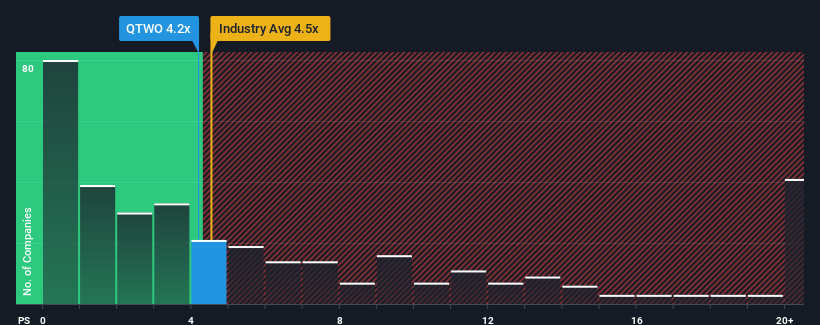

With a median price-to-sales (or "P/S") ratio of close to 4.5x in the Software industry in the United States, you could be forgiven for feeling indifferent about Q2 Holdings, Inc.'s (NYSE:QTWO) P/S ratio of 4.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Q2 Holdings

What Does Q2 Holdings' Recent Performance Look Like?

Q2 Holdings' revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Q2 Holdings will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Q2 Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Q2 Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Pleasingly, revenue has also lifted 60% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 10% over the next year. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Q2 Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Q2 Holdings' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 2 warning signs for Q2 Holdings you should be aware of.

If these risks are making you reconsider your opinion on Q2 Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives