- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

Discover 3 US Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing, with the S&P 500 and Nasdaq extending their winning streaks, investors are keenly observing growth opportunities amid this positive momentum. In such an environment, companies with strong insider ownership can be particularly appealing as they often indicate confidence in the company's potential for sustained growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.6% | 34.7% |

| Ryan Specialty Holdings (NYSE:RYAN) | 16.8% | 36.4% |

Underneath we present a selection of stocks filtered out by our screen.

Corcept Therapeutics (NasdaqCM:CORT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Corcept Therapeutics Incorporated focuses on the discovery and development of drugs for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market cap of approximately $5.33 billion.

Operations: The company generates revenue of $628.55 million from the discovery, development, and commercialization of pharmaceutical products.

Insider Ownership: 11.6%

Corcept Therapeutics is experiencing robust earnings growth, with a forecasted annual increase of 34.7%, outpacing the US market's average. Recent product developments include a new drug application for relacorilant, targeting Cushing’s syndrome, which has shown promising trial results. Despite limited insider buying recently, Corcept's revenue is expected to grow at 20.3% annually, surpassing the broader market rate. The company raised its 2024 revenue guidance and reported strong Q3 earnings improvements year-over-year.

- Dive into the specifics of Corcept Therapeutics here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Corcept Therapeutics is trading beyond its estimated value.

Sportradar Group (NasdaqGS:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

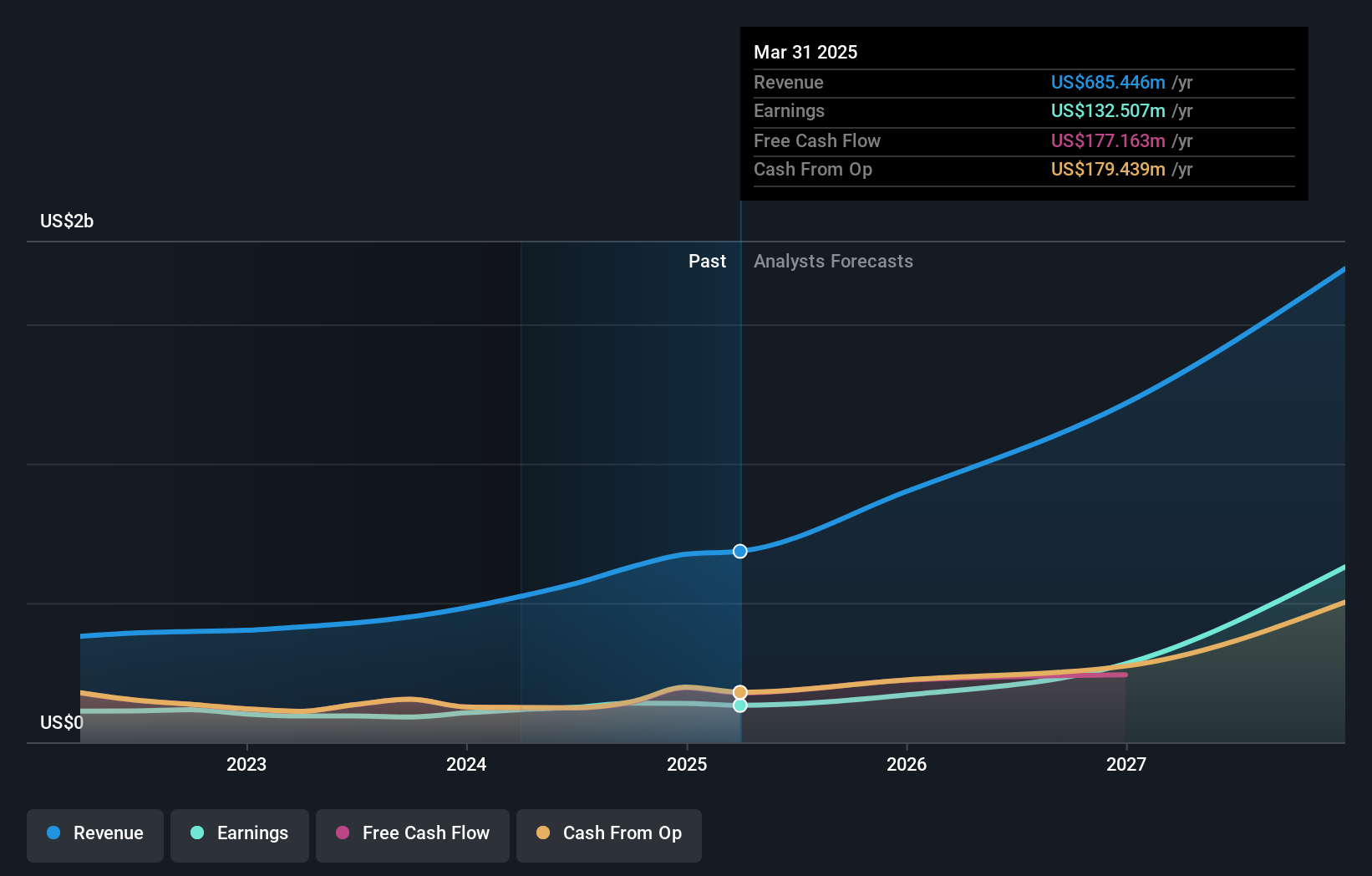

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services for the sports betting and media industries across various regions including the United Kingdom, the United States, Malta, Switzerland, and internationally; it has a market cap of approximately $5.29 billion.

