the United States, the United Kingdom, and internationally with a market cap of approximately $5.19 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $447.75 million.

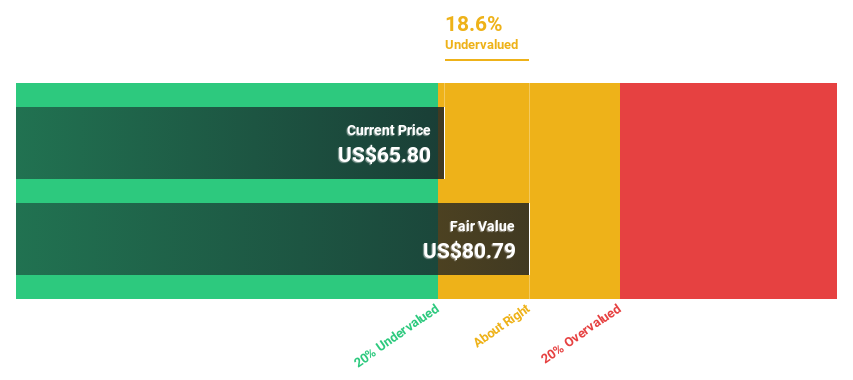

Estimated Discount To Fair Value: 17.5%

Intapp is trading at US$67.05, below its estimated fair value of US$81.28, reflecting potential undervaluation based on cash flows. The company expects revenue growth to surpass the market average, with recent client wins like Milsted Langdon and Alvarez & Marsal enhancing its collaboration and deal management solutions. Despite a net loss reduction to US$4.52 million in Q1 2025, Intapp's profitability is projected within three years amid strong revenue forecasts.

- Insights from our recent growth report point to a promising forecast for Intapp's business outlook.

- Click to explore a detailed breakdown of our findings in Intapp's balance sheet health report.

Smartsheet (NYSE:SMAR)

Overview: Smartsheet Inc. offers an enterprise platform designed to help teams and organizations plan, capture, manage, automate, and report on work, with a market cap of approximately $7.89 billion.

Operations: The company generates its revenue primarily from its Internet Software & Services segment, which accounted for $1.08 billion.

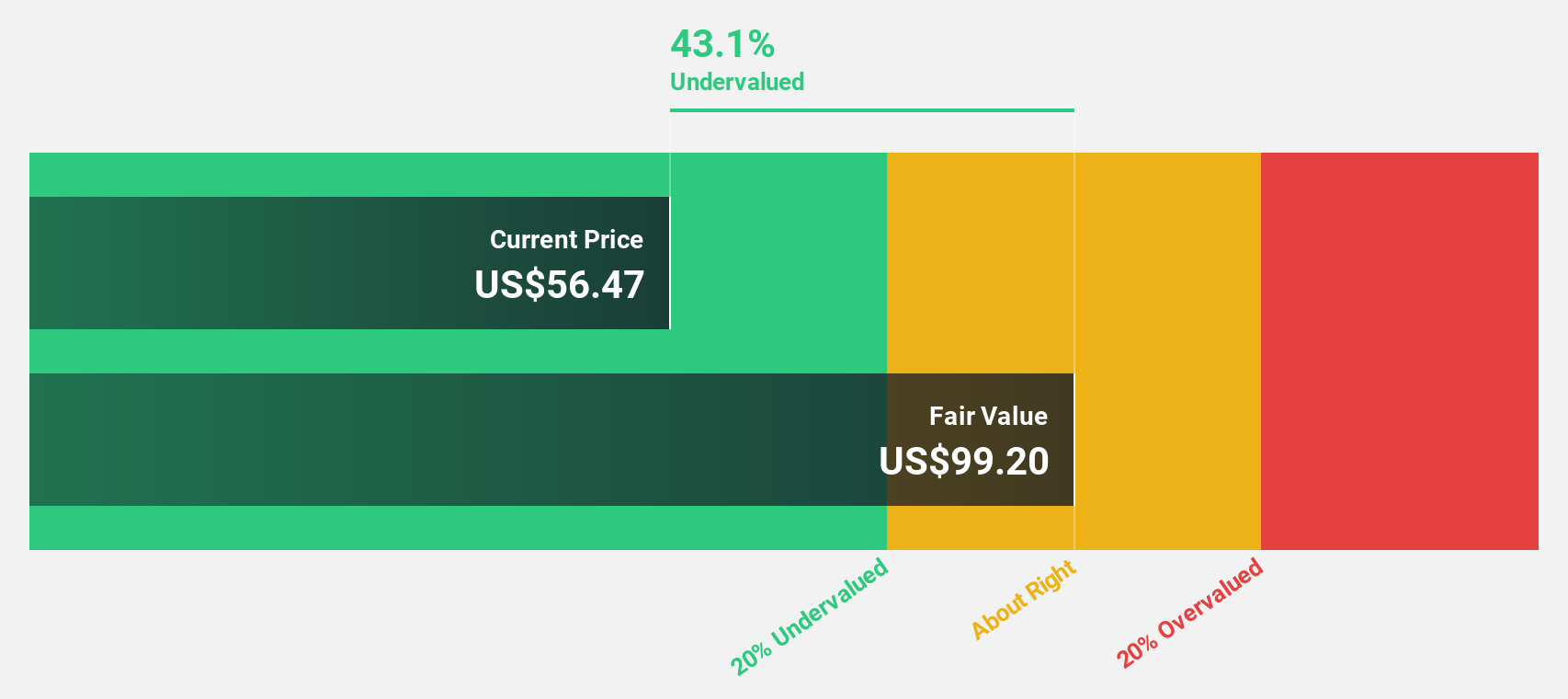

Estimated Discount To Fair Value: 43.5%

Smartsheet is trading at US$56.37, significantly below its estimated fair value of US$99.73, highlighting a potential undervaluation based on cash flows. The company's earnings are forecast to grow 62.76% annually and it is expected to achieve profitability within three years, surpassing market averages. Recent earnings show a shift from losses to net income, while shareholder approval for a merger has sparked debate over the adequacy of the US$8.4 billion acquisition offer.

- The analysis detailed in our Smartsheet growth report hints at robust future financial performance.

- Navigate through the intricacies of Smartsheet with our comprehensive financial health report here.

Make It Happen

- Click this link to deep-dive into the 172 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

Excellent balance sheet with reasonable growth potential.