- United States

- /

- Pharma

- /

- NasdaqCM:ANEB

3 US Penny Stocks With Market Caps Under $800M

Reviewed by Simply Wall St

As U.S. equities face a challenging period, with the Dow and S&P 500 on track for their worst month since April, investors are increasingly exploring alternative investment avenues. Penny stocks, despite their somewhat outdated name, continue to attract attention as they represent smaller or less-established companies that might offer value amidst market volatility. By focusing on those with strong financials and potential for growth, investors can uncover opportunities in this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $104.78M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86 | $6.25M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.89 | $229.35M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $9.2M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.54 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $25.72M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.57 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 731 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Anebulo Pharmaceuticals (NasdaqCM:ANEB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anebulo Pharmaceuticals, Inc. is a clinical-stage biotechnology company focused on developing treatments for unintentional cannabis poisoning and related conditions in the United States, with a market cap of $44.09 million.

Operations: Anebulo Pharmaceuticals, Inc. does not report any revenue segments as it is currently a clinical-stage biotechnology company.

Market Cap: $44.09M

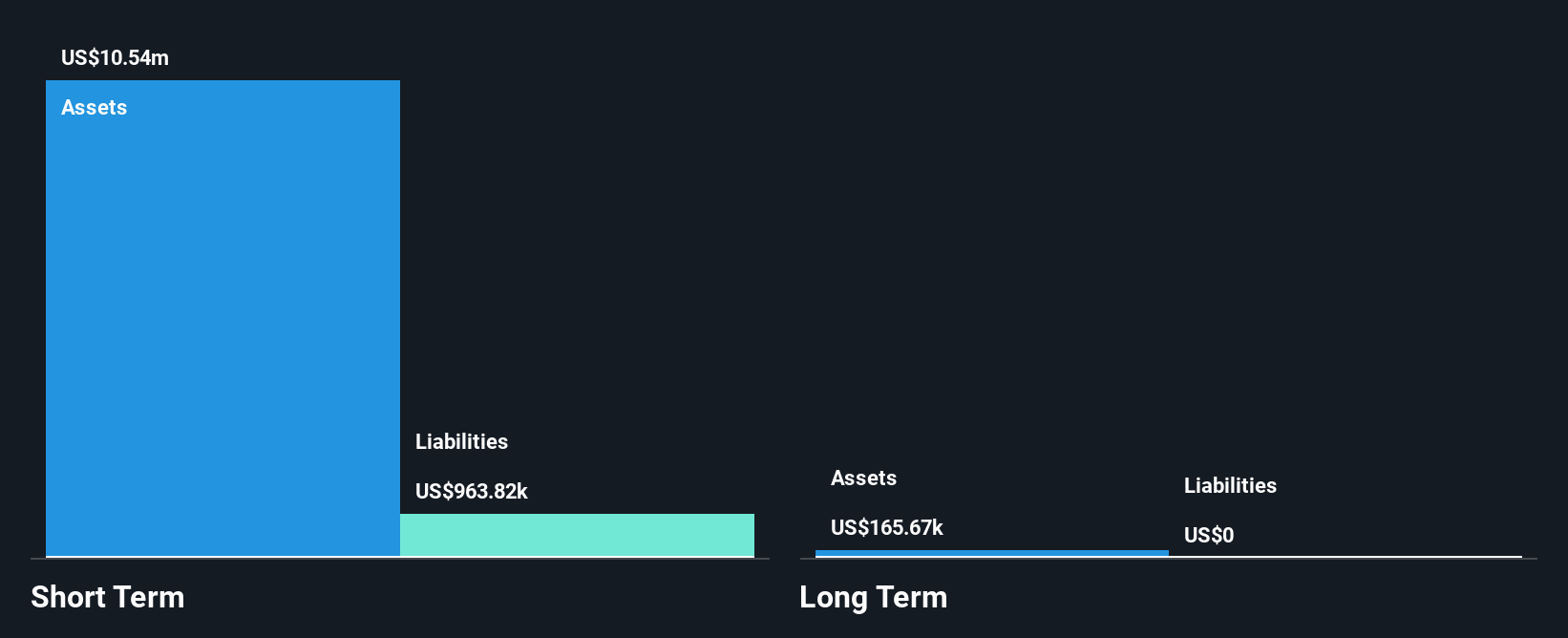

Anebulo Pharmaceuticals, Inc., a clinical-stage biotechnology firm, is pre-revenue and focuses on developing treatments for cannabis-related conditions. The company has no debt and maintains short-term assets of US$2 million against liabilities of US$569.2K. Despite its unprofitability, Anebulo has reduced losses by 29.9% annually over the past five years. Recent financing through a private placement raised nearly US$15 million, potentially extending its cash runway beyond the initial two months forecasted based on free cash flow estimates. However, the stock remains highly volatile with weekly volatility higher than 75% of U.S. stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Anebulo Pharmaceuticals.

- Examine Anebulo Pharmaceuticals' past performance report to understand how it has performed in prior years.

Sportsman's Warehouse Holdings (NasdaqGS:SPWH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sportsman's Warehouse Holdings, Inc. operates as an outdoor sporting goods retailer in the United States with a market cap of approximately $100.59 million.

Operations: The company generates revenue primarily from its Sporting Goods Retailer segment, amounting to $1.23 billion.

Market Cap: $100.59M

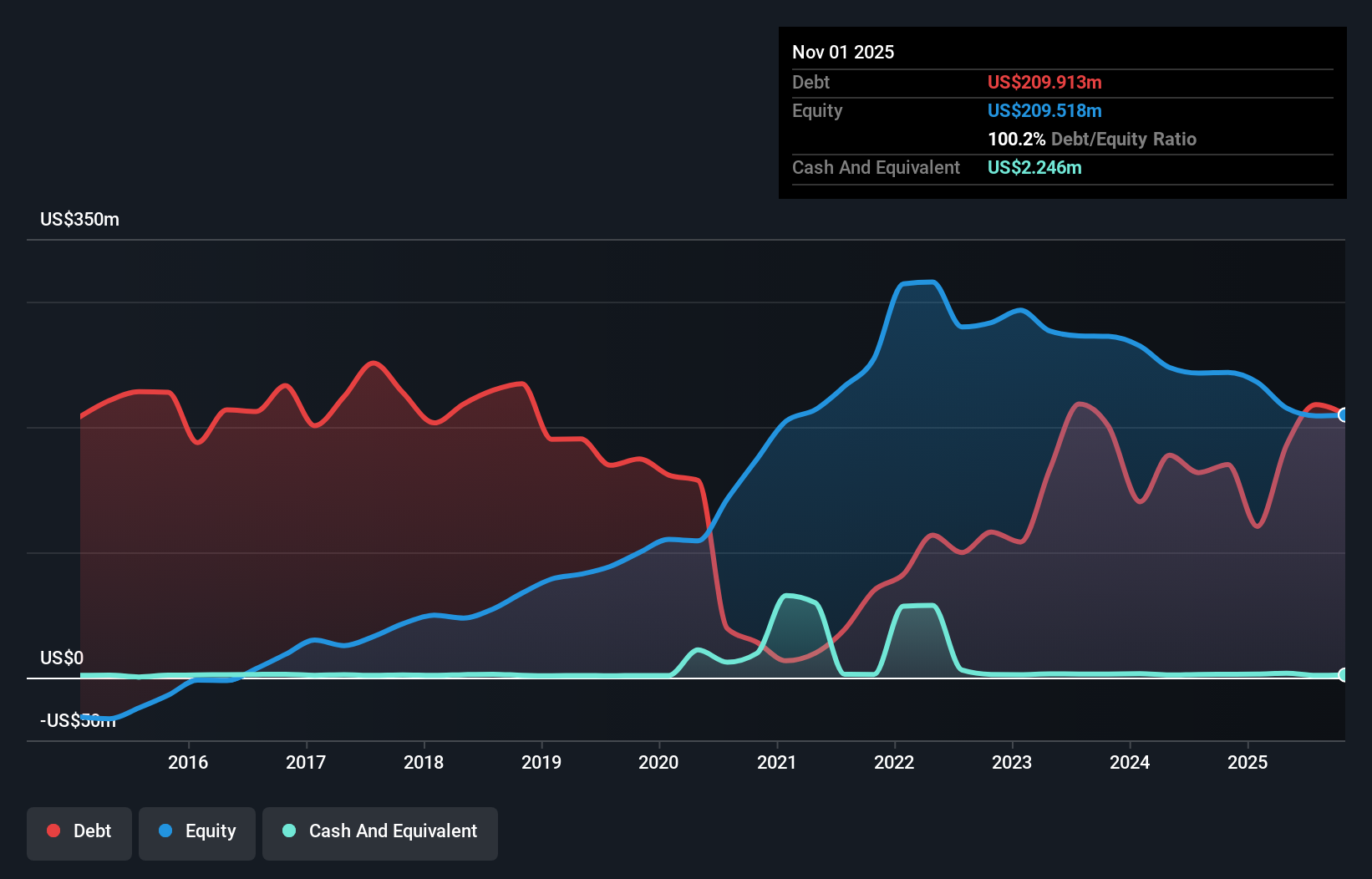

Sportsman's Warehouse Holdings, Inc. operates with a market cap of approximately US$100.59 million and generates substantial revenue from its Sporting Goods Retailer segment, totaling US$1.23 billion annually. Despite trading at a significant discount to its estimated fair value, the company faces challenges such as unprofitability and high debt levels, with a net debt to equity ratio of 68.7%. Recent earnings show decreased sales and increased losses compared to last year; however, the company projects net sales between US$1.18 billion and US$1.20 billion for fiscal year 2024, indicating potential stabilization in revenue streams amidst ongoing financial restructuring efforts.

- Get an in-depth perspective on Sportsman's Warehouse Holdings' performance by reading our balance sheet health report here.

- Examine Sportsman's Warehouse Holdings' earnings growth report to understand how analysts expect it to perform.

Riskified (NYSE:RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops and provides an e-commerce risk management platform for online merchants across various regions, including the United States, Europe, the Middle East, Africa, the Asia-Pacific, and the Americas; it has a market cap of approximately $779.26 million.

Operations: The company generates revenue from its Security Software & Services segment, totaling $318.05 million.

Market Cap: $779.26M

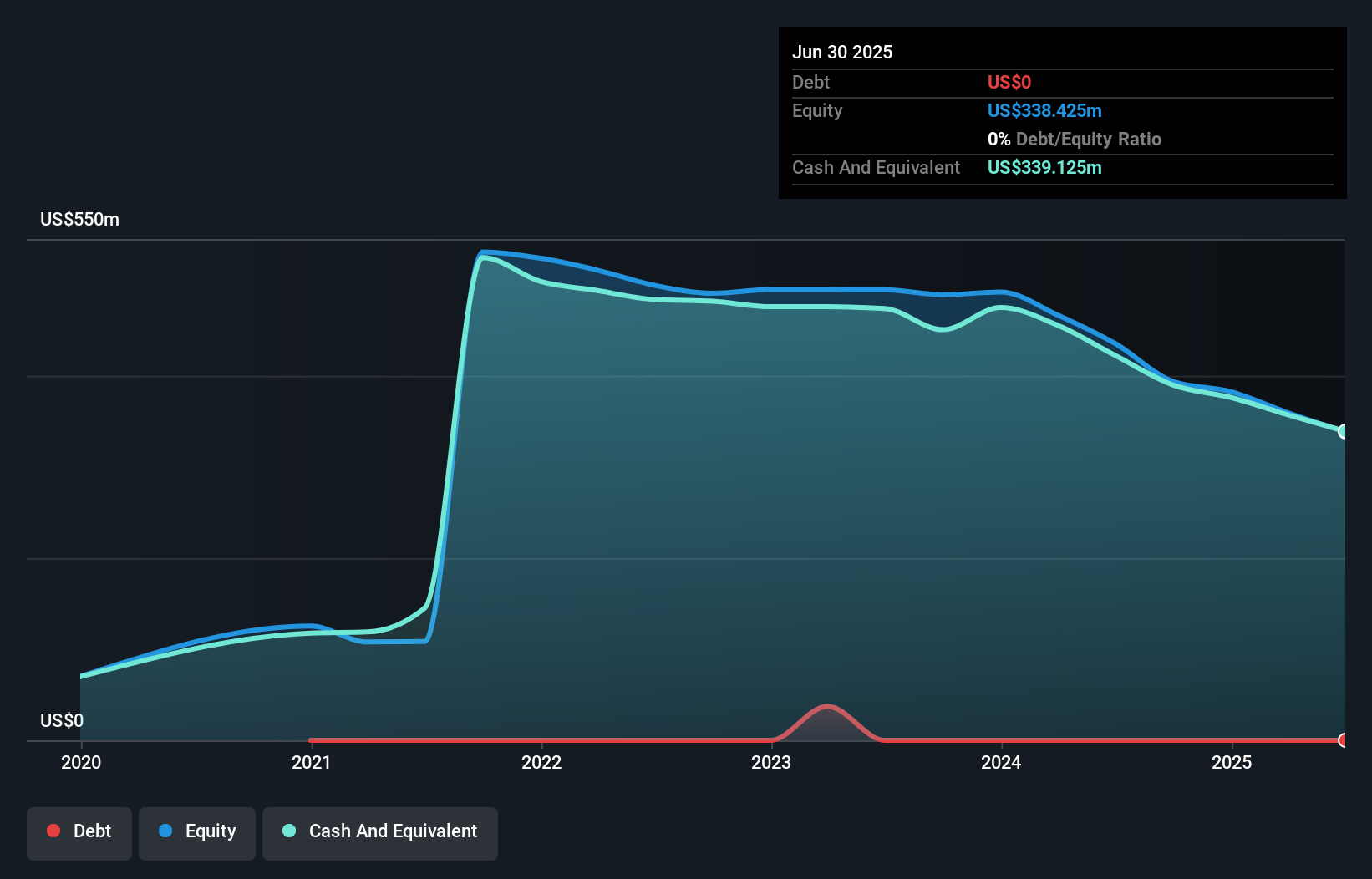

Riskified Ltd., with a market cap of US$779.26 million, operates in the e-commerce risk management space and has reported revenue of US$318.05 million from its Security Software & Services segment. Despite being unprofitable, the company is trading at a significant discount to its estimated fair value and remains debt-free, with short-term assets exceeding both short- and long-term liabilities. It has reduced losses over five years and maintains a cash runway exceeding three years due to positive free cash flow. Recent initiatives include share repurchase programs and exploring M&A opportunities to drive growth and scale efficiencies.

- Click here to discover the nuances of Riskified with our detailed analytical financial health report.

- Evaluate Riskified's prospects by accessing our earnings growth report.

Next Steps

- Embark on your investment journey to our 731 US Penny Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ANEB

Anebulo Pharmaceuticals

A clinical-stage biotechnology company, engages in developing treatments for unintentional cannabis poisoning, acute cannabinoid intoxication, and acute cannabis-induced conditions in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.