Operations: Sportradar Group AG generates revenue through its sports data services tailored for the sports betting and media sectors across multiple regions, including the UK, US, Malta, Switzerland, and beyond.

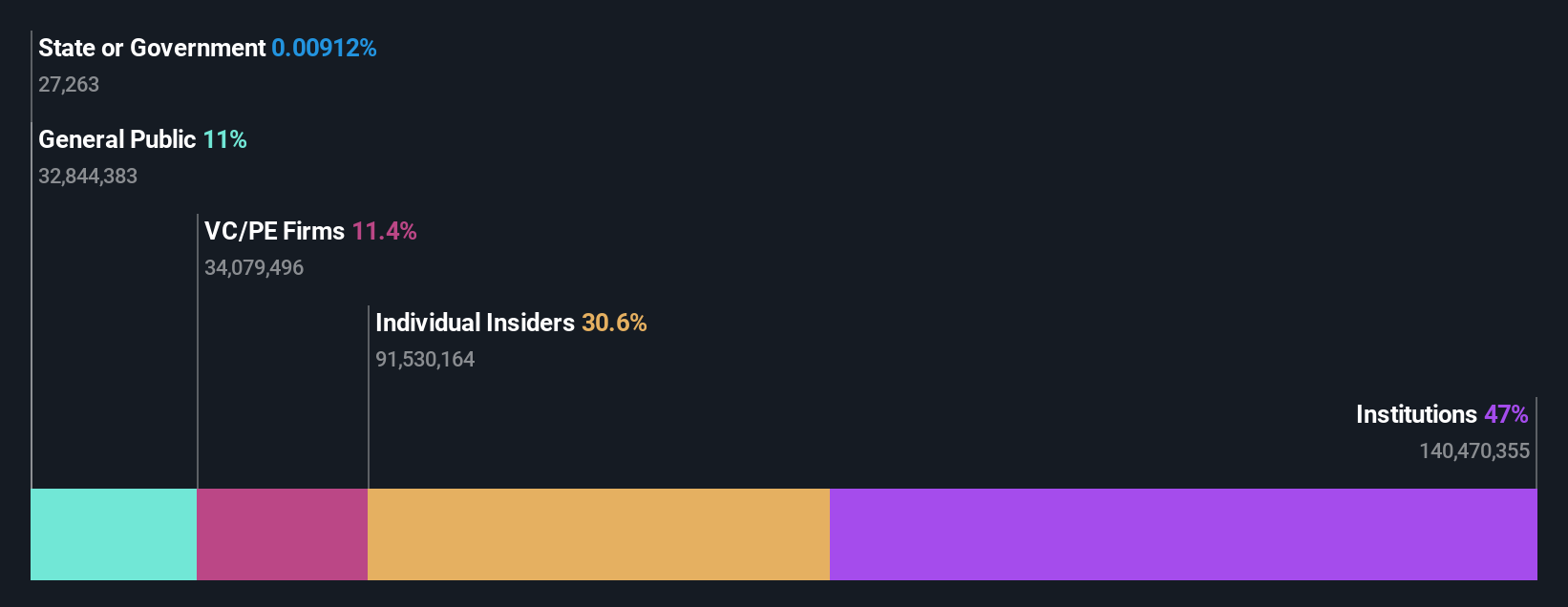

Insider Ownership: 31.9%

Sportradar Group is experiencing significant earnings growth, with a forecasted annual increase of 34.4%, surpassing the US market average. The company recently raised its 2024 revenue guidance to at least €1.09 billion, reflecting strong financial performance. Despite no recent insider trading activity, Sportradar's strategic focus on M&A opportunities and innovative NBA partnerships positions it for continued expansion in technology and content offerings, enhancing both organic and inorganic growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Sportradar Group.

- Our valuation report here indicates Sportradar Group may be overvalued.

RingCentral (NYSE:RNG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc. operates globally by offering cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions, with a market cap of approximately $3.20 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $2.36 billion.

Insider Ownership: 10.5%

RingCentral is trading at 74% below its estimated fair value, suggesting potential undervaluation compared to peers. Although insider activity shows more shares bought than sold recently, volumes are not substantial. The company is set to become profitable within three years with earnings growth forecasted at 61.35% annually, outpacing market averages. Recent enhancements in Zendesk integration and a new CFO appointment from Amazon Web Services highlight strategic moves aimed at operational efficiency and technological advancement.

- Click here to discover the nuances of RingCentral with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that RingCentral is priced lower than what may be justified by its financials.

Make It Happen

- Navigate through the entire inventory of 198 Fast Growing US Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Engages in the provision of sports data services in the United Kingdom, the United States, Malta, Switzerland, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives